Get the free Single Levy Proposed Tax Rate Worksheet - propertytax utah

Show details

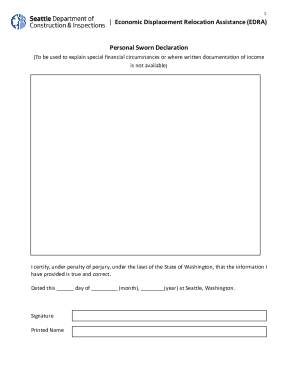

This document is used for reporting the proposed tax rate and related budgetary information for a taxing entity, including calculations and certifications by the authorized agent and county auditor.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign single levy proposed tax

Edit your single levy proposed tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your single levy proposed tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing single levy proposed tax online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit single levy proposed tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out single levy proposed tax

How to fill out Single Levy Proposed Tax Rate Worksheet

01

Gather information on the current and proposed tax rates.

02

Enter the name of the taxing authority on the top of the worksheet.

03

Fill out the current year levy and the proposed year levy in the appropriate fields.

04

List any exemptions or adjustments applicable to the current levy.

05

Calculate the total amount to be levied based on the proposed tax rate.

06

Review all figures for accuracy and completeness.

07

Submit the completed worksheet to the relevant county or state agency by the deadline.

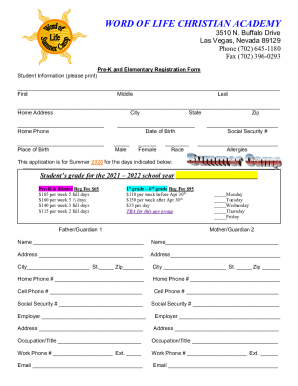

Who needs Single Levy Proposed Tax Rate Worksheet?

01

Local governments proposing a tax rate change.

02

School districts looking to adjust their funding.

03

Municipalities that require voter approval for tax increases.

Fill

form

: Try Risk Free

People Also Ask about

How to calculate taxable portion?

Taxable income = Gross Income - Exempt Income - Allowable Deductions + Taxable Capital Gains.

What is a taxable portion?

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year. It can be described broadly as adjusted gross income (AGI) minus allowable itemized or standard deductions.

Are Social Security and Medicare progressive taxes payroll taxes local taxes corporate taxes?

Community Answer. Social Security and Medicare are classified as payroll taxes, deducted from wages to fund retirement and healthcare programs. These taxes are not progressive; they apply a flat rate to income.

What is the minimum tax levy?

A: A minimum tax levy may be established by bylaw to increase the amount of taxation revenue generated from lower assessed properties within one or more property classifications. Minimum tax will generally be a specified value or amount; however, it may also be expressed in a formula.

How do you calculate the taxable amount of a product?

Let's say you have a product with a price of ₹1,000, and the applicable GST rate is 18%. GST Amount = (18/100) x ₹1,000 = ₹180. Total Amount (including GST) = ₹1,000 + ₹180 = ₹1,180.

How do you calculate taxable amount?

Income Tax on Salary Formula Taxable Income = Gross salary - Deductions. Income Tax = (Taxable income x Applicable tax rate) - Tax rebate. Income tax on salary per month can be calculated by dividing the total tax by 12.

How much is tax in the USA for a 100k salary?

Tax brackets 2024: What to know for taxes due in 2025 Tax RateSingle Filers/ Married Filing SeparateHeads of Households 10% $0 – $11,600 $0 – $16,550 12% $11,601 – $47,150 $16,551 – $63,100 22% $47,151 – $100,525 $63,101 – $100,500 24% $100,526 – $191,950 $100,501 – $191,9504 more rows

What is the formula for calculating taxable income?

Your taxable income is your gross income minus deductions you're eligible for. It's used to determine your tax bracket and marginal tax rate, so it's important to know this amount as you file your income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

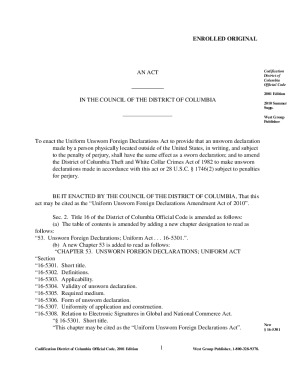

What is Single Levy Proposed Tax Rate Worksheet?

The Single Levy Proposed Tax Rate Worksheet is a document used by local governments or districts to calculate and propose their tax rates for a single levy. This worksheet aids in the transparent assessment of property tax rates intended to be levied.

Who is required to file Single Levy Proposed Tax Rate Worksheet?

Local governments, school districts, or specific taxing districts that are proposing a tax rate for their single levy are required to file the Single Levy Proposed Tax Rate Worksheet.

How to fill out Single Levy Proposed Tax Rate Worksheet?

To fill out the Single Levy Proposed Tax Rate Worksheet, you usually need to enter information regarding the proposed tax rate, estimated revenue, current valuation of properties, and other relevant financial data as guided by the worksheet's instructions.

What is the purpose of Single Levy Proposed Tax Rate Worksheet?

The purpose of the Single Levy Proposed Tax Rate Worksheet is to ensure transparency and clarity in how tax rates are proposed and calculated, allowing property owners and stakeholders to understand the financial implications of the proposed tax.

What information must be reported on Single Levy Proposed Tax Rate Worksheet?

The Single Levy Proposed Tax Rate Worksheet typically requires reporting information such as the proposed tax rate, the total assessed value, estimated tax revenue to be generated, the current tax rates in comparison, and a breakdown of funding needs for specific services.

Fill out your single levy proposed tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Single Levy Proposed Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.