Get the free pdffiller

Show details

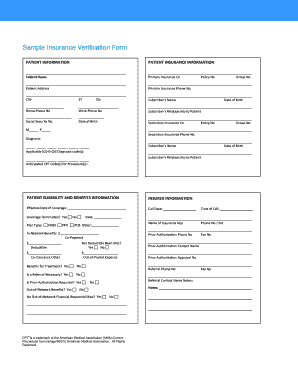

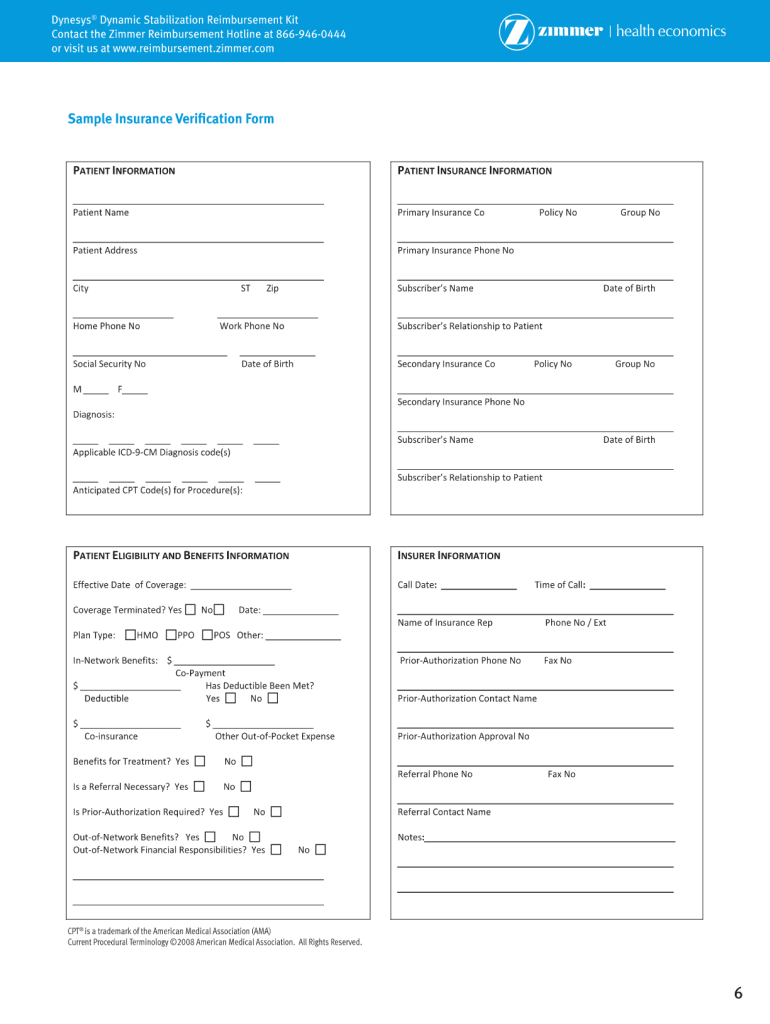

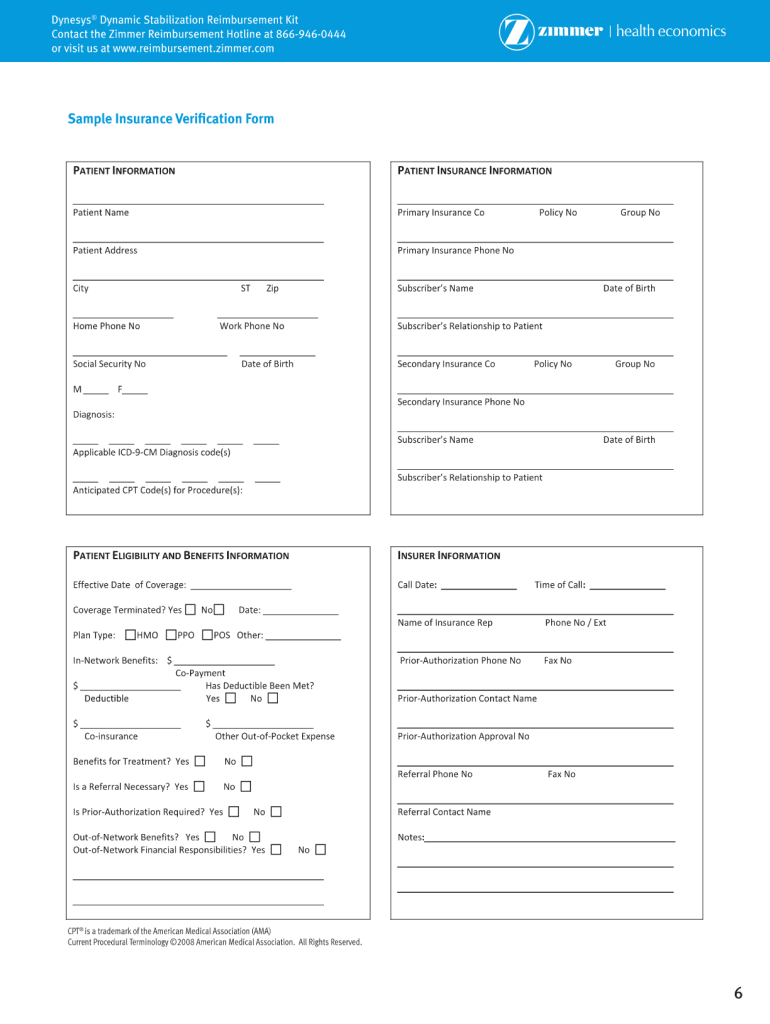

Dryness Dynamic Stabilization Reimbursement Kit Contact the Zimmer Reimbursement Hotline at 866-946-0444 or visit us at www.reimbursement.zimmer.com Sample Insurance Verification Form SAMPLE INSURANCE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medical diagnosis form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pdffiller form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out insurance verification forms for:

01

Gather all necessary information: Before starting to fill out the forms, gather all the required information such as your personal details, insurance policy number, employer information, and any other relevant documents.

02

Read the instructions carefully: Ensure that you thoroughly read and understand the instructions provided with the insurance verification forms. This will help you complete the forms accurately and avoid any mistakes.

03

Complete personal information section: Start by entering your personal information accurately, including your full name, address, contact details, and social security number.

04

Provide insurance policy details: Enter your insurance policy number, insurance provider's name, and any other relevant policy information requested on the forms.

05

Document employment details: If applicable, provide your employer's information, including their name, address, and contact details. This is important for verifying any coverage through your employer.

06

Add any additional required information: Some insurance verification forms may ask for additional details such as dependent information, previous insurance coverage, or other relevant information. Fill out these sections as required.

07

Attach supporting documents: If the forms require any supporting documents, such as copies of your insurance card or proof of employment, make sure to attach them to the forms.

08

Review and double-check: Before submitting the completed forms, review all the information you have provided to ensure its accuracy. Double-check the spelling of your name, policy details, and any other information.

09

Submit the forms: Once you are confident that the forms are complete and accurate, submit them to the relevant party or insurance company as instructed.

Who needs insurance verification forms for:

01

Individuals applying for new insurance coverage: When applying for new insurance coverage, insurance verification forms are often required to validate your eligibility and determine your insurance options.

02

Employees enrolling in employer-sponsored insurance plans: Many employers require their employees to complete insurance verification forms to ensure accurate enrollment in the company's health insurance plan.

03

Individuals seeking reimbursement for medical expenses: If you have incurred medical expenses and are seeking reimbursement from your insurance provider, you may need to fill out insurance verification forms to validate your claims and eligibility.

04

Healthcare providers: Healthcare providers may request patients to complete insurance verification forms to ensure accurate billing and reimbursement for medical services provided.

05

Insurance companies: Insurance companies themselves may need insurance verification forms to authenticate policyholders' information, process claims, and verify coverage details.

Overall, insurance verification forms are necessary for various individuals and entities involved in the insurance process, including individuals applying for insurance coverage, employees enrolling in employer-sponsored plans, individuals seeking reimbursement, healthcare providers, and insurance companies themselves.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of the insurance verification form?

An insurance verification form is a document used by a healthcare provider for the purpose of verifying a client's medical coverage and insurance.

What is included in insurance verification?

The insurance verification process includes deductibles, policy status, plan exclusions, and other items that affect cost and coverage and are done before patients are admitted to the hospital as it is the first step of the medical billing process.

What is the difference between an insurance authorization and an insurance verification?

Insurance verification establishes the eligibility of a patient's insurance claim, but not the requirement of the insurance provider to actually reimburse the patient. The authorization process binds the insurance payer to authorize the claim through a legally binding promise to pay a specified amount.

How do I verify insurance benefits of a patient?

The California Health & Wellness Online IVR system by calling toll free 1-877-658-0305.

What is the purpose of insurance verification and what patient details are needed?

Insurance verification confirms your patient's coverage and benefits, whereas insurance authorization gives you a green light to provide certain services. The insurance verification process involves collecting patient insurance information and verifying it with the insurer.

What is the main purpose for verifying a patient's insurance coverage at every visit?

By verifying eligibility, practices can determine a patient's medical insurance coverage status prior to the appointment and report demographic information accurately on insurance claims. Additionally, prioritizing eligibility promotes proactive patient collection measures and prevents payment delays.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your pdffiller form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I make changes in pdffiller form?

With pdfFiller, it's easy to make changes. Open your pdffiller form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I edit pdffiller form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share pdffiller form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is medical insurance verification form?

A medical insurance verification form is a document used by healthcare providers to confirm a patient's insurance coverage before services are rendered, ensuring that the patient is eligible for benefits.

Who is required to file medical insurance verification form?

Healthcare providers, including clinics, hospitals, and physicians, are typically required to file the medical insurance verification form to ascertain coverage for their patients.

How to fill out medical insurance verification form?

To fill out a medical insurance verification form, one must provide details such as the patient's personal information, insurance policy number, group number, and any relevant dates, along with the specific services being requested.

What is the purpose of medical insurance verification form?

The purpose of the medical insurance verification form is to ensure that the patient has valid insurance coverage for the required services, reduce billing errors, and confirm eligibility for benefits prior to treatment.

What information must be reported on medical insurance verification form?

The information that must be reported on a medical insurance verification form includes the patient's demographics, insurance provider details, policy numbers, dates of service, and the type of services to be verified.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.