Get the free PHFA Keystone Renovate & Repair Loan Program - phfa

Show details

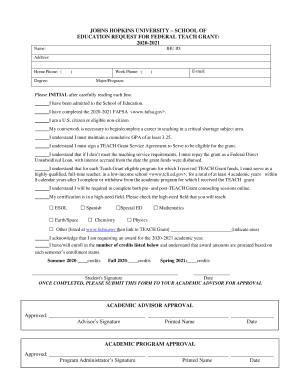

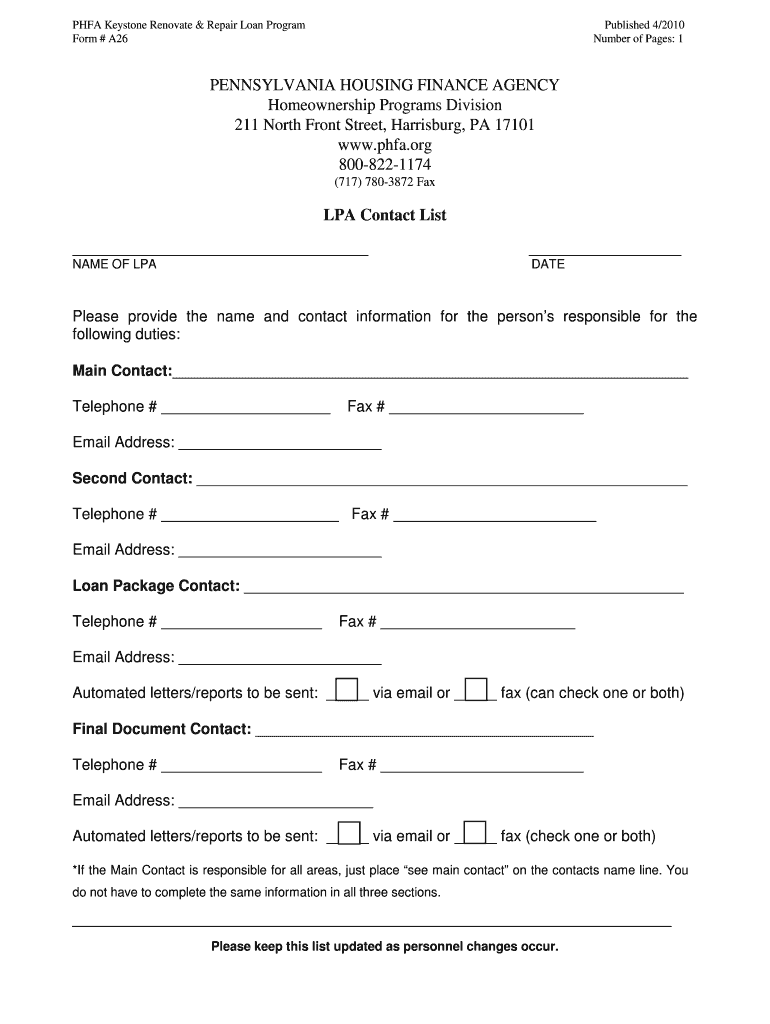

This document is used to collect contact information for individuals responsible for various duties within the Keystone Renovate & Repair Loan Program.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign phfa keystone renovate repair

Edit your phfa keystone renovate repair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your phfa keystone renovate repair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit phfa keystone renovate repair online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit phfa keystone renovate repair. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out phfa keystone renovate repair

How to fill out PHFA Keystone Renovate & Repair Loan Program

01

Gather necessary documents, including proof of income, credit history, and details about the property.

02

Review the PHFA Keystone Renovate & Repair Loan Program guidelines to ensure eligibility.

03

Determine the amount of funding needed for renovations and repairs.

04

Complete the application form accurately, providing all required information.

05

Submit the application along with required documentation to the PHFA.

06

Await approval or request for additional information from PHFA.

07

Once approved, review the terms of the loan and sign the agreement.

08

Use the funds for qualified renovation and repair projects on the property.

Who needs PHFA Keystone Renovate & Repair Loan Program?

01

Homeowners seeking to improve or repair their primary residence.

02

Individuals looking for financial assistance for home renovation projects.

03

Borrowers who meet the income limits and other eligibility requirements set by PHFA.

04

People intending to enhance the safety, livability, or value of their homes.

Fill

form

: Try Risk Free

People Also Ask about

What is a repair loan?

A home improvement loan typically refers to an unsecured personal loan used to pay for home upgrades — from remodeling or renovations to repairs and new furniture. Home improvement loans are often a good way to cover the cost of many home-related expenses. Some loans may take longer to get approved.

What is the restore repair renew program in Philadelphia?

Home improvement loans typically range from $1,000 to $100,000. You may need excellent credit or a co-signer to get a home improvement loan if you want a larger amount. But don't just borrow the maximum amount available. It's smarter to borrow just the amount needed for your project.

Are home renovation loans a good idea?

The Restore, Repair, Renew program is a City of Philadelphia and PHDC initiative to help Philadelphia homeowners to access low-interest home equity loans to invest in their properties.

What is a property improvement loan?

You can use a home improvement loan to pay contractors or cover the costs of materials. Take on projects such as adding a room, remodeling the kitchen or bathroom, installing solar panels, landscaping the yard, making repairs to the roof, replacing floors or pipes, and much more.

What is the home renovation loan in Philadelphia?

Restore, Repair, Renew is an initiative of the City of Philadelphia to help Philadelphia homeowners access low-interest loans to invest in their properties. Lender participating in the program is offering 10-year, 3% fixed Annual Percentage Rate loans that range from $2,500 to $50,000* to eligible homeowners.

What is the access home modification program in PA?

The ACCESS Home Modification Program provides mortgage loans to assist persons with disabilities or who have a family member(s) living in the household with disabilities who are purchasing a home that needs accessibility modifications.

Which loan is best for home renovation?

Taking out a home improvement loan can help you get started immediately on a big project. That could be important if your project improves your quality of life or safety, and the change needs to happen sooner rather than later. It can also be a great way to add value to your home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PHFA Keystone Renovate & Repair Loan Program?

The PHFA Keystone Renovate & Repair Loan Program is designed to provide funding for rehabilitation and repairs to existing homes in Pennsylvania, helping homeowners finance necessary improvements and enhancements.

Who is required to file PHFA Keystone Renovate & Repair Loan Program?

Homeowners in Pennsylvania seeking to undertake renovations or repairs on their primary residence are required to file for the PHFA Keystone Renovate & Repair Loan Program.

How to fill out PHFA Keystone Renovate & Repair Loan Program?

To fill out the PHFA Keystone Renovate & Repair Loan Program application, homeowners must complete the required forms provided by PHFA, gather necessary documentation regarding income and property ownership, and submit the application through an approved lender.

What is the purpose of PHFA Keystone Renovate & Repair Loan Program?

The purpose of the PHFA Keystone Renovate & Repair Loan Program is to assist homeowners with financing the costs associated with home repairs and renovations, ultimately improving the quality and safety of housing in Pennsylvania.

What information must be reported on PHFA Keystone Renovate & Repair Loan Program?

Information that must be reported includes details about the homeowner’s financial situation, the nature of the proposed renovations or repairs, documentation proving ownership of the property, and the projected costs associated with the improvements.

Fill out your phfa keystone renovate repair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Phfa Keystone Renovate Repair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.