Get the free Certification of Exception from General Early Retirement Provisions - varetire

Show details

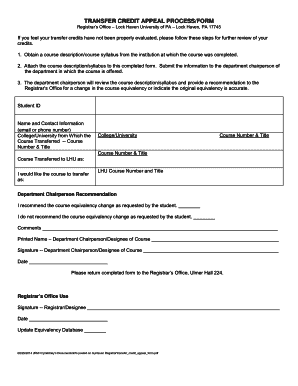

This document serves to certify exceptions from general early retirement provisions for certain employees in Virginia under specific conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certification of exception from

Edit your certification of exception from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certification of exception from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit certification of exception from online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit certification of exception from. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

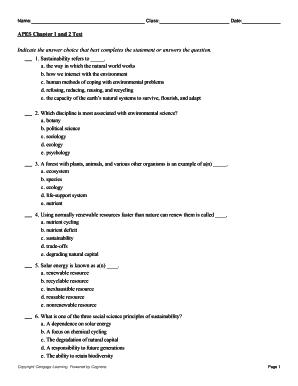

How to fill out certification of exception from

How to fill out Certification of Exception from General Early Retirement Provisions

01

Obtain the Certification of Exception form from your employer or relevant authority.

02

Read the instructions carefully before filling out the form.

03

Provide your personal information, including your name, Social Security number, and the date of birth.

04

Indicate the reason for the exception by checking the appropriate box or providing a detailed explanation.

05

Attach any necessary documentation that supports your reason for the exception.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the designated department or person within the deadline specified.

Who needs Certification of Exception from General Early Retirement Provisions?

01

Employees who are planning for early retirement and believe they qualify for an exception from general early retirement provisions.

02

Individuals who require a specific certification to meet certain conditions for retirement benefits.

03

Those who are in special circumstances that allow for early retirement without penalties or reductions.

Fill

form

: Try Risk Free

People Also Ask about

What are the exceptions to the 10 year IRA rule?

This 10-year rule has an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner.

How to not pay 10% penalty for early withdrawal?

You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your IRA. Once you turn age 59 1/2, you can withdraw any amount from your IRA without having to pay the 10% penalty. Regular income tax will still be due on each IRA distribution.

What is the rule for early retirement?

What is the rule of 55? The IRS rule of 55 recognizes you might leave or lose your job before you reach age 59½. If that happens, you might need to begin taking distributions from your 401(k). Unfortunately, there's usually a 10% penalty — on top of the taxes you owe — when you withdraw money early.

How to avoid paying 10% penalty for early withdrawal?

You can avoid the early withdrawal penalty by waiting until at least age 59 1/2 to start taking distributions from your IRA. Once you turn age 59 1/2, you can withdraw any amount from your IRA without having to pay the 10% penalty. Regular income tax will still be due on each IRA distribution.

What is the exception to the early withdrawal penalty?

You may be able to avoid the 10% tax penalty if your withdrawal falls under certain exceptions. The most common exceptions are: A first-time home purchase (up to $10,000) A birth or adoption expense (up to $5,000)

What is the additional rule for early withdrawal penalties for IRAs?

If you're due to turn age 59½ later this year (2025) but take an IRA distribution earlier (prior to your 59½ birthday), your distribution will generally be subject to the 10% penalty tax. In other words, avoiding such penalty requires that an IRA owner take a distribution after their 59½ birthday.

When can you withdraw early from IRA without penalty?

You are eligible to make withdrawals without penalties or fees from a traditional IRA at age 59½, but you can also wait until you are older. For traditional IRAs you must begin taking withdrawals, or Required Minimum Distributions (RMDs), starting at age 73*, (or 72 if you were born before July 1, 1949).

What is the penalty for early withdrawal from a Simple IRA?

You have to pay a 10% additional tax on the taxable amount you withdraw from your SIMPLE IRA if you are under age 59½ when you withdraw the money unless you qualify for another exception to this tax. In some cases, this tax is increased to 25%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certification of Exception from General Early Retirement Provisions?

Certification of Exception from General Early Retirement Provisions is a document that allows certain employees to qualify for early retirement benefits despite being subject to the general limitations imposed on early retirement. This certification provides evidence that the employee meets specific criteria for exemption.

Who is required to file Certification of Exception from General Early Retirement Provisions?

Employees who believe they qualify for early retirement exceptions under specific provisions set by their pension plan or relevant governing body are required to file this certification.

How to fill out Certification of Exception from General Early Retirement Provisions?

To fill out the certification, the employee must provide personal information, details regarding their employment, and the specific reasons for requesting an exemption from the early retirement provisions. It may also require additional documentation to support the request.

What is the purpose of Certification of Exception from General Early Retirement Provisions?

The purpose of this certification is to establish eligibility for early retirement benefits under circumstances that deviate from the standard early retirement rules. It allows employees to demonstrate their qualification for an exception.

What information must be reported on Certification of Exception from General Early Retirement Provisions?

The information that must be reported typically includes the employee's name, contact details, employment history, the nature of the exception being claimed, and any relevant supporting evidence or documentation that justifies the exemption from general early retirement provisions.

Fill out your certification of exception from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certification Of Exception From is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.