Get the free EAH Program Loan Application/Agreement - phfa

Show details

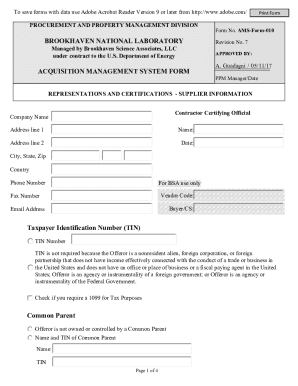

This document is an application for the Employer Assisted Housing Program which provides loans to employees for purchasing a home.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eah program loan applicationagreement

Edit your eah program loan applicationagreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eah program loan applicationagreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eah program loan applicationagreement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit eah program loan applicationagreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eah program loan applicationagreement

How to fill out EAH Program Loan Application/Agreement

01

Download the EAH Program Loan Application/Agreement from the official website.

02

Read through the eligibility requirements and guidelines to ensure you qualify.

03

Fill out the personal information section with your name, address, and contact details.

04

Provide your financial information, including income, expenses, and assets.

05

Detail the purpose of the loan in the designated section, explaining how the funds will be used.

06

Attach any required documentation, such as proof of income and identification.

07

Review the application for accuracy and completeness before submitting.

08

Submit the application via the specified submission method (online, mail, or in-person).

Who needs EAH Program Loan Application/Agreement?

01

Individuals or families seeking financial assistance for housing-related expenses.

02

First-time homebuyers looking to make a home purchase more affordable.

03

Low to moderate-income households needing help with down payments or closing costs.

04

Individuals facing financial hardship who require support to secure stable housing.

Fill

form

: Try Risk Free

People Also Ask about

What is a business loan agreement?

A business loan agreement is a legal contract between a borrower and lender that defines the terms and conditions of their loan arrangement. This document typically includes the loan amount, repayment terms and schedule, interest rates and collateral, among other terms.

Can I make my own loan agreement?

However, the do-it-yourself approach is perfectly acceptable and just as legally enforceable. Once you have both agreed on the terms, you may want to have the personal loan contract notarized or ask a third party to act as a witness during the signing.

How to write loan application in English?

By following these steps, you can ensure that your request is well-received and considered favourably. Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Assure the Lender of Repayment. Highlight Your Creditworthiness. Include Any Collateral (If Applicable)

What is another word for loan agreement?

Promissory Note – The promissory note is the legal document, signed by the lender and borrower, which details all the loan terms and binds both parties to those terms. It is also sometimes called a loan agreement.

Can I write my own loan agreement in the UK?

In theory, you can write your own loan agreement, but we wouldn't recommend this course of action. We would definitely advise against it if you're loaning money in connection to a property. For example, if you're helping with a house deposit, providing a bridging loan or paying off someone else's mortgage.

How do I write a simple loan agreement between friends?

All in all, a formal loan agreement between family members or friends should include: Both the lender's and borrower's personal details. The exact amount being lent. The purpose of the loan. How and when repayments will be made. If interest will be charged, the interest rate, and how it will be worked out.

Does a loan agreement need to be witnessed UK?

Witnesses aren't legally required when signing a loan agreement. However, either party may want to record a witness to prove the validity of the document should it ever be disputed.

What is the loan agreement?

The purpose of a loan agreement is to outline the terms of the loan, including the amount, due date, and method of repayment. Once put into practice, the loan agreement document is essentially a commitment to pay the lender. It states what is given and expected in return. Lending money is a dangerous investment.

What is your loan agreement?

A written loan agreement is a contract between the person lending the money and the person borrowing the money. A written loan agreement should include details of: the full names and addresses of the parties. the principal amount of the loan.

How do I write a legal loan agreement in the UK?

Written Loan Agreements - what should be in a loan agreement Put the full names & addresses of the people entering into the agreement. Put the full details of any price agreed, or any other arrangements agreed. If interest is to be paid on any outstanding amounts, then put down full details of the interest rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is EAH Program Loan Application/Agreement?

The EAH Program Loan Application/Agreement is a formal document that individuals or organizations must complete to apply for a loan through the EAH (Emergency Assistance for Homeowners) Program. It outlines the terms of the loan and the responsibilities of the borrower.

Who is required to file EAH Program Loan Application/Agreement?

Individuals or families who are seeking financial assistance to prevent foreclosure or to obtain emergency financial support for housing are required to file the EAH Program Loan Application/Agreement.

How to fill out EAH Program Loan Application/Agreement?

To fill out the EAH Program Loan Application/Agreement, applicants should carefully read all instructions, provide all required personal and financial information, ensure accuracy in the data entered, and submit any necessary supporting documents as specified in the application guidelines.

What is the purpose of EAH Program Loan Application/Agreement?

The purpose of the EAH Program Loan Application/Agreement is to collect necessary information to evaluate eligibility for financial assistance, outline the loan terms, and formalize the agreement between the borrower and the lending entity.

What information must be reported on EAH Program Loan Application/Agreement?

The information that must be reported on the EAH Program Loan Application/Agreement includes personal identification details, income and employment information, current financial obligations, housing situation, and any additional information required by the program guidelines.

Fill out your eah program loan applicationagreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eah Program Loan Applicationagreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.