Get the free eFiling Information Note

Show details

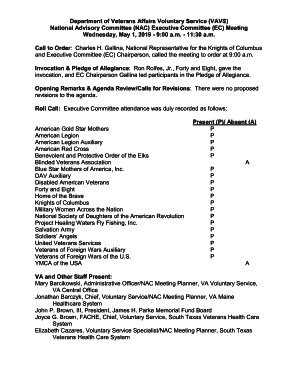

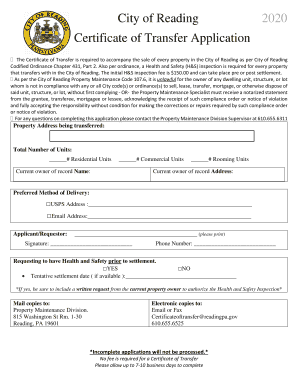

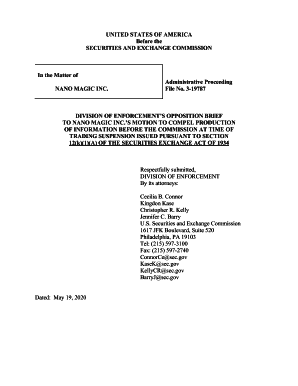

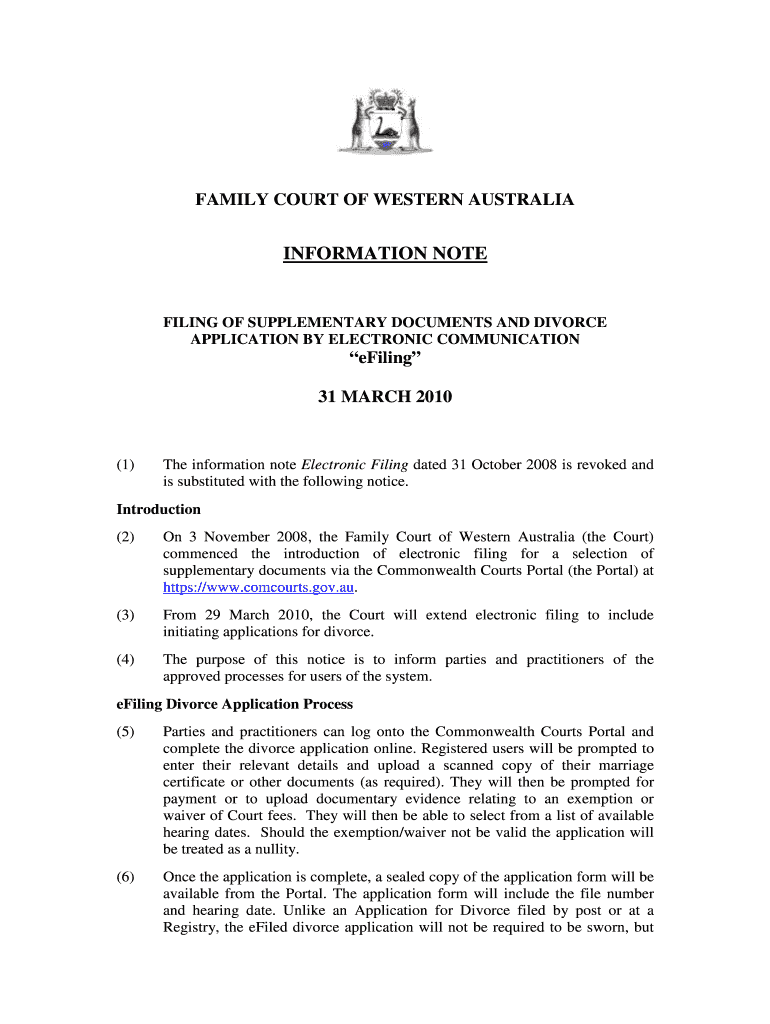

This document provides information on the procedures for filing supplementary documents and divorce applications electronically via the Commonwealth Courts Portal.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign efiling information note

Edit your efiling information note form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your efiling information note form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit efiling information note online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit efiling information note. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out efiling information note

How to fill out eFiling Information Note

01

Begin by accessing the eFiling Information Note form online.

02

Fill in the personal details section, including your name, address, and contact information.

03

Indicate the type of filing you are submitting by selecting the appropriate option.

04

Provide any required details specific to the nature of your filing, such as relevant dates or amounts.

05

Review the information for accuracy and completeness before submitting.

06

Submit the form electronically or print it out for physical submission, as required.

Who needs eFiling Information Note?

01

Individuals or businesses that are required to file certain documents with the tax authority.

02

Tax professionals assisting clients with their filings.

03

Anyone seeking to keep record of submissions to support future audits or inquiries.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of e-filing?

Drawbacks of E-Filing If something happens to your computer or your computer has a virus, e-filing your tax return via that computer can lead to identity theft or errors in your tax return. Another drawback is that if your tax return is very complicated or you have a special situation, you may not be able to e-file.

What is an e-filing pdf?

The process of electronically filing Income tax Returns/Forms through the internet is known as e-Filing.

How does eFiling work?

SARS eFiling is a free online solution for the submission of returns, declarations, and other related services. This service allows taxpayers, tax practitioners, representatives to register and submit returns/declarations, make payments, and perform several other interactions with SARS in a secure online environment.

What is the purpose of Efiling?

This service allows taxpayers, tax practitioners, traders and businesses to register and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment.

What are the benefits of electronic filing?

E-file is faster, easier and more accurate than filing a paper return. E-file makes compliance with reporting and disclosure requirements easier by eliminating the need to make copies, assemble all of the appropriate schedules and attachments, and pay for postage.

What is the purpose of electronic filing?

E-filing is a fast, safe, and reliable way to submit your tax return. Whether you do it yourself or use a professional, e-filing can help you avoid delays and errors.

What are the benefits of eFiling?

Benefits of Electronic Filing Convenient and flexible. Saves time and money. Increased accuracy. Less room for manipulation of records and window dressing. Increased authenticity and accountability.

What are the benefits of efile?

The e-file allows for a gentler touch compared to manual tools. It reduces the risk of cuts or abrasions and can be adjusted to a comfortable speed, ensuring a pleasant experience. This makes it a great option for individuals with sensitive skin or those who find traditional pedicures uncomfortable.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is eFiling Information Note?

The eFiling Information Note is a formal document used to submit important information electronically to relevant authorities or organizations.

Who is required to file eFiling Information Note?

Individuals or organizations that are mandated by law or regulations to report certain information electronically are required to file the eFiling Information Note.

How to fill out eFiling Information Note?

To fill out the eFiling Information Note, one must gather the required information, access the designated electronic filing platform, and complete the online form by entering the necessary details accurately.

What is the purpose of eFiling Information Note?

The purpose of the eFiling Information Note is to streamline the reporting process, ensuring compliance with legal requirements and facilitating the efficient handling of submitted information by authorities.

What information must be reported on eFiling Information Note?

The information to be reported on the eFiling Information Note typically includes personal details, business information, relevant transactions, and any other specific data required by the regulatory body.

Fill out your efiling information note online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Efiling Information Note is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.