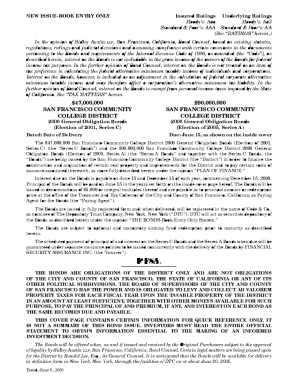

Get the free STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT

Show details

This document serves as the Annual Report for the fiscal year ending June 30, 1996, submitted by the State of Wisconsin to comply with SEC Rule 15c2-12. It presents information about general obligations,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of wisconsin continuing

Edit your state of wisconsin continuing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of wisconsin continuing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of wisconsin continuing online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state of wisconsin continuing. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state of wisconsin continuing

How to fill out STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT

01

Obtain the STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT form from the official website or appropriate authority.

02

Review the instructions provided with the form to understand the specific requirements.

03

Gather relevant financial data, including past annual reports, current financial statements, and any other required disclosures.

04

Fill out the sections of the report, including general information, financial condition, and any updates on significant events.

05

Ensure all required disclosures are accurately completed and supported with proper documentation.

06

Review the completed report for accuracy and compliance with disclosure regulations.

07

Submit the report by the specified deadline to the appropriate governing body or agency.

Who needs STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

01

Municipal bond issuers in Wisconsin that are required to provide ongoing disclosures to bondholders.

02

Investors and financial analysts who require updated financial information about Wisconsin municipalities.

03

Regulatory bodies that oversee municipal finance and require transparency from public entities.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to renew my LLC every year in Wisconsin?

Every Wisconsin LLC needs to file an Annual Report each year to renew their LLC. If you just started your Limited Liability Company, you won't have to file this until next year (just bookmark this page for later).

Does Wisconsin require an annual report?

All Wisconsin corporations, nonprofits, LLCs, and LLPs need to file a Wisconsin Annual Report each year. These reports must be submitted to the Wisconsin Department of Financial Institutions, Division of Corporate & Consumer Services.

How much is the annual report fee in Wisconsin?

Wisconsin Corporations, foreign or domestic, file Annual Report. The state filing fee for domestic Corporations is $40 (by mail), $25 online. The state filing fee for foreign Corporations is $80 (by mail), $65 (online).

Does Wisconsin require an annual report?

All Wisconsin corporations, nonprofits, LLCs, and LLPs need to file a Wisconsin Annual Report each year. These reports must be submitted to the Wisconsin Department of Financial Institutions, Division of Corporate & Consumer Services.

How much is Wisconsin Efiling fee?

Changes to the electronic filing fee effective May 1 Stat. § 758.19(4m) and § 801.18(7). Effective May 1, 2024, electronically filed cases will be subject to a fee of $35 per case per party and $70 for attorney-mediators.

What is an annual report letter?

Most public companies hire auditing companies to write their annual reports. An annual report begins with a letter to the shareholders, then a brief description of the business and industry. The report should include the audited financial statements: balance sheet, income statement, and statement of cash flows.

What is the annual report in English?

An annual report is a comprehensive report on a company's activities throughout the preceding year. Annual reports are intended to give shareholders and other interested people information about the company's activities and financial performance. They may be considered as grey literature.

How much is the Wisconsin annual report fee?

Domestic Wisconsin Corporation Annual Report Requirements: Filing Method: Mail or online. Agency Fee: $25 online or $40 by mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

The State of Wisconsin Continuing Disclosure Annual Report is a financial report that provides updated information about the state's financial condition and future financial commitments, ensuring compliance with securities regulations.

Who is required to file STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

Entities that have issued bonds, including state agencies and local governments, are required to file the State of Wisconsin Continuing Disclosure Annual Report to maintain transparency and fulfill legal obligations.

How to fill out STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

To fill out the report, entities must provide accurate and thorough financial information, including budgets, financial statements, and any significant changes in operations or financial condition, according to the guidelines provided by the state.

What is the purpose of STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

The purpose of the report is to disclose essential financial information to investors and the public, thereby enhancing transparency and accountability in the state's financial management.

What information must be reported on STATE OF WISCONSIN CONTINUING DISCLOSURE ANNUAL REPORT?

The report must include financial statements, budgetary information, updates on economic conditions, and changes in debt obligations, as well as any events that might affect the state's ability to meet its financial commitments.

Fill out your state of wisconsin continuing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of Wisconsin Continuing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.