Get the free SC 1101 B - sctax

Show details

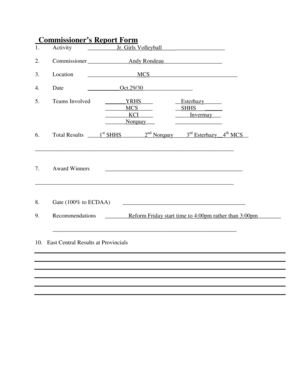

This document serves as the State of South Carolina's Bank Tax Return for banks, requiring taxpayers to report their income, deductions, and calculate tax liability. It includes instructions for filing,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sc 1101 b

Edit your sc 1101 b form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc 1101 b form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sc 1101 b online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit sc 1101 b. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sc 1101 b

How to fill out SC 1101 B

01

Begin by gathering the required personal information, including your name, address, and Social Security number.

02

Fill out the 'Request for Order of Relief' section with the relevant details about your request.

03

Provide information regarding the parties involved in the case, including their names and addresses.

04

Sign and date the document at the designated signature line.

05

Review the form for any errors or missing information before submission.

06

Submit the completed SC 1101 B form to the appropriate court or agency as per the instructions provided.

Who needs SC 1101 B?

01

Individuals seeking a legal order of relief related to family law matters.

02

People involved in court proceedings requiring formal requests for modifications or enforcement.

Fill

form

: Try Risk Free

People Also Ask about

What do non residents need to file in SC?

A nonresident individual receiving South Carolina income from wages, rental property, businesses, or other investments in South Carolina, must file an SC1040 South Carolina Individual Income Tax Return and Schedule NR Nonresident Schedule.

Is it better to file as a resident or nonresident in South Carolina?

You should file as a South Carolina resident if you intend to maintain the state as your permanent home, keep South Carolina as the center of your financial, social and family life, and when you're away, intend to return back to the state.

What do you need for proof of residency in SC?

SC Residency Information Statement of full-time employment; Designating South Carolina as state of legal residence on military record; Possession of a valid South Carolina driver's license, or if a non-driver, a South Carolina identification card.

What is the bank tax in South Carolina?

Bank. A bank doing business in South Carolina must file a Bank Tax return, SC1101B. The Corporate Income Tax rate on Banks is 4.5% on South Carolina taxable income.

What is the penalty for filing taxes late in SC?

Late Filing Penalty: This penalty is 5% of your total taxes owed if the failure to file your return is not more than one month after your SC tax return is due. You will be charged an additional 5% for each additional month or fraction of the month you file your return late, not exceeding 25%.

Do I need to file a non resident South Carolina tax return?

If you are a nonresident or part-year resident, you are generally required to file a South Carolina return if you work in South Carolina or are receiving income from rental property, businesses, or other investments in South Carolina.

Do I have to file taxes if I don't live in the US?

If you are a U.S. citizen or resident living or traveling outside the United States, you generally are required to file income tax returns, estate tax returns, and gift tax returns and pay estimated tax in the same way as those residing in the United States.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SC 1101 B?

SC 1101 B is a specific form used for reporting tax information in certain jurisdictions, typically related to business or organizational tax filings.

Who is required to file SC 1101 B?

Entities or businesses operating in jurisdictions where SC 1101 B is required must file this form, usually involving sole proprietors, partnerships, or corporations.

How to fill out SC 1101 B?

To fill out SC 1101 B, individuals or businesses need to provide required details like business information, income details, deductions, and signatures as stipulated in the form's instructions.

What is the purpose of SC 1101 B?

The purpose of SC 1101 B is to collect accurate tax information from businesses to ensure compliance with state or local tax laws.

What information must be reported on SC 1101 B?

SC 1101 B typically requires reporting information such as business name, address, tax identification number, income, expenses, and other relevant financial data.

Fill out your sc 1101 b online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sc 1101 B is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.