Get the free Vermont Insurance Premium Tax Return - state vt

Show details

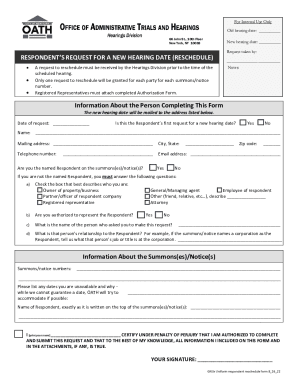

This document is a tax return form for insurance premium tax liability for Property & Casualty, Life, Accident & Health, and Annuity Companies in Vermont for the year 2009.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vermont insurance premium tax

Edit your vermont insurance premium tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont insurance premium tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vermont insurance premium tax online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vermont insurance premium tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vermont insurance premium tax

How to fill out Vermont Insurance Premium Tax Return

01

Gather necessary information: Collect all relevant financial documents and records, including insurance premiums collected, and expenses related to insurance operations.

02

Obtain the Vermont Insurance Premium Tax Return form: The form can be downloaded from the Vermont Department of Taxes website.

03

Fill out the Company Information section: Include your name, address, and taxpayer identification number.

04

Report gross premiums: Enter the total amount of insurance premiums collected during the tax year.

05

Calculate deductions: If applicable, list any deductions for reinsurance or other allowable expenses.

06

Determine taxable premiums: Subtract any deductions from gross premiums to determine your taxable amount.

07

Calculate the tax: Apply the appropriate tax rate to your taxable premiums.

08

Complete any additional sections: If you offer multiple types of insurance, make sure to fill out any required information for those lines.

09

Review the return: Ensure all information is accurate and complete.

10

Sign and date the form: Make sure the return is signed by an authorized individual.

11

Submit the form: Send the completed return to the Vermont Department of Taxes by the due date.

Who needs Vermont Insurance Premium Tax Return?

01

Insurance companies operating in Vermont that collect premiums must file the Vermont Insurance Premium Tax Return.

02

Insurance brokers and agents who handle insurance transactions in Vermont are also required to file.

03

Any out-of-state insurance companies that write policies for Vermont residents need to file this return.

Fill

form

: Try Risk Free

People Also Ask about

What is the income tax 111?

(1) Where the accumulated balance due to an employee participating in a recognised provident fund is included in his total income, owing to the provisions of Rule 8 of Part A of the Fourth Schedule not being applicable, the Income-tax Officer shall calculate the total of the various sums of 2[tax] in ance with

What is the VT Form 113?

What is VT Schedule IN-113? VT Schedule IN-113 is a form used by residents of Vermont to report their income and calculate their income tax liability.

What do you mean by insurance premium?

An insurance premium equates to the money that is paid by any person or company/business for availing of an insurance policy.

What is the captive premium tax rate in Vermont?

(a) Each captive insurance company shall pay to the Commissioner of Taxes on or before March 15 of each year a tax at the rate of 38-hundredths of one percent on the first 20 million dollars and 285-thousandths of one percent on the next 20 million dollars and 19-hundredths of one percent on the next 20 million dollars

What is the form in-111 for Vermont income tax return?

Form IN-111 is the official Vermont (VT) state income tax return document used by individuals to report their taxable income for a specific tax year and calculate any taxes owed or refundable to the state.

What is the tax form for a non resident in Vermont?

NON-RESIDENT: Complete Form IN-111, by filing Parts I and II to determine the allocation of Vermont income of Form IN-111. A non-resident is when an individual does not live in the state for at least part of the year or earn income in the state.

What is the VT tax form in-111?

The Vermont Income Tax Return Form IN-111 serves the primary purpose of helping residents accurately report their annual income to the state for taxation purposes.

Do I need to file Vermont income tax return?

If you are a Resident, Nonresident or Part Year resident you must file a Vermont income tax return if you are required to file a federal tax return, AND: You had earned Vermont income over $100, OR. You earned or received Vermont gross income of more than $1,000 as a nonresident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Vermont Insurance Premium Tax Return?

The Vermont Insurance Premium Tax Return is a tax form that insurance companies must file with the state of Vermont to report the premiums they have collected and to calculate the taxes owed on those premiums.

Who is required to file Vermont Insurance Premium Tax Return?

All insurance companies doing business in Vermont are required to file the Vermont Insurance Premium Tax Return.

How to fill out Vermont Insurance Premium Tax Return?

To fill out the Vermont Insurance Premium Tax Return, insurers must provide their financial information, including total premiums collected, allowable deductions, and other relevant details as specified on the form.

What is the purpose of Vermont Insurance Premium Tax Return?

The purpose of the Vermont Insurance Premium Tax Return is to ensure that insurance companies report their premium income accurately and pay the appropriate taxes to the state.

What information must be reported on Vermont Insurance Premium Tax Return?

The information that must be reported includes total premiums written, deductions allowed by law, and the calculation of tax owed to the state.

Fill out your vermont insurance premium tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Insurance Premium Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.