Get the free Order of the Utah State Tax Commission - tax utah

Show details

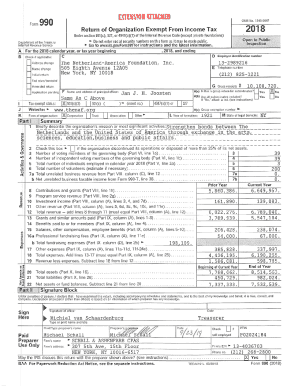

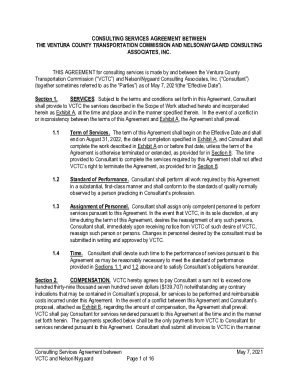

This document is an order from the Utah State Tax Commission regarding a property tax appeal concerning the assessment of a bed and breakfast property in Grand County, Utah. It details the petitioner's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign order of form utah

Edit your order of form utah form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your order of form utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing order of form utah online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit order of form utah. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

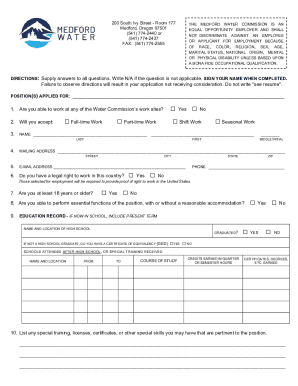

How to fill out order of form utah

How to fill out Order of the Utah State Tax Commission

01

Obtain the 'Order of the Utah State Tax Commission' form from the official website or local Tax Commission office.

02

Carefully read the instructions provided on the form.

03

Fill in your personal information including your name, address, and taxpayer identification number.

04

Provide details about the tax year for which you are filing the order.

05

Describe the reason for the order clearly and concisely, providing any necessary supporting documentation.

06

Check the relevant boxes related to your situation, such as whether you are contesting an assessment or requesting a refund.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form to the address specified in the instructions, ensuring you keep a copy for your records.

Who needs Order of the Utah State Tax Commission?

01

Individuals or businesses who have disputes regarding tax assessments.

02

Taxpayers seeking refunds for overpaid taxes.

03

Anyone involved in administrative law cases related to state taxation.

04

Representatives of estates or trusts when filing on behalf of the taxpayer.

Fill

form

: Try Risk Free

People Also Ask about

How much is $120,000 a year after taxes in utah?

If you make $120,000 a year living in the region of Utah, United States of America, you will be taxed $34,528. That means that your net pay will be $85,473 per year, or $7,123 per month. Your average tax rate is 28.8% and your marginal tax rate is 36.5%.

How do I contact the Utah State Tax Commission?

Tax rates are also available online at Utah Sales & Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800-662-4335.

Do I pay utah state taxes if I work remotely?

Utah taxes income earned for personal services performed while in Utah (even if you're a nonresident). This includes remote work for an employer or clients based outside Utah if you were physically in the state while doing the work.

What is the penalty for paying utah state taxes late?

Penalty Detail Days LatePenalty 1-5 Greater of $20 or 2% of unpaid tax, fee or charge 6-15 Greater of $20 or 5% of unpaid tax, fee or charge 16 or more Greater of $20 or 10% of unpaid tax, fee or charge

Why am i getting a letter from Utah State Tax Commission?

General Information. If a taxpayer does not file a return, files it late, or if the tax due is underpaid, the Tax Commission will send the taxpayer a billing notice approximately thirty days after the due date. The amount due on the billing notice will include any penalty and interest calculated to the notice due date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Order of the Utah State Tax Commission?

The Order of the Utah State Tax Commission is a formal decision issued by the commission that resolves tax disputes, establishes tax liabilities, or provides directives related to tax matters in the state of Utah.

Who is required to file Order of the Utah State Tax Commission?

Taxpayers who are disputing a tax assessment or who are required to provide information about their tax status may be required to file an Order of the Utah State Tax Commission.

How to fill out Order of the Utah State Tax Commission?

To fill out the Order of the Utah State Tax Commission, taxpayers must complete the required forms accurately, provide necessary documentation, and submit their case for review, including all relevant information pertaining to their tax issues.

What is the purpose of Order of the Utah State Tax Commission?

The purpose of the Order of the Utah State Tax Commission is to provide a mechanism for resolving tax disputes, ensuring compliance with tax regulations, and clarifying tax obligations for individuals and businesses in Utah.

What information must be reported on Order of the Utah State Tax Commission?

The information that must be reported includes the taxpayer's identification details, the nature of the dispute, any relevant financial records, and supporting documentation that justifies the taxpayer's position regarding the tax issue.

Fill out your order of form utah online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Order Of Form Utah is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.