WI DFI/CORP/502 2012 free printable template

Show details

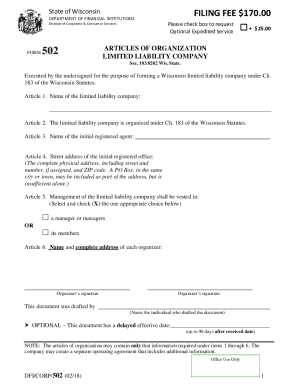

Reset Form Sec. 183.0202 Wis. Stats. State of Wisconsin Department of Financial Institutions Division of Corporate and Consumer Services ARTICLES OF ORGANIZATION LIMITED LIABILITY COMPANY Executed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WI DFICORP502

Edit your WI DFICORP502 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WI DFICORP502 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WI DFICORP502 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit WI DFICORP502. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WI DFI/CORP/502 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WI DFICORP502

How to fill out WI DFI/CORP/502

01

Download the WI DFI/CORP/502 form from the official Wisconsin Department of Financial Institutions website.

02

Fill in the entities' name as it appears on official documents.

03

Provide the principal office address including city, state, and zip code.

04

Include the name and address of the registered agent for service of process.

05

Indicate the purpose of the entity in the designated section.

06

Complete any additional sections required based on the entity's structure (e.g., corporation, LLC).

07

Review the completed form for accuracy and ensure all required fields are filled.

08

Submit the form via mail or online, along with the necessary filing fee.

Who needs WI DFI/CORP/502?

01

Any individual or business entity looking to incorporate in Wisconsin.

02

Businesses seeking to register or maintain their corporate status in Wisconsin.

03

Companies that need to file their annual reports or updated corporate information.

Fill

form

: Try Risk Free

People Also Ask about

What is an operating agreement LLC Wisconsin?

A Wisconsin LLC operating agreement is a document that holds the rules for the day-to-day activities of the business and its members. The agreement should include the rights of members, ownership, and the appointment of officers. All terms must be agreed to and signed by all the members of the company.

What taxes does an LLC pay in Wisconsin?

Wisconsin also imposes a franchise tax on LLCs. This tax is 7.9% of the company's net income. In addition, a Wisconsin LLC that employs more than two employees must register with the Wisconsin Workforce Commission.

How do I file LLC taxes in Wisconsin?

You only need to file your personal tax return (Federal Form 1040 and Wisconsin Form 1) and include your LLC profits on the return. Multi-Member LLC taxed as a Partnership: Yes. Your LLC must file a IRS Form 1065 and a Wisconsin Partnership Return (Form 3).

Is an operating agreement required for an LLC in Wisconsin?

In order to operate, LLCs require real humans (and other entities) to carry out company operations. Operating agreements are not legally required for Wisconsin LLCs.

How do I change the members of an LLC with the IRS?

If the member you are removing is also your Responsible Party, you will need to name a new Responsible Party and file the correct form with the IRS. The form you will use to change your Responsible Party is Form 8822-B, and you will need to file this form within 60 days of the membership change.

Is operating agreement important for single member LLC?

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

How do you allocate ownership in an LLC?

In order to split ownership in an LLC, you will need to draft an LLC operating agreement. This operating agreement document will outline how profits and losses are divided among LLC members and other controlling provisions such as voting rights and management structure.

How much does it cost to maintain an LLC in Wisconsin?

To maintain an LLC in Wisconsin you will need to pay an annual fee of $25 along with state income tax at 3.54% to 7.65%, sales & use tax at 5%, and federal taxes.

Is there an annual fee for Wisconsin LLC?

Wisconsin requires LLCs to file an annual report every year. The fee is $25.

Do I need an operating agreement if it's just me?

If you're forming—or have formed—an LLC in California, New York, Missouri, Maine, or Delaware, state laws require you to create an LLC Operating Agreement. But no matter what state you're in, it's always a good idea to create a formal agreement between LLC members.

Is ownership transferable in LLC?

There are two main ways to transfer ownership of your LLC: Transferring partial interest in an LLC: This applies if you are not selling the entire business, and you do not have 100 percent ownership. Selling your LLC: This applies if you are transferring ownership of your entire business to someone else.

How do I change ownership of an LLC in Wisconsin?

When the ownership transfer is a sale of the LLC, a buy-sell agreement may be necessary. An operating agreement should specify the process for ownership transfer, but if it doesn't, you must follow state guidelines. Under some circumstances, the state may require you to form a new LLC.

What are the benefits of an LLC in Wisconsin?

Benefits of starting a Wisconsin LLC: Protects your personal assets from your business liability and debts. Easy tax filing and potential advantages for tax treatment. Quick and simple filing, management, compliance, regulation and administration. Low cost to file ($130)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify WI DFICORP502 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your WI DFICORP502 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send WI DFICORP502 to be eSigned by others?

WI DFICORP502 is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I fill out WI DFICORP502 on an Android device?

Complete WI DFICORP502 and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is WI DFI/CORP/502?

WI DFI/CORP/502 is a form used by businesses in Wisconsin to report certain corporate tax information to the Department of Financial Institutions.

Who is required to file WI DFI/CORP/502?

Corporations and entities operating in Wisconsin that meet specific criteria set by the Department of Financial Institutions are required to file WI DFI/CORP/502.

How to fill out WI DFI/CORP/502?

To fill out WI DFI/CORP/502, businesses need to provide detailed information about their corporate structure, income, and any applicable deductions, following the instructions provided with the form.

What is the purpose of WI DFI/CORP/502?

The purpose of WI DFI/CORP/502 is to ensure compliance with state tax laws and provide the Department of Financial Institutions with the necessary information to assess and collect taxes from corporations operating in Wisconsin.

What information must be reported on WI DFI/CORP/502?

Information that must be reported on WI DFI/CORP/502 includes corporate name, address, type of business, income details, and any deductions or credits the corporation is claiming.

Fill out your WI DFICORP502 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WI dficorp502 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.