Get the free Form CO-411-U - state vt

Show details

This document is a tax return form for unitary groups in Vermont, detailing income, deductions, payments, and overpayments related to state taxes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form co-411-u - state

Edit your form co-411-u - state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form co-411-u - state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form co-411-u - state online

To use the professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form co-411-u - state. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

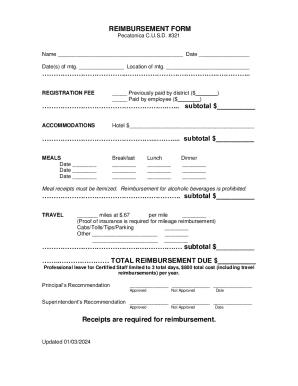

How to fill out form co-411-u - state

How to fill out Form CO-411-U

01

Obtain Form CO-411-U from the appropriate government website or office.

02

Carefully read the instructions that accompany the form to understand the requirements.

03

Fill out your personal information in the designated sections, such as name, address, and contact details.

04

Provide any necessary identification numbers (e.g., Social Security number or tax identification number).

05

Complete the specific sections that apply to your situation, providing accurate and truthful information.

06

Review the form for any errors or omissions before submission.

07

Sign and date the form where required.

08

Submit the completed form via the method specified in the instructions (e.g., by mail, electronically, or in person).

Who needs Form CO-411-U?

01

Individuals who are applying for certain government benefits or services may need Form CO-411-U.

02

Residents who need to report changes in their personal circumstances related to benefits.

03

Employees seeking specific tax exemptions or statuses may also be required to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

Is the co 421 discontinued in Vermont?

Only one CO-411 is now needed for all companies within the combined group, we no longer require multiple company filings within a combined group. Because of this change, the CO-411 has been updated and Vermont no longer supports the Form CO-421 since only one return (CO- 411) is needed now for return submission.

What items are not taxed in Vermont?

Vermont imposes a 6% sales tax on most goods and some services, but understanding what is exempt from sales tax in Vermont is crucial. Exemptions cover essentials like groceries, clothing, and medical equipment, making it easier for consumers to manage expenses.

What is the 183 day rule in Vermont?

What is the 183-day rule in Vermont? Employees who spend 183 or more days in Vermont during a calendar year may be classified as state residents for tax purposes. This impacts how much of their income is subject to Vermont state income tax.

Does Vermont accept federal extensions for corporations?

Yes. The state of Vermont requires businesses to file a Federal Form 7004 rather than requesting a separate state tax extension. State Tax Extension Form can be filed only if the federal tax extension Form 7004 was rejected.

What is a co-411 form in Vermont?

VT DoT CO-411 is a form used by the Vermont Department of Taxes for the reporting of certain tax-related information, typically related to corporate and business taxes.

What is the 40 capital gain exclusion in Vermont?

A Percentage Exclusion allows you to you exclude up to 40% of your adjusted net capital gain from the sale of assets held for more than three years. Only certain categories of capital gain income are eligible for this exclusion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form CO-411-U?

Form CO-411-U is a tax form used in the state of Colorado for reporting specific income and expenses associated with unincorporated businesses.

Who is required to file Form CO-411-U?

Individuals operating unincorporated businesses or sole proprietorships in Colorado are required to file Form CO-411-U.

How to fill out Form CO-411-U?

To fill out Form CO-411-U, gather all necessary financial information related to your unincorporated business, follow the instructions provided with the form to complete each section accurately, and submit it to the Colorado Department of Revenue.

What is the purpose of Form CO-411-U?

The purpose of Form CO-411-U is to report income earned by unincorporated businesses to ensure proper taxation and compliance with state tax laws.

What information must be reported on Form CO-411-U?

Form CO-411-U requires reporting of total income, allowable expenses, and other relevant financial data pertaining to the unincorporated business for the tax year.

Fill out your form co-411-u - state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Co-411-U - State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.