Get the free Vermont Form CO-418 - state vt

Show details

This document provides a schedule for C corporations in Vermont to adjust their bonus depreciation and recapture gain calculations for tax purposes as dictated by the Jobs Creation and Worker Assistance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vermont form co-418

Edit your vermont form co-418 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont form co-418 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vermont form co-418 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vermont form co-418. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vermont form co-418

How to fill out Vermont Form CO-418

01

Obtain Vermont Form CO-418 from the Vermont Department of Taxes website or local office.

02

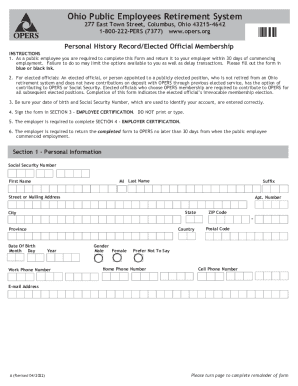

Fill in your name, address, and contact information at the top of the form.

03

Provide your Social Security Number or Employer Identification Number.

04

Complete the sections regarding your business activities and income.

05

Attach relevant supporting documents, such as financial statements or schedules.

06

Calculate your total tax liability based on the instructions provided.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the form by the appropriate deadline either electronically or by mail.

Who needs Vermont Form CO-418?

01

Businesses operating in Vermont that need to report certain income or taxes.

02

Taxpayers who are required to file a partnership or corporate tax return in Vermont.

03

Entities undergoing certain business transactions that necessitate reporting via Form CO-418.

Fill

form

: Try Risk Free

People Also Ask about

What is the 40 capital gain exclusion in Vermont?

A Percentage Exclusion allows you to you exclude up to 40% of your adjusted net capital gain from the sale of assets held for more than three years. Only certain categories of capital gain income are eligible for this exclusion.

What is the withholding tax in Vermont for non residents?

This withholding tax is typically calculated at 2.5% of the sale price and is due at the time of the sale. The non-resident seller must then prepare and file a Vermont income tax return by April 15 th of the following year (plus extensions) to determine the state capital gains tax due.

What is the tax form for a non-resident in Vermont?

NON-RESIDENT: Complete Form IN-111, by filing Parts I and II to determine the allocation of Vermont income of Form IN-111. A non-resident is when an individual does not live in the state for at least part of the year or earn income in the state.

What is the minimum corporate tax in Vermont?

The corporate income tax rate ranges from 6% to 8.5% of a company's net income, with businesses making $10,000 or more from Vermont sources paying an additional flat fee tax. The Department of Taxes has also instituted a minimum annual tax ranging from $300 to $750 based on a corporation's Vermont gross receipts.

Does Vermont accept federal extensions for corporations?

Yes. The state of Vermont requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax Extension Form can be filed only if the federal tax extension Form 7004 was rejected.

What items are not taxed in Vermont?

Vermont imposes a 6% sales tax on most goods and some services, but understanding what is exempt from sales tax in Vermont is crucial. Exemptions cover essentials like groceries, clothing, and medical equipment, making it easier for consumers to manage expenses.

What is the 183 day rule in Vermont?

What is the 183-day rule in Vermont? Employees who spend 183 or more days in Vermont during a calendar year may be classified as state residents for tax purposes. This impacts how much of their income is subject to Vermont state income tax.

Is the co 421 discontinued in Vermont?

Only one CO-411 is now needed for all companies within the combined group, we no longer require multiple company filings within a combined group. Because of this change, the CO-411 has been updated and Vermont no longer supports the Form CO-421 since only one return (CO- 411) is needed now for return submission.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Vermont Form CO-418?

Vermont Form CO-418 is a form used for the Corporate Income Tax reconciliation. It is primarily utilized by corporations operating within the state of Vermont.

Who is required to file Vermont Form CO-418?

Corporations that have income subject to Vermont corporate income tax are required to file Vermont Form CO-418.

How to fill out Vermont Form CO-418?

To fill out Vermont Form CO-418, corporations must provide information including their business identification details, income calculations, tax credits, and any other relevant financial information as required by the form.

What is the purpose of Vermont Form CO-418?

The purpose of Vermont Form CO-418 is to report a corporation's taxable income and to compute the amount of corporate income tax owed to the state of Vermont.

What information must be reported on Vermont Form CO-418?

Vermont Form CO-418 requires information such as total income, deductions, credits, and tax computations related to the corporation's financial activities during the tax year.

Fill out your vermont form co-418 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Form Co-418 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.