Get the free Tentative Corporation Tax Return and Conditional Extension - sctax

Show details

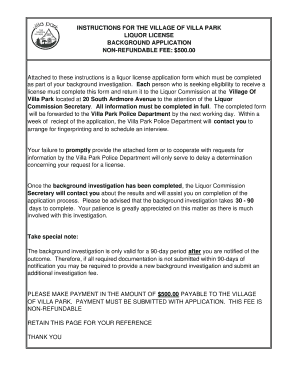

This document is used to file a tentative corporation tax return and request a conditional extension for corporations in South Carolina.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tentative corporation tax return

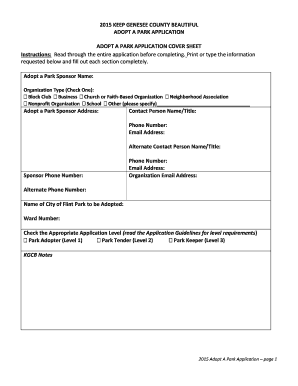

Edit your tentative corporation tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tentative corporation tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tentative corporation tax return online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

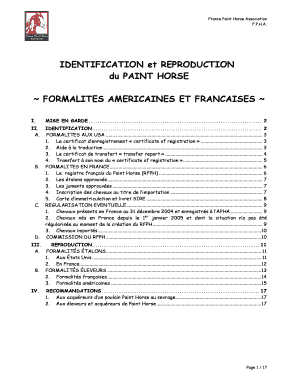

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tentative corporation tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tentative corporation tax return

How to fill out Tentative Corporation Tax Return and Conditional Extension

01

Begin by gathering all necessary financial documents, including income statements, expenses, and any prior tax returns.

02

Fill out the Tentative Corporation Tax Return form, ensuring to include proper details such as your corporation's name, address, and tax identification number.

03

Calculate your estimated taxable income based on the financial information gathered.

04

Complete the sections of the form regarding deductions and credits you may be eligible for.

05

Review the form for accuracy and completeness before signing and dating it.

06

Submit the Tentative Corporation Tax Return by the specified deadline to your tax authority, ensuring that you keep a copy for your records.

07

If applicable, apply for a Conditional Extension by filing the necessary request with your tax authority, outlining the reason for requesting the extension.

08

Maintain documentation to support your request for an extension.

Who needs Tentative Corporation Tax Return and Conditional Extension?

01

Corporations and businesses that require additional time to prepare their final tax returns may need to file a Tentative Corporation Tax Return.

02

Companies that anticipate owing taxes but are unable to finalize their tax returns by the deadline would benefit from a Conditional Extension.

Fill

form

: Try Risk Free

People Also Ask about

What is the deadline for paying income tax in Canada?

The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by April 30 of every year. If April 30 falls on a weekend, the CRA extends the deadline to the following business day.

What happens if you don't pay corporate tax in Canada?

Late-Filing Penalties for Corporations These penalties are calculated as follows: Base penalty: 5% of unpaid tax for the year. Monthly accumulation: An additional 1% of unpaid tax for each complete month the return is late. Maximum duration: Penalties accumulate for up to 12 months.

How to extend nj cbt?

Corporation Business Tax (CBT)- Extensions You may request an extension by filing a Tentative Return and Application for Extension of Time to File (Form CBT-200-T) using the Corporation Business Tax Online Filing and Payments system. You must include a tentative tax payment with your application for extension.

What is the deadline to pay corporate taxes in Canada?

For most businesses, fiscal year ends December 31 and tax returns are due June 30. If you miss your corporate tax return deadline, you risk facing penalties and interest charges. You can file your corporate T2 and T2 Short tax return online easily with TurboTax.

How to file a zero corporate tax return in Canada?

For a nil corporate tax return, you will need to use Form T2 Short Return. This is the most straightforward way to report a nil income for your business. The T2 Short Return form is designed for corporations with no significant business expenses or deductions to claim.

How long do you have to pay corporate taxes in Canada?

In most cases, corporations with taxes owing must pay their taxes within two months after the fiscal year has concluded. However, this timeline is extended to three months if certain conditions are met.

What is the corporate tax filing deadline in Canada?

Corporate tax returns are due 6 months after the end of your fiscal year. For most businesses, fiscal year ends December 31 and tax returns are due June 30.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tentative Corporation Tax Return and Conditional Extension?

A Tentative Corporation Tax Return is a preliminary tax return filed by corporations that expect a loss for the year or wish to anticipate tax deductions. A Conditional Extension allows corporations to extend their filing deadline while establishing an expected tax situation based on estimates.

Who is required to file Tentative Corporation Tax Return and Conditional Extension?

Corporations that expect to have a tax liability that can be offset by losses or deductions, or those that cannot complete their final return on time but need to avoid penalties, are required to file a Tentative Corporation Tax Return and may file for a Conditional Extension.

How to fill out Tentative Corporation Tax Return and Conditional Extension?

To fill out the Tentative Corporation Tax Return, a corporation must provide estimated income, deductions, and credits. The form usually requires the completion of specific sections detailing prior tax liability, expected losses, and justification for the extension if applicable.

What is the purpose of Tentative Corporation Tax Return and Conditional Extension?

The purpose is to allow corporations to report estimated tax obligations and file on time while giving them the flexibility to finalize their returns without incurring penalties, particularly when anticipating tax deductions or losses.

What information must be reported on Tentative Corporation Tax Return and Conditional Extension?

The information that must be reported includes estimated gross income, deductions, applicable credits, prior year tax details, and any other relevant information that supports the estimations and claims for the extension.

Fill out your tentative corporation tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tentative Corporation Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.