Get the free Form IN-114 - state vt

Show details

This document provides the necessary instructions and forms for individuals in Vermont to submit estimated tax payments for the year 2003, including guidelines on how to calculate and submit these

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form in-114 - state

Edit your form in-114 - state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form in-114 - state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form in-114 - state online

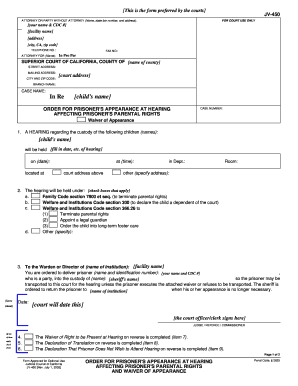

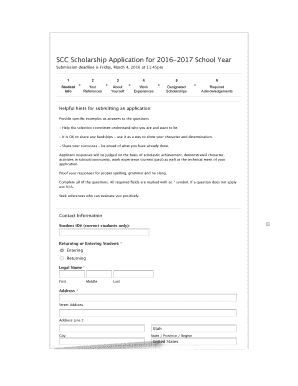

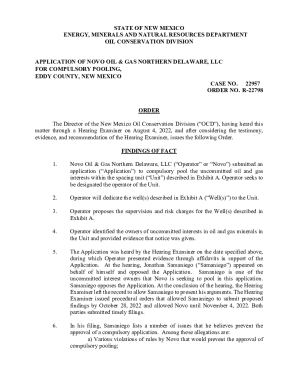

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form in-114 - state. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form in-114 - state

How to fill out Form IN-114

01

Download Form IN-114 from the official website.

02

Fill in your personal information including name, address, and contact details.

03

Provide details about the purpose of the form in the designated section.

04

Review the specific instructions for each section to ensure accurate completion.

05

Attach any necessary supporting documents as required.

06

Sign and date the form at the bottom.

07

Submit the form via the specified method (mail or electronic submission) as directed on the form.

Who needs Form IN-114?

01

Individuals applying for a specific type of immigration relief.

02

Those seeking to verify their eligibility for certain benefits.

03

Applicants looking to resolve issues related to their immigration status.

Fill

form

: Try Risk Free

People Also Ask about

How much is 100k after taxes in Vermont?

If you make $100,000 a year living in the region of Vermont, United States of America, you will be taxed $27,434. That means that your net pay will be $72,566 per year, or $6,047 per month. Your average tax rate is 27.4% and your marginal tax rate is 38.3%.

What is the CHC tax in Vermont?

Vermont employers will be required to make contributions to fund the new child care program beginning July 1, 2024. The contribution rate is set at 0.44% of an employee's wages earned in Vermont. All wages subject to Vermont income tax withholding are also subject to the 0.44% Child Care Contribution.

What is the self employment tax in Vermont?

All members or managers who take profits out of the LLC must pay self-employment tax. This tax is administered by the Federal Insurance Contributions Act (FICA), and covers Social Security, Medicare and other benefits. The current self-employment tax rate is 15.3 percent.

What is the personal income tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

What is form 26AS in English?

Form 26AS is a statement of all the tax-related information associated with the assessee's PAN (Permanent Account Number). It shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee, self-assessment tax paid, and any refunds issued to the taxpayer.

What is the tax rate in Vermont for small business?

Vermont Tax Rates, Collections, and Burdens Vermont has a graduated corporate income tax, with rates ranging from 6.0 percent to 8.5 percent. Vermont also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.36 percent.

How to pay VT tax?

Pay Online with myVTax If you file your return electronically, you can submit your payment by ACH Debit. Enter your account number and the routing number of your bank or financial institution into the secure online form.

What is form 145 in English?

Form 145 is a form that workers must submit to their company to communicate their personal and family situation, which is used to calculate the Personal Income Tax (IRPF) withholding rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form IN-114?

Form IN-114 is a form used for reporting certain income or financial information to the relevant tax authorities, specifically for individuals or entities that have foreign accounts or financial interests.

Who is required to file Form IN-114?

Individuals or entities that have foreign financial accounts or income must file Form IN-114 if their total foreign financial assets exceed a specific threshold established by the tax authorities.

How to fill out Form IN-114?

To fill out Form IN-114, gather all relevant financial information regarding foreign accounts or assets, accurately input the details required, ensure all sections are completed, and submit the form electronically or by mail to the appropriate agency.

What is the purpose of Form IN-114?

The purpose of Form IN-114 is to ensure transparency and compliance with tax regulations regarding foreign income and accounts, ultimately assisting in the prevention of tax evasion.

What information must be reported on Form IN-114?

Form IN-114 must report details such as account numbers, bank names, maximum account values, and personal identification information of the filer, along with any income earned from foreign assets.

Fill out your form in-114 - state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form In-114 - State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.