Get the free RT-1 - revenue wi

Show details

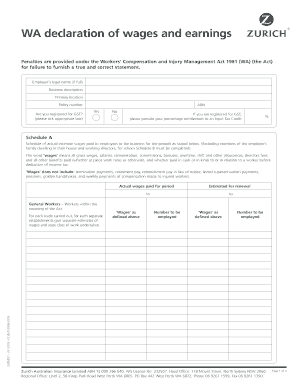

This form is for entities to report expenses that have been disallowed related to income reported by another entity, requiring submission with Wisconsin tax forms.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rt-1 - revenue wi

Edit your rt-1 - revenue wi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rt-1 - revenue wi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rt-1 - revenue wi online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rt-1 - revenue wi. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rt-1 - revenue wi

How to fill out RT-1

01

Obtain the RT-1 form from the appropriate government website or office.

02

Fill in your personal information in the designated fields, including your name and address.

03

Provide the specific details of the transaction or application for which you are submitting the RT-1.

04

Include any required identification numbers or tax IDs.

05

Review the form for completeness and accuracy.

06

Sign and date the form as required.

07

Submit the form to the appropriate agency, either in person or electronically, as per the instructions.

Who needs RT-1?

01

Individuals applying for a tax exemption or tax-related benefit.

02

Businesses requiring official documentation for tax purposes.

03

Anyone needing to report changes in their tax status.

Fill

form

: Try Risk Free

People Also Ask about

What is RT?

“RT” stands for “Retweet” and was a fundamental action on the social media platform formerly known as Twitter. It allowed you to share a post (tweet) created by another user with your own followers.

What language is RT?

RT (TV network) Country Russia Broadcast area Worldwide Headquarters Borovaya Street, Building 3/1, Moscow, Russia Programming Language(s) News channel: English, French, German, Arabic & Spanish Documentary channel: English, Russian Online platforms: Portuguese (Brazil) & Serbian.13 more rows

What country is RT?

Russia Today also known as RT is an English-language channel in Moscow, Russia. It is on all the time and broadcasts from its offices in Moscow. It is used to tell people about urgent news and information. Many people say that the news at RT are not true quite often.

What media outlets are in Russia?

As of 2018, the three main news agencies in Russia were TASS, RIA Novosti and Interfax. TASS, founded in 1904, is a federal, state-owned news agency, working throughout Soviet times as TASS. It has over 500 correspondents and broadcasts in six languages, with 350-650 items daily.

Why was RT banned?

The UK media regulator Ofcom repeatedly found RT to have breached its rules on impartiality and on one occasion found it had broadcast "materially misleading" content.

When did RT shut down?

RT America Programming Sister channels RT International RT France RT UK (formerly) RT Arabic RT Documentary RT en Español RT Deutsch (formerly) History Launched February 2010 Closed March 3, 20228 more rows

What is RT?

“RT” stands for “Retweet” and was a fundamental action on the social media platform formerly known as Twitter. It allowed you to share a post (tweet) created by another user with your own followers.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RT-1?

RT-1 is a tax form used in certain jurisdictions for reporting specific types of income or transactions to tax authorities.

Who is required to file RT-1?

Persons or entities that meet certain income thresholds or engage in specific transactions outlined by the tax authority are required to file RT-1.

How to fill out RT-1?

To fill out RT-1, individuals or entities need to provide required information accurately, following the instructions provided with the form, and ensuring all calculations are correctly performed.

What is the purpose of RT-1?

The purpose of RT-1 is to provide tax authorities with necessary information to assess tax liabilities and ensure compliance with tax regulations.

What information must be reported on RT-1?

The information that must be reported on RT-1 typically includes details about income, expenses, identification information, and any relevant transaction specifics.

Fill out your rt-1 - revenue wi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rt-1 - Revenue Wi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.