Get the free FORM 13 - denr sd

Show details

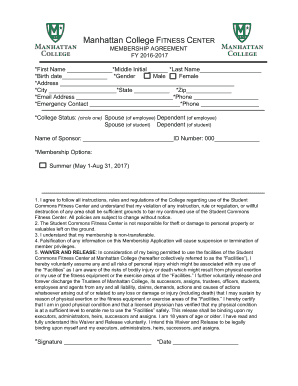

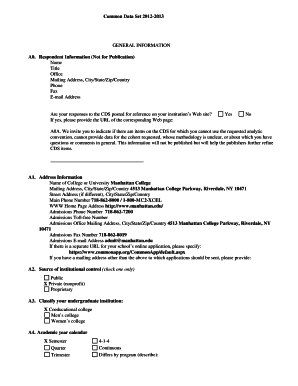

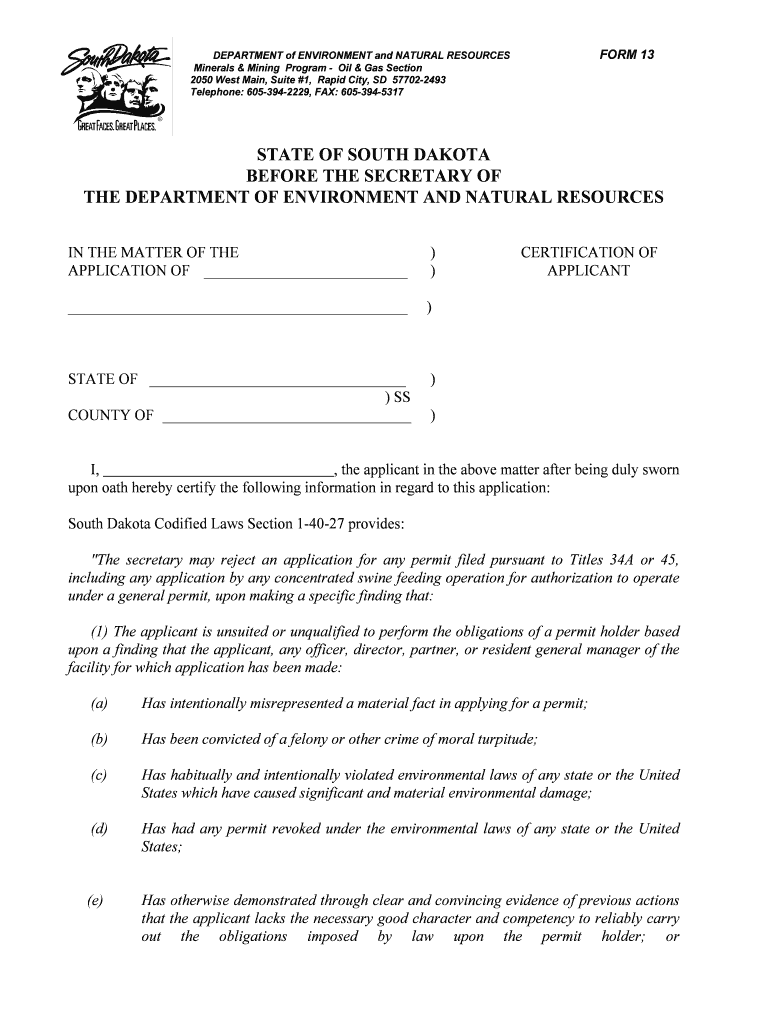

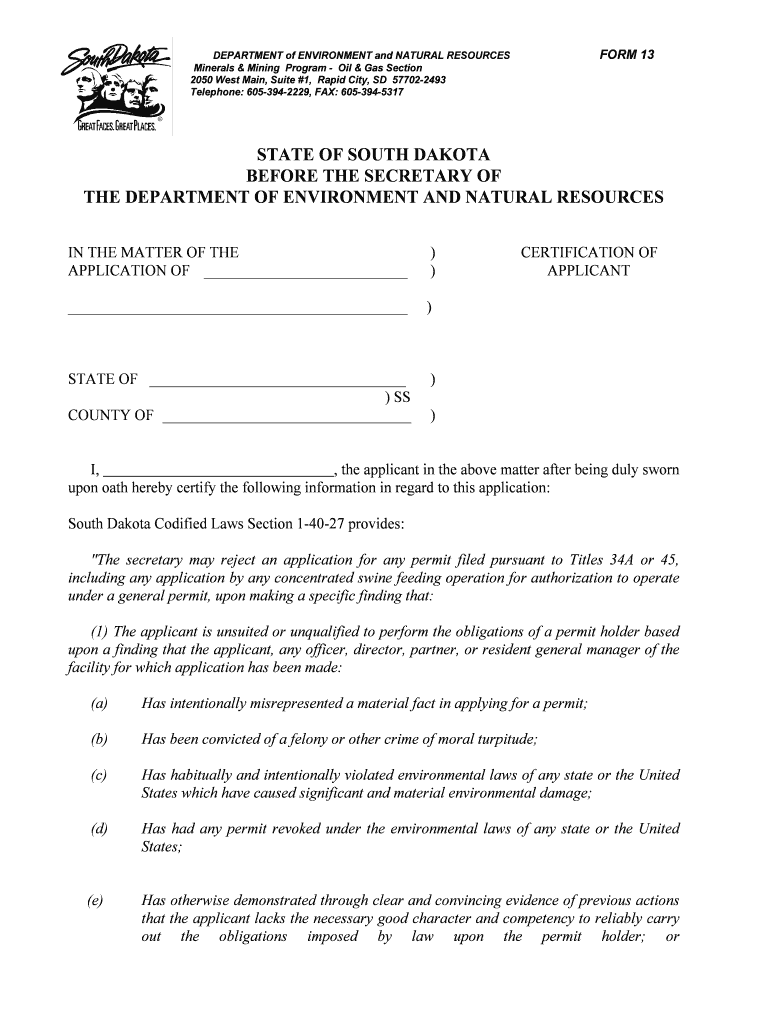

This document is a certification form required for applicants seeking permits related to environmental and natural resources management in South Dakota. It includes declarations regarding the applicant's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 13 - denr

Edit your form 13 - denr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 13 - denr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 13 - denr online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 13 - denr. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 13 - denr

How to fill out FORM 13

01

Obtain FORM 13 from the relevant authority or download it from their official website.

02

Read the instructions accompanying the form carefully.

03

Fill in your personal details such as name, address, and contact information in the designated sections.

04

Provide any required identification information or documentation as specified.

05

Complete any sections related to your specific situation or reason for filling out the form.

06

Review your completed form for accuracy and completeness before submission.

07

Submit FORM 13 as per the instructions provided, either online or in-person.

Who needs FORM 13?

01

Individuals who need to apply for a specific permit or registration.

02

Persons seeking to update their personal information with the authority.

03

Those required to report changes in circumstances affecting their application.

Fill

form

: Try Risk Free

People Also Ask about

What is form 13 for?

Form 13 is a crucial form for taxpayers who believe their actual tax liability is lower than the TDS being deducted by their payer (client, employer, etc.). By filing this form, you can apply to the Income Tax Department for a lower TDS certificate or even a nil TDS certificate, if eligible.

What is Form 13F used for?

FORM-13 (REVISED) THE EMPLOYEES' PROVIDENT FUND SCHEME, 1952. (Para-57) [APPLICATION FOR TRANSFER OF EPF ACCOUNT] NOTE: (1) To be submitted by the member to the present employer for onward transmission to the Commissioner, EPF by whom the transfer is to be effected.

What is meant by form 13?

Official Form 13 is used in chapter 11 reorganization cases to provide certain parties in interest with notice of the court's approval of the disclosure statement, their opportunity to file acceptances or rejections of the plan, and an order and notice of a hearing to consider the approval of the plan of reorganization

How long does form 13 process take?

Take a printout of Form 13 and sign it. ' Submit the signed form to your employer within 10 days for further processing and approval by both the employer and EPFO. Once approved you will receive a confirmation SMS for the same.

How can I transfer my PF from one employer to another online?

Go to the EPFO website and log in with your UAN and password. Click on 'Online Services' and select the 'One Member - One EPF Account (Transfer Request)' option. Verify personal details and provide information wherever needed about your previous and current employers.

What is form thirteen?

The Form 13 must be given to the seller at the time of the purchase to document why sales tax does not apply to the purchase. The Form 13 must be kept with the seller's records for audit purposes.

How much time does it take for a PF transfer?

The employee will get an SMS notifying the completion of the transfer of old EPF balance to the new EPF account. The total time taken to complete the transfer of PF account is approximately 20 days. This can differ depending on the time taken by the previous employer for attesting the old claim.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM 13?

FORM 13 is a tax form used in certain jurisdictions to report specific information related to tax obligations, often related to income or withholding tax.

Who is required to file FORM 13?

Individuals or entities who are subject to specific tax regulations, often including employers or businesses that have withholding obligations, are required to file FORM 13.

How to fill out FORM 13?

To fill out FORM 13, you typically need to provide your taxpayer identification details, report income figures, and detail any withholding information as required by the form's instructions.

What is the purpose of FORM 13?

The purpose of FORM 13 is to ensure compliance with tax laws by reporting withheld taxes and providing necessary information to tax authorities.

What information must be reported on FORM 13?

Required information usually includes taxpayer identification numbers, amounts of income earned, amounts of tax withheld, and potentially other relevant financial information as stipulated by the form.

Fill out your form 13 - denr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 13 - Denr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.