Get the free Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased - revenue wi

Show details

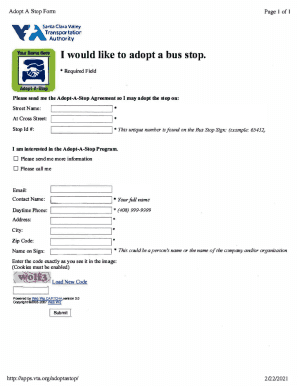

This document is a quarterly reporting form for permit holders in Wisconsin to report tax-paid cigarettes purchased, including required information about the permit holder and their transactions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly report of wisconsin

Edit your quarterly report of wisconsin form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly report of wisconsin form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quarterly report of wisconsin online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit quarterly report of wisconsin. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly report of wisconsin

How to fill out Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased

01

Obtain the Quarterly Report form from the Wisconsin Department of Revenue website or relevant office.

02

Fill in the reporting period for the quarter you are submitting.

03

Enter your business information, including name, address, and tax identification number.

04

Report the total quantity of tax-paid cigarettes purchased during the quarter.

05

Include any additional details required, such as invoices or receipts related to the purchases.

06

Double-check all filled information for accuracy.

07

Sign and date the report at the designated section.

08

Submit the completed report by the specified deadline, either electronically or via mail.

Who needs Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

01

Any business or entity in Wisconsin that purchases tax-paid cigarettes for resale.

02

Distributors of cigarettes operating within the state.

03

Retailers selling cigarettes who must report their purchases for tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

Which state has the highest tobacco tax?

Which State has the Highest Tax Rate? The jurisdiction with the highest tax rate on cigarettes is currently New York at $5.35 for a pack of 20. Washington D.C. is the second highest at $5.03/20-pack.

Which country has the highest tax on tobacco?

Countries That Impose The Highest Tax On Cigarettes RankCountryTaxes as Percentage Of Cigarette Price 1 Bosnia and Herzegovina 86.0 % 2 Israel 85.0 % 3 Slovakia 84.6 % 4 Bulgaria 84.0 %6 more rows

What is the tax on cigarettes in Wisconsin?

Cigarette Taxes State cigarette tax rates range from a high of $4.50 in the District of Columbia (DC) to a low of $0.17 in Missouri. As of January 1, 2022, Wisconsin's $2.52 rate was the 15th highest among the 50 states.

How is tobacco taxed in the US?

Through June 30, 2024, the state excise tax on cigarettes ranges from $0.170 per pack in Missouri, to $5.350 per pack in New York. The federal tax remains at $1.010 per pack. Four states (Georgia, Missouri, North Carolina, and North Dakota) have an excise tax on cigarettes that is less than $0.500 per pack.

What is the tobacco law in Wisconsin?

The federal law on tobacco sales is clear: it's illegal to sell tobacco products to anyone under the age of 21. How does that impact retailers and people who purchase tobacco in Wisconsin? It's simple: 21 means 21, no matter what.

Which state taxed the most on cigarettes at $4.35 per pack in 2011?

In 2011, Missouri had the lowest state cigarette excise tax in the United States, at $0.17 per pack, and New York had the highest, at $4.35 per pack (Table).

What is the tobacco excise tax in Wisconsin 2025?

Tobacco Products Tax However, pursu- ant to 2023 Act 150, the tax is imposed at a rate of 71% of actual cost for sales of cigars and pipe to- bacco (including remote retail sales), effective January 1, 2025, but not more than 50 cents per cigar.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

The Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased is a document that summarizes the amount of tax-paid cigarettes purchased by retailers or distributors within Wisconsin during a specific quarter.

Who is required to file Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

Retailers and distributors of tobacco products in Wisconsin who purchase and sell tax-paid cigarettes are required to file this quarterly report.

How to fill out Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

To fill out the Quarterly Report, you need to provide the total quantity of tax-paid cigarettes purchased during the quarter, along with relevant identification details, such as business name, address, and license number.

What is the purpose of Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

The purpose of the Quarterly Report is to ensure compliance with state tax regulations and to track tobacco product sales for tax assessment and regulatory purposes.

What information must be reported on Quarterly Report of Wisconsin Tax-Paid Cigarettes Purchased?

The information that must be reported includes the quantity of cigarettes purchased, the date of purchase, the name and address of the seller, and the retailer's business information.

Fill out your quarterly report of wisconsin online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Report Of Wisconsin is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.