Get the free State Property Tax Moratorium Application - history sd

Show details

This document is an application form for the state property tax moratorium administered by the South Dakota State Historical Society. It includes instructions for application submission, fee schedule,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state property tax moratorium

Edit your state property tax moratorium form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state property tax moratorium form via URL. You can also download, print, or export forms to your preferred cloud storage service.

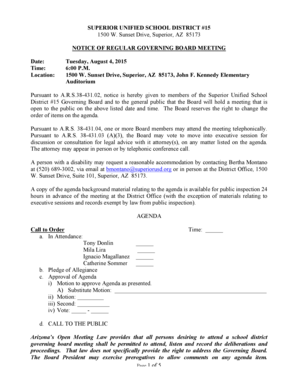

Editing state property tax moratorium online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit state property tax moratorium. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state property tax moratorium

How to fill out State Property Tax Moratorium Application

01

Download the State Property Tax Moratorium Application form from the official state website.

02

Carefully read the instructions provided on the application form.

03

Fill in your personal information, including your name, address, and contact details.

04

Provide information about the property for which you are requesting the moratorium, including the property address and tax identification number.

05

Indicate the reason for requesting the property tax moratorium, ensuring that you meet eligibility requirements.

06

Gather any required documentation, such as proof of income, financial hardship, or other relevant evidence.

07

Review your completed application for accuracy and completeness.

08

Submit the application by the specified deadline, either online or via mail, as instructed.

Who needs State Property Tax Moratorium Application?

01

Homeowners experiencing financial hardship.

02

Individuals facing temporary job loss or reduced income.

03

Property owners who are unable to pay property taxes due to unforeseen circumstances.

04

Eligible residents seeking tax relief to prevent property loss.

Fill

form

: Try Risk Free

People Also Ask about

How do I become exempt from property taxes in California?

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

Can I file PAS 1 online?

Eligible applicants can file the 2024 Application for Property Tax Relief online or by paper. File your application by October 31, 2025. All paper applications postmarked on or before the due date are considered filed on time. Online applications must be submitted by 11:59pm., October 31, 2025.

At what age can you freeze your property taxes in California?

The State Controller's Property Tax Postponement Program allows homeowners who are 62 and over and who meet other requirements to file for a postponement. For more details on this program, please visit the State Controller's website. Please note, this is a program administered by the State of California.

Do seniors get a break on property taxes in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $53,574 or less

At what age do seniors stop paying property taxes in California?

1. Senior Citizen Homeowners' Property Tax Exemption. The Senior Citizen Homeowners' Property Tax Exemption is available to homeowners who are at least 65 years old and meet certain income requirements.

Do property taxes go down after age 65?

Often, if you're 65 or older, you'll be able to reduce your property tax bill not only on a house but mobile and manufactured homes, houseboats, townhomes, iniums and so on. You will have to apply: You typically need to apply for a senior freeze.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is State Property Tax Moratorium Application?

The State Property Tax Moratorium Application is a formal request submitted by property owners to temporarily suspend or reduce property tax payments due to specific qualifying circumstances, often related to financial hardships or disaster relief.

Who is required to file State Property Tax Moratorium Application?

Property owners who are experiencing financial difficulties or other qualifying situations that warrant a temporary suspension or reduction of property taxes are required to file the State Property Tax Moratorium Application.

How to fill out State Property Tax Moratorium Application?

To fill out the State Property Tax Moratorium Application, property owners must gather necessary documentation, complete the application form, providing details about their property, the reason for requesting the moratorium, and submit it to the appropriate local tax authority.

What is the purpose of State Property Tax Moratorium Application?

The purpose of the State Property Tax Moratorium Application is to provide financial relief to property owners during times of economic hardship or natural disasters by allowing them to temporarily defer or reduce their property tax obligations.

What information must be reported on State Property Tax Moratorium Application?

The information that must be reported includes the property owner's name, property address, reasons for the moratorium request, any supporting financial documents, and any additional information as required by local tax authorities.

Fill out your state property tax moratorium online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Property Tax Moratorium is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.