Get the free Vermont Insurance Bond - dfr vermont

Show details

This document serves as a bond for insurance consultants and managing general agents wishing to operate in the State of Vermont, ensuring their compliance with state laws and regulations regarding

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vermont insurance bond

Edit your vermont insurance bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vermont insurance bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vermont insurance bond online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit vermont insurance bond. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

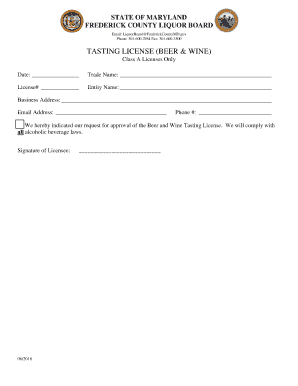

How to fill out vermont insurance bond

How to fill out Vermont Insurance Bond

01

Obtain the Vermont Insurance Bond form from the official state website or your insurance provider.

02

Enter your name and business information at the top of the form.

03

Provide the bond amount required by the state for your specific business type.

04

Fill in the details of the surety bond company that will underwrite your bond.

05

Sign the form where indicated to certify the information provided is accurate.

06

Submit the completed form along with any required fees to the appropriate state department.

Who needs Vermont Insurance Bond?

01

Individuals or businesses seeking to obtain a license or permit in Vermont.

02

Contractors who need to comply with state bonding requirements.

03

Businesses requiring financial protection for their clients or customers.

Fill

form

: Try Risk Free

People Also Ask about

How does an insurance bond work?

An insurance bond is a contract between three parties, the principal, the surety and the obligee. Principal – the person or persons who are bonded and paying the bond premium. Their obligation is to complete the contract as promised, perform ethically as promised, etc. Also called the 'obligor.

What is insurance bond certificate?

An insurance bond, also known as a surety bond, is a financial agreement between three parties guaranteeing that one will fulfill their contractual obligations to the other.

Why would a person need to be bonded?

Insurance companies, premiums and bond investments Insurers hold nearly 40% of US corporate bonds (Chart 1). Their primary source of financing is insurance premiums from households, i.e. payments made by policyholders for protection against losses caused by events such as car accidents or windstorms.

What is a bond from an insurance company?

Bond insurance, also known as "financial guaranty insurance", is a type of insurance whereby an insurance company guarantees scheduled payments of interest and principal on a bond or other security in the event of a payment default by the issuer of the bond or security.

How much does a $40,000 surety bond cost?

Surety Bond Cost Table Surety Bond AmountYearly Premium Excellent Credit (675 and above)Average Credit (600-675) $40,000 Surety Bond $400 - $1,200 $1,200 - $2,000 $50,000 Surety Bond $500 - $1,500 $1,500 - $2,500 $75,000 Surety Bond $750 - $2,250 $2,250 - $3,7509 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Vermont Insurance Bond?

A Vermont Insurance Bond is a legally binding agreement that ensures compliance with state regulations and guarantees financial obligations are met in the insurance industry.

Who is required to file Vermont Insurance Bond?

Insurance companies and agents operating in Vermont are required to file a Vermont Insurance Bond as part of their licensing and regulatory requirements.

How to fill out Vermont Insurance Bond?

To fill out a Vermont Insurance Bond, you need to provide necessary details such as the bond amount, principal's information, surety's information, and any specific terms required by the state.

What is the purpose of Vermont Insurance Bond?

The purpose of a Vermont Insurance Bond is to protect consumers and the state by ensuring that insurance companies and agents fulfill their financial and legal obligations.

What information must be reported on Vermont Insurance Bond?

The Vermont Insurance Bond must include information such as the names of the principal and surety, the bond amount, the effective date, and the conditions under which the bond is enforceable.

Fill out your vermont insurance bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vermont Insurance Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.