Get the free Form 105–046 - nvcc

Show details

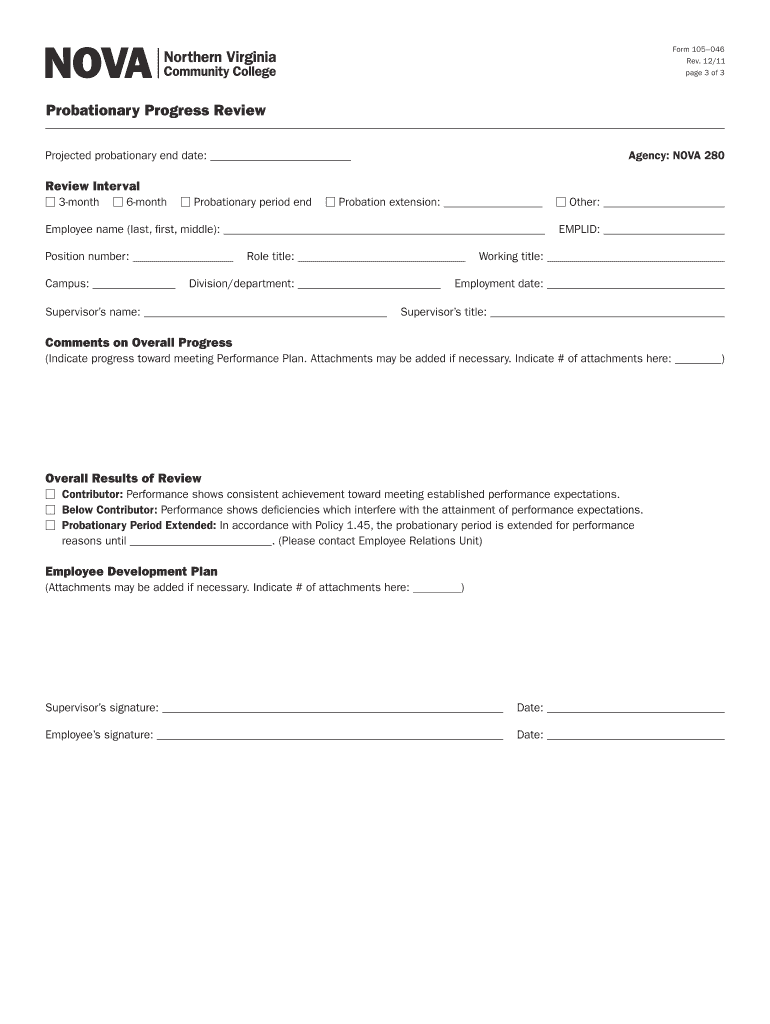

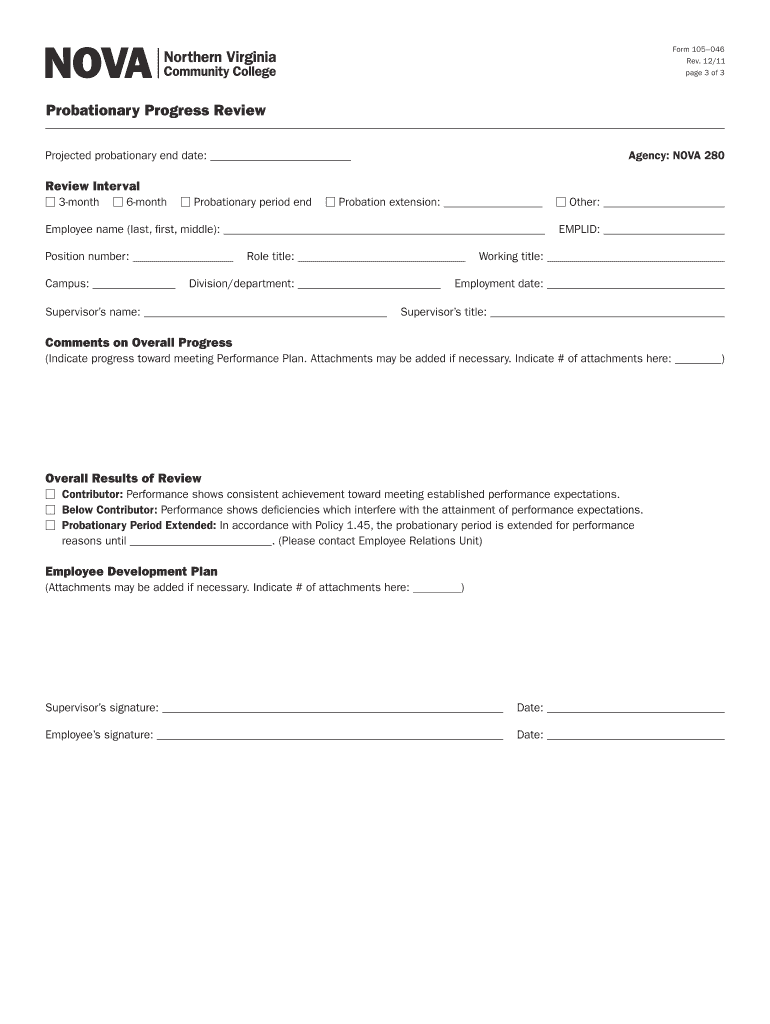

The Probationary Progress Review (Form 105–046) is used to assess a probationary employee’s performance during the initial 12 months of employment, outlining procedures for conducting reviews,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 105046 - nvcc

Edit your form 105046 - nvcc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 105046 - nvcc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 105046 - nvcc online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form 105046 - nvcc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form 105046 - nvcc

How to fill out Form 105–046

01

Begin by downloading Form 105–046 from the official website.

02

Fill in your personal information in the designated sections, including name, address, and contact details.

03

Provide any required identification numbers such as Social Security Number or Tax Identification Number.

04

Complete the specific sections related to your request, ensuring that all details are accurate.

05

Review the form for any errors or missing information.

06

Sign and date the form at the bottom.

07

Submit the form via the specified method, whether by mail or online, as directed.

Who needs Form 105–046?

01

Individuals who are applying for benefits or services that require the use of Form 105–046.

02

Persons needing to report specific information as mandated by the relevant authority.

Fill

form

: Try Risk Free

People Also Ask about

What is FinCEN Form 105?

To declare currency, the bearer must complete a FinCEN Form 105, Report of International Transportation of Currency or Monetary Instruments. The FinCEN Form 105 is available from any U.S. Customs and Border Protection (CBP) officer.

What is the limit on the FinCEN form 105?

To report to CBP that you are bringing more than $10,000 in currency or money instruments into or out of the U.S., do one of the following: Fill out the Currency Reporting Form (FinCen 105) online.

How do you declare $10,000 at US Customs?

International travelers entering the United States must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their Customs Declaration Form (CBP Form 6059B) and then file a FinCEN Form 105.

What are the consequences of FinCEN 105?

PENALTIES: Civil and criminal penalties, including under certain circumstances a fine of not more than $500,000 and Imprisonment of not more than ten years, are provided for failure to file a report, filing a report containing a material omission or misstatement, or filing a false or fraudulent report.

How to declare money when leaving us?

How to report money when you travel. To report to CBP that you are bringing more than $10,000 in currency or money instruments into or out of the U.S., do one of the following: Fill out the Currency Reporting Form (FinCen 105) online. Fill out and print Form FinCen 105 before you travel and present it to a CBP officer.

Is FinCEN form 105 reported to the IRS?

This means that the IRS has access to the information disclosed on the form and can use that information during an audit or investigation into tax fraud. Furthermore, the information revealed on the FinCEN form might trigger significant legal and international tax implications and consequences.

How do you declare foreign currency?

International travelers entering the United States must declare if they are carrying currency or monetary instruments in a combined amount over $10,000 on their Customs Declaration Form (CBP Form 6059B) and then file a FinCEN Form 105.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 105–046?

Form 105–046 is a specific tax form used for reporting purposes, typically related to income, deductions, or other relevant financial information as mandated by the tax authorities.

Who is required to file Form 105–046?

Individuals or entities who meet certain criteria set by the tax authorities, such as income thresholds or specific tax obligations, are required to file Form 105–046.

How to fill out Form 105–046?

To fill out Form 105–046, you need to provide your personal information, report income, deductions, and any other relevant financial details as instructed in the form's guidelines.

What is the purpose of Form 105–046?

The purpose of Form 105–046 is to gather specific financial information for tax reporting, ensuring compliance with tax laws and regulations.

What information must be reported on Form 105–046?

Form 105–046 requires the reporting of personal information, including income sources, allowable deductions, and other financial data as specified in the filing instructions.

Fill out your form 105046 - nvcc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 105046 - Nvcc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.