Get the free 09-2071 - tax utah

Show details

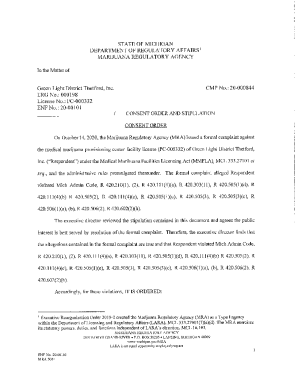

This document is an Initial Hearing Order concerning a petitioner's appeal of the denial of his motor vehicle salesperson license by the Motor Vehicle Enforcement Division of the Utah State Tax Commission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 09-2071 - tax utah

Edit your 09-2071 - tax utah form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 09-2071 - tax utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 09-2071 - tax utah online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 09-2071 - tax utah. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 09-2071 - tax utah

How to fill out 09-2071

01

Obtain Form 09-2071 from the relevant authority or website.

02

Read the instructions provided with the form carefully.

03

Fill in the applicant's full name in the designated field.

04

Provide the mailing address, including city, state, and ZIP code.

05

Enter the date of birth in the specified format.

06

Indicate your Social Security number if required.

07

Complete any additional required sections, such as employment information or reason for application.

08

Review the form for accuracy and completeness.

09

Sign and date the form at the bottom.

10

Submit the form via mail or online as directed in the instructions.

Who needs 09-2071?

01

Individuals applying for government assistance programs.

02

Applicants seeking specific benefits or services related to their situation.

03

Organizations or agencies assisting clients with filling out the form.

Fill

form

: Try Risk Free

People Also Ask about

What year is 1822?

1822 (MDCCCXXII) was a common year starting on Tuesday of the Gregorian calendar and a common year starting on Sunday of the Julian calendar, the 1822nd year of the Common Era (CE) and Anno Domini (AD) designations, the 822nd year of the 2nd millennium, the 22nd year of the 19th century, and the 3rd year of the 1820s

What year is 1421 in English?

1421 (MCDXXI) was a common year starting on Wednesday of the Julian calendar, the 1421st year of the Common Era (CE) and Anno Domini (AD) designations, the 421st year of the 2nd millennium, the 21st year of the 15th century, and the 2nd year of the 1420s decade.

What year is 1421 Hijri?

Islamic Hijri Calendar For 1421 Hijri Hijri MonthStarts OnDay of Week Safar 1421 5-May-2000 Friday Rabi al-awwal 1421 4-Jun-2000 Sunday Rabi al-thani 1421 3-Jul-2000 Monday Jumada al-awwal 1421 1-Aug-2000 Tuesday8 more rows

What is 1421?

02:21 p.m. in military format is 1421. The military format, similar to the 24-hour format, represents time as a continuous sequence from 0000 (midnight) to 2359, eliminating the need for AM/PM.

What happened in the year 1421?

On November 18, 1421, a massive storm batters North Sea coast, sending surge waters inland, breaching dikes and inundating villages in what is now the Netherlands. Over the next day, up to 10,000 people died in the resulting floods.

How do you say 09 10 in English?

24-hour and 12-hour clock Examples: 16:45 4:45 p.m. It's a quarter to five p.m. 08:15 8:15 a.m. It's a quarter past eight a.m. 20:15 8:15 p.m. It's a quarter past eight p.m. 09:10 9:10 a.m. It's ten (minutes) past nine a.m.10 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 09-2071?

09-2071 is a specific tax form used for reporting income, deductions, and other tax-related information as required by the tax authority.

Who is required to file 09-2071?

Individuals or businesses that meet certain income thresholds or have specific tax situations defined by the tax authority are required to file 09-2071.

How to fill out 09-2071?

To fill out 09-2071, gather all necessary financial documents, follow the instructions provided with the form, and ensure all fields are accurately completed before submitting.

What is the purpose of 09-2071?

The purpose of 09-2071 is to accurately report income and related tax information to ensure compliance with tax regulations.

What information must be reported on 09-2071?

Information that must be reported on 09-2071 includes total income, allowable deductions, tax credits, and any other relevant financial details required by the tax authority.

Fill out your 09-2071 - tax utah online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

09-2071 - Tax Utah is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.