Get the free Tax Incentive Application

Show details

This document is an application form for requesting tax incentives for properties that are commercially zoned. It requires detailed information about the applicant, the property location, proposed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentive application

Edit your tax incentive application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentive application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax incentive application online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax incentive application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentive application

How to fill out Tax Incentive Application

01

Gather all necessary financial documents and records.

02

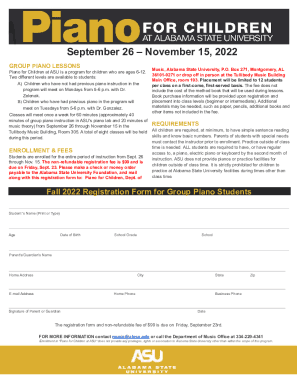

Obtain the Tax Incentive Application form from the relevant government agency or website.

03

Complete the application form with accurate and detailed information about your business.

04

Calculate eligible tax incentives based on your business activities and expenditures.

05

Review the application to ensure all sections are filled out correctly.

06

Attach any required supporting documents, such as tax returns or proof of expenses.

07

Submit the application by the specified deadline, either online or via mail.

Who needs Tax Incentive Application?

01

Small business owners seeking financial assistance.

02

Corporations investing in new projects or job creation.

03

Non-profit organizations working on community development.

04

Individuals or businesses involved in eligible sectors as defined by tax incentive programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of VAT concession?

A concession basis can be applied for in cases when goods and services are supplied to property leasees through landlords. Landlords are not obliged to issue invoices showing VAT as they receive payments from their leasees.

What is the meaning of concession in price?

A concession is a special price which is lower than the usual price and which is often given to old people, people who are unemployed, and students.

What is another word for tax incentives?

What is another word for tax break? concessionreduction discount rebate decrease deduction allowance cut grant saving40 more rows

How do you use tax incentive in a sentence?

He is lobbying government to introduce tax incentives to encourage donations. Massive tax incentives encouraged people to invest. It will mean governments extending tax incentives on saving to reduce the burden on the taxpayer in years to come.

What is a tax concession?

Tax concessions — defined as preferential tax treatment for certain types of firms or entities — are commonplace in developed as well as developing countries. Concessions are granted to promote investment, in which case they may be termed tax incentives or investment incentives, or to achieve defined social objectives.

What is the meaning of giving concessions?

something that is allowed or given up, often in order to end a disagreement, or the act of allowing or giving this: Both sides involved in the conflict made some concessions in yesterday's talks. He stated firmly that no concessions will be made to the terrorists. See. concede (ADMIT)

What is the meaning of tax concessions?

a reduction made by the government in the amount of tax that a particular group of people or type of organization has to pay or a change in the tax system that benefits those people.

What are the principles of tax incentives?

There are six broad principles, each with sub-principles. They span the life cycle of a tax incentive: Justification, Design, International Considerations, Legislation, Implementation and Evaluation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Incentive Application?

A Tax Incentive Application is a formal request submitted by individuals or businesses to receive benefits such as tax credits, deductions, or exemptions provided by the government to encourage specific economic activities or investments.

Who is required to file Tax Incentive Application?

Generally, businesses and individuals seeking tax incentives or benefits are required to file a Tax Incentive Application. This may include startups, companies involved in certain industries, or those engaged in qualifying activities as defined by tax authorities.

How to fill out Tax Incentive Application?

To fill out a Tax Incentive Application, you typically need to obtain the correct form from the tax authority's website, provide accurate information about your business or personal finances, describe the incentive sought, and attach supporting documentation as required.

What is the purpose of Tax Incentive Application?

The purpose of a Tax Incentive Application is to allow taxpayers to request tax benefits that can reduce their overall tax burden, encourage investment in certain areas, and stimulate economic growth.

What information must be reported on Tax Incentive Application?

Information that must be reported on a Tax Incentive Application typically includes applicant details (name, address, tax ID), type of incentive being requested, financial statements, details about the specific project or activity, and any other relevant documentation that supports the claim for the incentive.

Fill out your tax incentive application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentive Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.