Get the free FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST - wvinsurance

Show details

This form is used to request a waiver or reduction of penalties for failure to pay taxes in West Virginia, as authorized by the Insurance Commissioner.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign failure to pay penalty

Edit your failure to pay penalty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your failure to pay penalty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing failure to pay penalty online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit failure to pay penalty. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out failure to pay penalty

How to fill out FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST

01

Obtain the FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST form from the official website or relevant office.

02

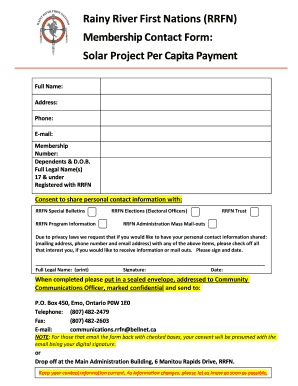

Fill out your personal information, including your name, address, and contact details at the top of the form.

03

Clearly state the reason for your inability to pay the penalty by providing a detailed explanation of your financial situation.

04

Attach supporting documents, such as income statements, expense reports, and any relevant documentation that substantiates your claim.

05

Review the completed form for any errors or omissions before submitting.

06

Submit the form to the appropriate department or agency by the specified deadline, either in person or via mail.

Who needs FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

01

Individuals who have received a penalty due to failure to pay taxes, fees, or other financial obligations.

02

People experiencing financial hardship or who cannot afford to pay their penalties in full.

03

Taxpayers who believe that they have valid reasons to request a waiver or reduction of their penalties.

Fill

form

: Try Risk Free

People Also Ask about

How to write a letter requesting a fee waiver?

Outline of a Letter for an Application Fee Waiver Subject line: The subject of your email should be clear and apt. Body: In this section, you will describe the financial situation and why you are requesting a fee waiver. Complimentary close — At the end, use the words “sincerely.”

Can penalties be waived?

If the taxpayer proves a reasonable cause for failure or making defaults listed in section 273B, the penalty proceedings may be waived off by the Assessing Officer.

How do I write a letter requesting a waiver?

Waiver letters are usually brief and limited to two or three paragraphs. Stick to the facts. Don't exaggerate the reasons why you require the waiver or dramatize your situation. Include evidence that supports your reasons for requesting a waiver such as names, dates or anything else that backs up what you say.

How to write a penalty waiver request letter?

Subject: Request for Penalty Waiver Due to Reasonable Cause I am seeking a waiver for the penalties assessed for the tax year [year] due to circumstances beyond my control. Specifically, I [explain your situation succinctly, e.g., experienced a significant health issue, natural disaster, etc.].

How can you avoid the failure to file penalty?

You can avoid a penalty by filing and paying your tax by the due date. If you can't do so, you can apply for an extension of time to file or a payment plan.

How to write a letter to waive late fee?

Use professional language: Maintain a respectful tone to encourage cooperation and goodwill. Provide context: Briefly explain the reasons for the late payment to build credibility and understanding. Reference past reliability: Highlight a history of timely payments or good standing to strengthen your request.

What is the meaning of penalty waiver?

A penalty waiver is a process that allows you to request that all or part of your penalty be waived. Only certain penalties are eligible to be waived.

How do I write a letter of penalty waiver?

How to Write an IRS Penalty Abatement Letter in 5 Easy Steps Step 1: Review the IRS Penalty Notice and Gather Information. Step 2: Write the Introduction. Step 3: Explain Your Situation and Add Supporting Docs. Step 4: Make the Request Penalty Abatement. Step 5: Close an IRS Penalty Abatement Letter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

A FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST is a formal request submitted to the tax authority asking for the waiver or reduction of penalties incurred due to failure to pay taxes on time.

Who is required to file FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

Taxpayers who have incurred penalties for not paying their taxes on time are required to file this request to seek relief from those penalties.

How to fill out FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

To fill out the request, taxpayers must provide personal information, details of the penalties incurred, reasons for the failure to pay on time, and any supporting documentation that justifies their request.

What is the purpose of FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

The purpose of the request is to ask the tax authority to reconsider the penalties imposed and possibly reduce or eliminate them based on the taxpayer's circumstances.

What information must be reported on FAILURE TO PAY PENALTY WAIVER / REDUCTION REQUEST?

The information that must be reported includes taxpayer identification details, the amount of penalties, the tax periods affected, the reasons for late payment, and any supporting evidence relating to the taxpayer's claim.

Fill out your failure to pay penalty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Failure To Pay Penalty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.