Get the free S.B. 36 - le utah

Show details

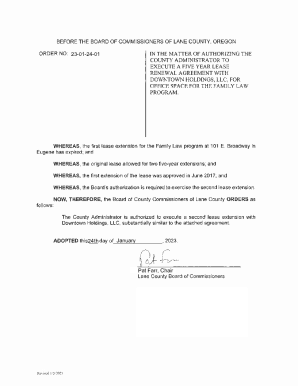

This document pertains to amendments made to the Sales and Use Tax Act related to prepaid telephone calling cards, including provisions exempting these amounts from state and local sales and use taxes,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sb 36 - le

Edit your sb 36 - le form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sb 36 - le form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sb 36 - le online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sb 36 - le. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sb 36 - le

How to fill out S.B. 36

01

Begin by downloading S.B. 36 form from the official website or obtaining a hard copy.

02

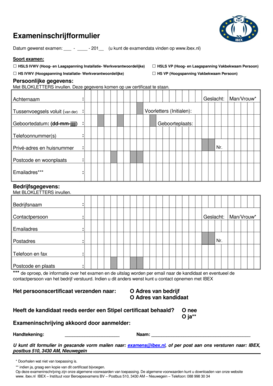

Fill in your personal information at the top of the form, including your name, address, and contact information.

03

Provide details about the specific purpose of the application as required by the form.

04

Complete any additional sections relevant to your circumstances, ensuring all fields are filled out accurately.

05

Review the form for any errors or missing information.

06

Sign and date the form at the designated section.

07

Submit the completed form through the appropriate channel, whether online or by mail, as instructed.

Who needs S.B. 36?

01

Individuals or organizations seeking to comply with regulations or requirements specified under S.B. 36.

02

Professionals who are involved in processes or activities that necessitate the submission of this form.

03

Anyone required by law to report or apply for permits related to S.B. 36.

Fill

form

: Try Risk Free

People Also Ask about

What does SB 319 mean in Georgia?

SB 319/AP (b) Any person who is not prohibited by law from possessing a handgun or long gun may have or carry on his or her person a long gun without a valid weapons carry license, provided that if the long gun is loaded, it shall only be carried in an open and fully exposed manner .

What is the Senate Bill 36 in California?

Under Senate Bill 36 (SB 36), the Judicial Council is required to publish an annual report with data related to outcomes and potential biases in pretrial release for pretrial programs funded by the state to perform risk assessments.

What is Senate bill 36 in Georgia?

A BILL to be entitled an Act to amend Title 50 of the Official Code of Georgia Annotated, relating to state government, so as to provide for the preservation of religious freedom; to provide for the granting of relief; to provide for definitions; to provide for construction; to provide for statutory interpretation; to

What is Georgia 529 benefit?

Funds may be used at virtually any college or university in the United States, and many abroad. Contributions up to $4,000 per year, per beneficiary, are eligible for a Georgia state income tax deduction for those filing a single return; and $8,000 per year, per beneficiary, for those filling a joint return.

What is Georgia SB36?

A BILL to be entitled an Act to amend Title 50 of the Official Code of Georgia Annotated, relating to state government, so as to provide for the preservation of religious freedom; to provide for the granting of relief; to provide for definitions; to provide for construction; to provide for statutory interpretation; to

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is S.B. 36?

S.B. 36 is a legislative bill that pertains to specific regulations or requirements, which can vary by jurisdiction. Generally, it involves financial disclosures or compliance regulations affecting certain entities.

Who is required to file S.B. 36?

Typically, entities such as businesses, organizations, or individuals who fall under the purview of the regulations set forth in S.B. 36 are required to file it. This often includes those working in regulated industries or receiving public funds.

How to fill out S.B. 36?

To fill out S.B. 36, one must complete the designated forms accurately, providing all required information, and attached any necessary documentation as specified in the instructions accompanying the bill.

What is the purpose of S.B. 36?

The purpose of S.B. 36 is to ensure compliance with specific regulatory requirements, enhance transparency, and protect the interests of stakeholders by requiring relevant disclosures.

What information must be reported on S.B. 36?

The information required usually includes financial data, operational details, disclosures related to conflicts of interest, and other relevant data as outlined by the specific requirements of S.B. 36.

Fill out your sb 36 - le online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sb 36 - Le is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

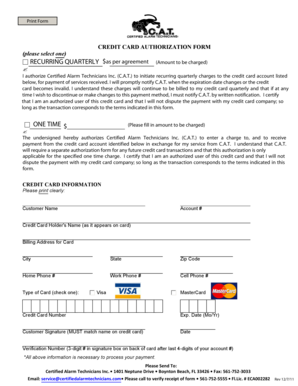

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.