Get the free TARIFF NO. 2

Show details

This document outlines the rate and fee schedules, rules and service regulations, and facility extension policy for the culinary water service provided by Hidden Creek Water Company.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tariff no 2

Edit your tariff no 2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tariff no 2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tariff no 2 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tariff no 2. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tariff no 2

How to fill out TARIFF NO. 2

01

Obtain the TARIFF NO. 2 form from the relevant authority or website.

02

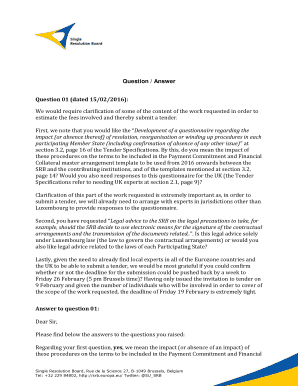

Carefully read the instructions provided with the form.

03

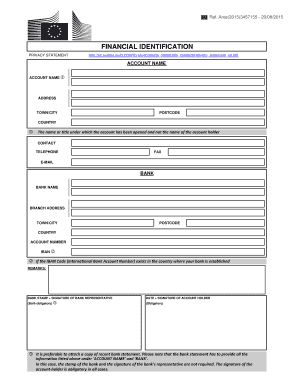

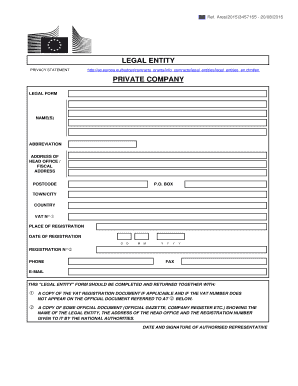

Fill in your personal information in the designated fields, including name, address, and contact details.

04

Enter the relevant product information for which the tariff is applicable, including description, quantity, and value.

05

Review the tariff classifications and select the appropriate codes as per the guidelines.

06

Sign and date the form where indicated to validate your submission.

07

Submit the completed form according to the submission guidelines (online, mail, or in-person).

Who needs TARIFF NO. 2?

01

Businesses involved in importing or exporting goods that are subject to tariffs.

02

Customs brokers and agents managing tariff-related documentation.

03

Individuals or organizations applying for tariff exemptions or reductions.

Fill

form

: Try Risk Free

People Also Ask about

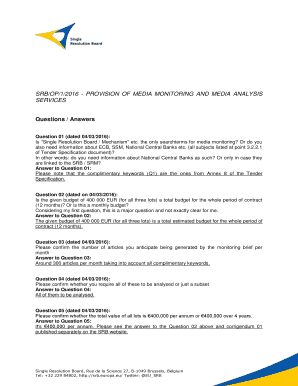

How do you read the harmonized tariff schedule?

HTS numbers are 10-digit codes that categorize each imported good. The first six digits are an HS code. The subsequent two digits identify the US subheading of the HS code to determine the duty rate, while the final two digits are a statistical suffix.

What is tariff 2?

Tariff 2. For any hiring either during Monday to Friday between 20:00 and 22:00 or during Saturday or Sunday between 06:00 and 22:00, other than on a public holiday: For the first 220 metres or 47.4 seconds (whichever is reached first) there is a minimum charge of £2.20.

What is tariff in English?

1. a. : a schedule of duties imposed by a government on imported or in some countries exported goods. b. : a duty or rate of duty imposed in such a schedule.

What is column 2 in the harmonized tariff schedule?

Column 2 (the so-called "statutory rates") applies to countries listed in general note 3(b); the general notes set forth the rules for applying the HTS. Embargoes, anti-dumping duties, countervailing duties, and other very specific matters administered by the Executive Branch are not contained in the HTS.

What do you mean by tariff code?

Tariff codes are classification systems used to identify and categorize goods in international trade. Although the Harmonized System(HS) is the common global basis, there are specific extensions and adaptations that vary by region or country.

What is column 2 in HTS code?

Countries not covered by NTR are commonly referred to as "Column Two" countries, meaning duty rates for products from these countries are listed in Column two of the HTS. Currently, the countries with Column Two status are Cuba, North Korea, Russia and Belarus.

How do I find my tariff code?

If your product is difficult to classify, the Customs Rulings Online Search System (CROSS) database can help you find its HS code. CROSS contains official, legally binding rulings from requests for Harmonized Tariff System (HTS) numbers for products importing into the United States.

What is a tariff code in shipping?

Tariff Code is an internationally recognized numerical system created by the World Customs Organization (WCO) with the purpose to facilitate international trade by easing the task of identifying and categorizing traded goods. These numbers exist for every product involved in global commerce.

What is a tariff code in English?

A tariff code is a code that describes your product, which you must provide on your customs documents, including customs declarations for import and export. You may also encounter the terms “customs tariff code” or “customs code” but they also refer to the part of the code you need for customs purposes.

What is the Harmonized System 2 digit?

The HS code consists of 6-digits. The first two digits designate the Chapter wherein headings and subheadings appear. The second two digits designate the position of the heading in the Chapter. The last two digits designate the position of the subheading in the heading.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TARIFF NO. 2?

TARIFF NO. 2 is a document used to report specific tariffs and fees applicable to goods and services.

Who is required to file TARIFF NO. 2?

Entities involved in the importation or exportation of goods that are subject to tariff regulations are required to file TARIFF NO. 2.

How to fill out TARIFF NO. 2?

To fill out TARIFF NO. 2, follow the provided instructions carefully, ensuring all relevant details about the goods and applicable tariffs are accurately entered.

What is the purpose of TARIFF NO. 2?

The purpose of TARIFF NO. 2 is to ensure compliance with tariff regulations and to document the applicable tariffs for goods being imported or exported.

What information must be reported on TARIFF NO. 2?

Information that must be reported on TARIFF NO. 2 includes the description of the goods, their tariff classification, and the applicable tariff rates.

Fill out your tariff no 2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tariff No 2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.