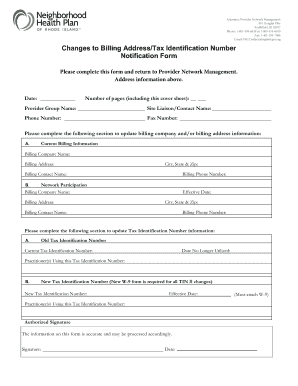

Get the free Form 529

Show details

This form is used to claim a credit for guaranty fees paid to the U.S. Small Business Administration for small businesses, as well as providing information necessary for calculating the credit based

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 529

Edit your form 529 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 529 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 529 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form 529. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 529

How to fill out Form 529

01

Obtain a copy of Form 529 from the IRS website or your local tax office.

02

Start by entering your personal information, including your name, address, and Social Security number.

03

Enter the information regarding your income, including wages, dividends, and interest.

04

Fill in the deductions and credits you wish to claim, ensuring to follow the instructions carefully.

05

Review your entries for accuracy and completeness.

06

Sign and date the form to validate the submission.

07

Submit the completed Form 529 to the appropriate IRS address or electronically if applicable.

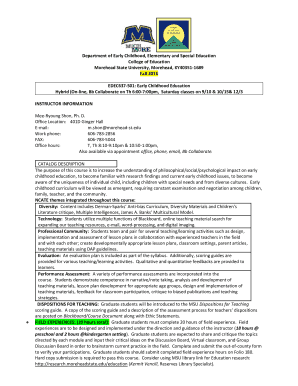

Who needs Form 529?

01

Parents or guardians looking to save for a child's education through tax-advantaged accounts.

02

Individuals contributing to a Section 529 plan for educational expenses.

03

Anyone planning to withdraw funds from a 529 plan for qualified education expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the point of a 529 plan?

If the beneficiary of a 529 account doesn't go to college, you canchange the beneficiary or take a non-qualified withdrawal. If you take a non-qualified withdrawal, you will incur income tax as well as a 10% penalty tax on the earnings portionof the account.

What is a 529 form?

This generally includes unreimbursed employee business expenses ( ¶941), expenses incurred for the production or collection of income, management of investments, and the preparation of taxes.

What happens to 529 if kid doesn't go to college?

ScholarShare 529 provides tax benefits for California families saving for college. Any earnings are tax-deferred, and withdrawals are tax-free when used for qualified higher education expenses. These tax advantages can add up and give your beneficiary an even bigger head start! Limitations apply.

Do I have to report 529 distributions on my taxes?

Withdrawals from 529 plans are not taxed at the federal level — as long as you understand and follow all the rules for qualifying expenses. You'll have to report your 529 plan spending to the IRS, so keeping careful records is important. Decide ahead of time how you'll withdraw the funds and use them.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 529?

Form 529 is a tax form used in the United States for reporting contributions to and earnings from a qualified tuition program, which is a type of education savings plan designed to help save for future college costs.

Who is required to file Form 529?

Individuals who contribute to or withdraw funds from a 529 college savings plan are typically required to file Form 529 to report any contributions or earnings, especially if they need to fulfill certain tax obligations or claim deductions.

How to fill out Form 529?

To fill out Form 529, taxpayers need to provide personal identification information, details about the beneficiary, contributions made, and any distributions taken from the account. It's important to follow the IRS guidelines and consult the form's instructions for accuracy.

What is the purpose of Form 529?

The purpose of Form 529 is to enable taxpayers to report their contributions to a qualified tuition program, track earnings, and ensure compliance with tax regulations regarding the use of funds for education expenses.

What information must be reported on Form 529?

Form 529 requires reporting of the taxpayer's name and Social Security number, the beneficiary's details, total contributions made, total distributions taken, and the earnings on investments within the account. Additional information may include the purpose of the distributions.

Fill out your form 529 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 529 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.