Get the free Form IN-114 - state vt

Show details

Este documento proporciona instrucciones y formularios para que los individuos en Vermont realicen pagos estimados de impuestos sobre la renta individual. Incluye información sobre cómo calcular

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form in-114 - state

Edit your form in-114 - state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form in-114 - state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form in-114 - state online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form in-114 - state. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form in-114 - state

How to fill out Form IN-114

01

Obtain Form IN-114 from the official website or authorized source.

02

Read the instructions provided with the form carefully.

03

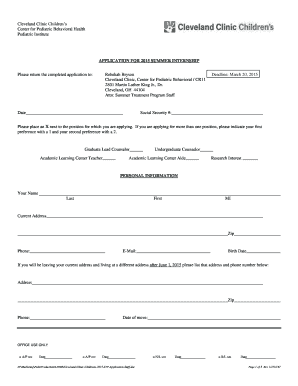

Fill out the personal information section including your name, address, and contact details.

04

Provide any required identification information, such as social security number or taxpayer ID.

05

Complete the relevant sections regarding your eligibility or reason for filling out the form.

06

Review all information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form either online or by mailing it to the designated address.

Who needs Form IN-114?

01

Individuals or entities who need to request a specific determination or adjustment from the relevant authority.

02

Those who are applying for certain benefits or statuses as specified by the form's purpose.

03

Users seeking to report information related to their tax obligations or other administrative requirements.

Fill

form

: Try Risk Free

People Also Ask about

What is form 26AS and how to get it?

Form 26AS helps in the computation of income and to claim the tax credits at the time of filing Income Tax Return (ITR) on income. A taxpayer can confirm the verification of refunds during the applicable financial or assessment year using Form 26AS.

Who submits form 26AS?

Income Tax Department facilitates a PAN holder to view its Tax Credit Statement (Form 26AS/Annual Tax Statement) online. Tax Credit Statement (Form 26AS/Annual Tax Statement) is generated when valid PAN is reported in the TDS/TCS statements.

What is the CHC tax in Vermont?

Vermont employers will be required to make contributions to fund the new child care program beginning July 1, 2024. The contribution rate is set at 0.44% of an employee's wages earned in Vermont. All wages subject to Vermont income tax withholding are also subject to the 0.44% Child Care Contribution.

What is the meaning of processed for 26AS?

Does it mean that the statement is processed successfully? The status 'Processed for 26AS' means that the TDS statement is processed partially and the tax credit is transferred to the deductee. The statement is processed successfully when the status is 'Processed with Default' or 'Processed without Default'.

What is form 145 in English?

Form 145 is a form that workers must submit to their company to communicate their personal and family situation, which is used to calculate the Personal Income Tax (IRPF) withholding rate.

What is the tax rate in Vermont for small business?

Vermont Tax Rates, Collections, and Burdens Vermont has a graduated corporate income tax, with rates ranging from 6.0 percent to 8.5 percent. Vermont also has a 6.00 percent state sales tax rate and an average combined state and local sales tax rate of 6.36 percent.

What is form 26AS in English?

Form 26AS is a statement of all the tax-related information associated with the assessee's PAN (Permanent Account Number). It shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee, self-assessment tax paid, and any refunds issued to the taxpayer.

What is the self employment tax in Vermont?

All members or managers who take profits out of the LLC must pay self-employment tax. This tax is administered by the Federal Insurance Contributions Act (FICA), and covers Social Security, Medicare and other benefits. The current self-employment tax rate is 15.3 percent.

What is the personal income tax in Vermont?

Vermont Capital Gains Tax Most capital gains in Vermont are subject to the personal income tax rates of 3.35% - 8.75%. This includes all short-term gains, but long term-gains may be eligible for an exclusion.

How much is 100k after taxes in Vermont?

If you make $100,000 a year living in the region of Vermont, United States of America, you will be taxed $27,434. That means that your net pay will be $72,566 per year, or $6,047 per month. Your average tax rate is 27.4% and your marginal tax rate is 38.3%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form IN-114?

Form IN-114 is a specific tax form used by organizations to report certain financial information to the tax authorities.

Who is required to file Form IN-114?

Entities that meet specific criteria set by the tax authorities, such as certain nonprofits or organizations with specific financial thresholds, are required to file Form IN-114.

How to fill out Form IN-114?

To fill out Form IN-114, organizations must provide accurate financial information, complete all required sections, and ensure compliance with filing instructions provided by the tax authorities.

What is the purpose of Form IN-114?

The purpose of Form IN-114 is to provide the tax authorities with detailed financial information regarding the organization's activities and compliance with tax regulations.

What information must be reported on Form IN-114?

Form IN-114 requires the reporting of financial data including income, expenses, assets, liabilities, and any relevant organizational details as specified in the filing instructions.

Fill out your form in-114 - state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form In-114 - State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.