AU DOT VL184 (Formerly MR184) 2013 free printable template

Show details

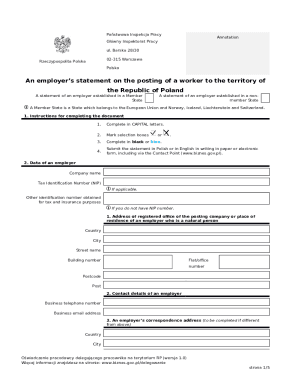

MR184 Government of Western Australia Change in Heavy Vehicle Use Department of Transport Driver and Vehicle Services For a vehicle with gross mass over 4. I declare that the vehicle will be used in the configuration nominated above. I acknowledge that I must advise the Department of Transport of any change in the nominated use and that heavy vehicle changes cannot be backdated. Signature of licence holder or agent Date Effective A Certificate of Variation will be issued to authorise this...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AU DOT VL184 Formerly MR184

Edit your AU DOT VL184 Formerly MR184 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU DOT VL184 Formerly MR184 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU DOT VL184 Formerly MR184 online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU DOT VL184 Formerly MR184. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU DOT VL184 (Formerly MR184) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU DOT VL184 Formerly MR184

How to fill out AU DOT VL184 (Formerly MR184)

01

Obtain the AU DOT VL184 form from the relevant transport authority's website or office.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide personal details, including your full name, address, and contact information.

04

Indicate your driver license number and any other identification details as required.

05

Fill out the section related to the vehicle, including make, model, and registration details.

06

Complete the purpose of the form and any additional information requested.

07

Review the form for any errors or missing information before submission.

08

Submit the completed form either online (if applicable) or in person to the appropriate office.

Who needs AU DOT VL184 (Formerly MR184)?

01

Individuals applying for a specific type of license or permit in accordance with Australian Department of Transport regulations.

02

Drivers seeking to obtain or renew their vehicle registration.

03

Transport businesses needing to register their vehicles or drivers.

04

Anyone required to provide vehicle information for legal or compliance reasons.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file 2290 every year?

What is the IRS Form 2290 due date? If you have vehicles with a combined gross weight of 55,000 pounds or more, the IRS requires you to file Heavy Vehicle Use Tax Form 2290 each year by August 31.

What is the heavy use tax in Texas?

The state use tax rate is 6.25 percent. Depending on where you use or store your off-highway vehicle, you may owe up to an additional 2 percent in local use taxes. Use our tax rate locator to search for your tax rate by your address. Texas allows a credit for sales or use tax due and payable to other states.

How is 2290 tax calculated?

Calculating fees (fees are based on gross taxable weight per vehicle): A vehicle having a registered gross vehicle weight of 55,000 lbs pays $100 using Form 2290. Additional weight over 55,000 lbs is subject to paying $22 per 1,000 lbs, up to a maximum of 75,000 lbs.

What happens if you don't file your 2290?

The penalty for failing to file your IRS Form 2290 by the deadline is equal to 4.5% of the total tax amount due, and the penalty will increase monthly for up to five months.

How much is the 2290 tax for 2021?

Single Vehicle $14.90 Form 2290 PricingOne Truck (Single Vehicle)$14.90Small Fleet (3 to 24 Vehicles)$44.90Medium Fleet (25 to 100 Vehicles)$89.90Large Fleet (101 to 500 Vehicles)$149.903 more rows

How much is 2290 tax per year?

Price Per 2290 Filing. Free VIN Correction. IRS Form 8849 Pricing: Claiming a Refund of the 2290 Heavy Vehicle Use Tax.Subscription for Form 2290 Filing. Vehicles on All Form 2290sAnnual Fee1 - 24 Vehicles$120.9925 – 100 Vehicles$217.79101 – 250 Vehicles$362.99251 – 500 Vehicles$399.292 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU DOT VL184 Formerly MR184?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the AU DOT VL184 Formerly MR184 in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit AU DOT VL184 Formerly MR184 in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing AU DOT VL184 Formerly MR184 and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out AU DOT VL184 Formerly MR184 on an Android device?

Use the pdfFiller app for Android to finish your AU DOT VL184 Formerly MR184. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is AU DOT VL184 (Formerly MR184)?

AU DOT VL184, previously known as MR184, is a form used for specific reporting requirements related to transportation and vehicle incidents in Australia.

Who is required to file AU DOT VL184 (Formerly MR184)?

Individuals or entities involved in transportation activities that meet certain regulatory criteria are required to file AU DOT VL184.

How to fill out AU DOT VL184 (Formerly MR184)?

To fill out AU DOT VL184, gather the necessary information, follow the instructions provided with the form, and ensure all sections are completed accurately.

What is the purpose of AU DOT VL184 (Formerly MR184)?

The purpose of AU DOT VL184 is to collect data on transportation activities and incidents to enhance safety and regulatory compliance.

What information must be reported on AU DOT VL184 (Formerly MR184)?

The information reported on AU DOT VL184 includes details such as vehicle information, incident specifics, and the parties involved in the transportation activity.

Fill out your AU DOT VL184 Formerly MR184 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU DOT vl184 Formerly mr184 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.