Get the free An Act to revise the suitability requirements for annuities - legis state sd

Show details

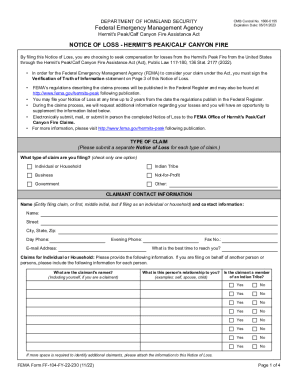

This document outlines the amendments to the suitability requirements for the purchase and exchange of annuities in the state of South Dakota, detailing the responsibilities of insurance producers

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign an act to revise

Edit your an act to revise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your an act to revise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit an act to revise online

Follow the steps below to use a professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit an act to revise. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out an act to revise

How to fill out An Act to revise the suitability requirements for annuities

01

Read the introduction to understand the purpose of the Act.

02

Gather necessary documentation related to existing annuity contracts.

03

Identify the current suitability requirements that are being revised.

04

Review the proposed revisions to assess their implications.

05

Complete any required forms or applications as outlined in the Act.

06

Compile supporting information or evidence supporting your compliance with the revised requirements.

07

Submit the completed documentation to the appropriate regulatory body.

08

Monitor any responses or requests for additional information from regulators.

Who needs An Act to revise the suitability requirements for annuities?

01

Financial advisors who sell annuity products.

02

Insurance companies offering annuities.

03

Consumers considering purchasing annuities.

04

Regulatory bodies overseeing the financial services industry.

05

Legal professionals specializing in financial law.

Fill

form

: Try Risk Free

People Also Ask about

When did the NAIC amend Model regulation 275?

In February 2020, the NAIC made significant revisions to the model, following extensive deliberations and input from state insurance regulators, consumer representatives, and the insurance industry.

What is the effective date of the revisions to NAIC suitability in annuity transaction model regulation?

Question: The effective date of the revisions to NAIC Suitability in Annuity Transaction Model Regulation (#275) is:June 30, 2020.

Who would the NAIC annuity best interest obligation apply to?

NAIC Best Interest mandates that producers who engage in the sale of annuity products must complete an approved, state-specific best interest annuity training course, and insurers must verify the completion of said training before the agent can solicit the sale of annuities.

What organization adopted the 2010 suitability in annuity transactions model regulation?

In 2010, the NAIC introduced their Model Regulation 275 - Suitability in Annuity Transactions. This model regulation outlined an insurance producer's responsibilities when recommending an annuity to a client. In 2020 the NAIC updated that model to require insurance producer's to work in their client's best interests.

What is the NAIC suitability in annuity transaction model regulation?

The Suitability in Annuity Transactions Model Regulation (#275) serves as a basis for this regulatory framework. Model #275 sets forth standards and procedures for recommending annuity products to consumers to ensure their insurance and financial objectives are appropriately addressed.

Which of the following best defines the purpose of the 2010 NAIC annuity suitability model regulation?

The purpose of this regulation is to require producers, as defined in this regulation, to act in the best interest of the consumer when making a recommendation of an annuity and to require insurers to establish and maintain a system to supervise recommendations and to set forth standards and procedures for

What is used to determine annuity suitability?

This involves evaluating their income, assets, liabilities, risk tolerance, and future financial goals. Proper client assessment determines each individual's most suitable annuity product. Advisors must thoroughly understand the different types of annuities, their features, benefits, and potential drawbacks.

What is the suitability law for annuities?

The Suitability in Annuity Transactions Model Regulation (#275) serves as a basis for this regulatory framework. Model #275 sets forth standards and procedures for recommending annuity products to consumers to ensure their insurance and financial objectives are appropriately addressed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is An Act to revise the suitability requirements for annuities?

An Act to revise the suitability requirements for annuities is legislation aimed at ensuring that financial advisors recommend annuity products that are appropriate for the financial needs and circumstances of their clients.

Who is required to file An Act to revise the suitability requirements for annuities?

Financial institutions and insurance companies that offer annuity products, as well as financial advisors who recommend these products to clients, are typically required to comply with and file relevant documentation under this Act.

How to fill out An Act to revise the suitability requirements for annuities?

To fill out the Act, individuals must follow the provided guidelines for gathering client information, complete the suitability assessment forms, and document the rationale for recommending specific annuity products based on client profiles.

What is the purpose of An Act to revise the suitability requirements for annuities?

The purpose of the Act is to protect consumers by ensuring that the annuity products sold to them are suitable for their individual financial situations, thereby promoting transparency and accountability in the financial advisory process.

What information must be reported on An Act to revise the suitability requirements for annuities?

The information that must be reported includes client financial profiles, the suitability assessments conducted, the rationale for product recommendations, and any disclosures related to risks, costs, and benefits of the annuity products.

Fill out your an act to revise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

An Act To Revise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.