Get the free Partial Release of Collateral

Show details

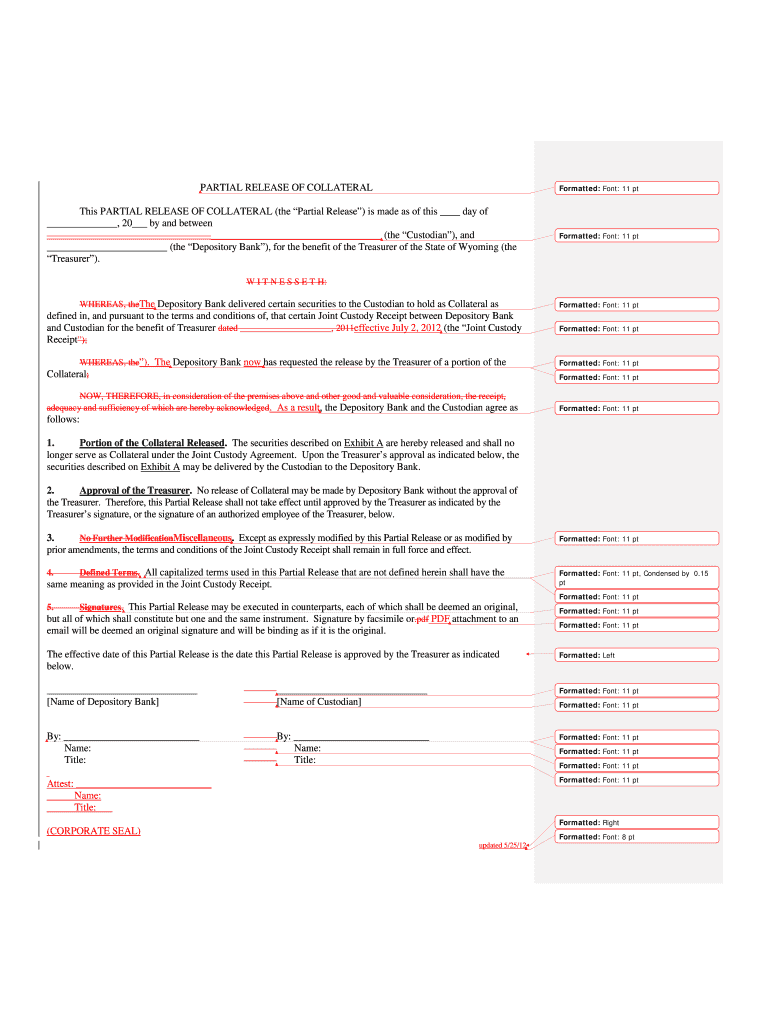

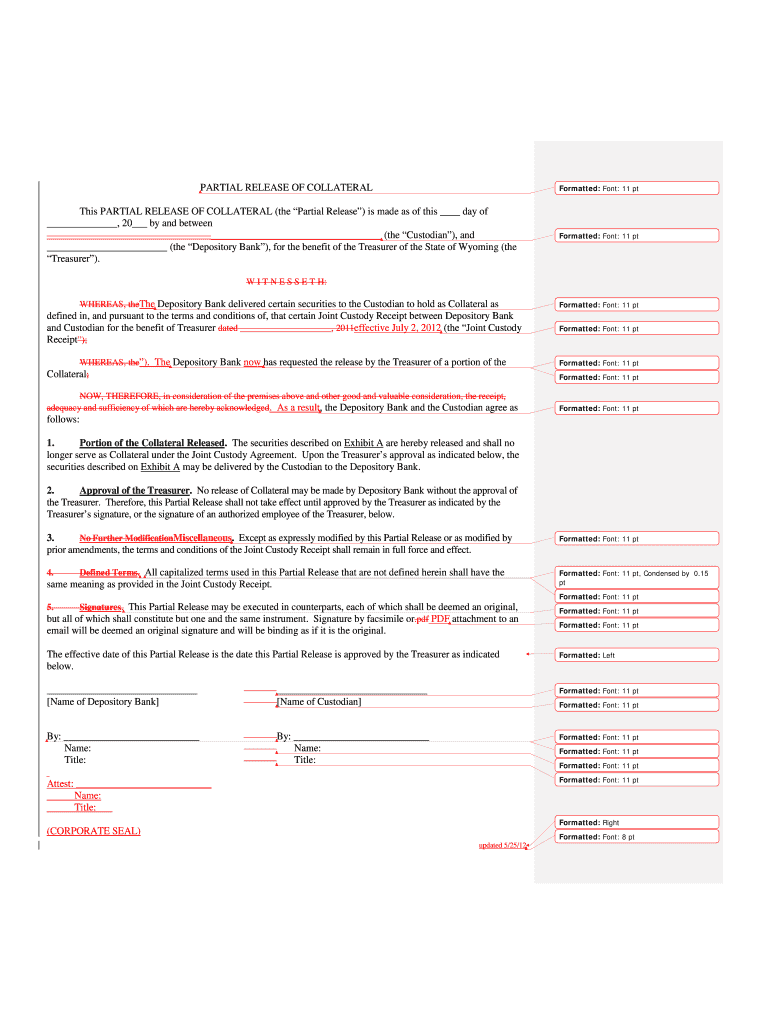

Este documento establece los términos y condiciones para la liberación parcial de colateral entre el Custodio y el Banco Depositorio para el beneficio del Tesorero del Estado de Wyoming.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partial release of collateral

Edit your partial release of collateral form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partial release of collateral form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing partial release of collateral online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit partial release of collateral. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

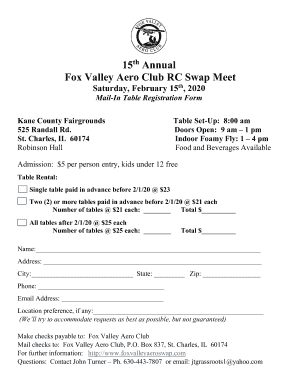

How to fill out partial release of collateral

How to fill out Partial Release of Collateral

01

Obtain the Partial Release of Collateral form from your lender or financial institution.

02

Fill in the borrower's name and information as it appears on the original loan agreement.

03

Clearly specify the collateral that is to be released, including any relevant identification or description.

04

Include details about the loan agreement such as the loan number and amount.

05

Get any necessary approval signatures from relevant parties, such as the lender or co-borrowers.

06

Submit the completed form to the lender for processing.

07

Keep a copy of the signed Partial Release of Collateral for your records.

Who needs Partial Release of Collateral?

01

Borrowers who have a secured loan and wish to release a portion of the collateral pledged.

02

Individuals or businesses that are refinancing debt and need to adjust the collateral on file.

03

Lenders who require official documentation to release specific assets used as loan security.

Fill

form

: Try Risk Free

People Also Ask about

What is partial collateral?

Side collateral is a pledge to partially collateralize a loan in case of a borrower default. It can consist of a physical asset, financial asset, or personal guarantee. Side collaterals typically involve signing a security agreement that gives the lender legal authority to sell or dispose of the collateral.

What is the release of collateral?

Release of collateral refers to the process by which a secured party (typically a lender or creditor) relinquishes or removes the lien or security interest over the collateral that was pledged as part of a loan or credit agreement. Collateral is typically property or assets that the borrower pledges to secure a loan.

What is release of collateral?

Release of collateral refers to the process by which a secured party (typically a lender or creditor) relinquishes or removes the lien or security interest over the collateral that was pledged as part of a loan or credit agreement. Collateral is typically property or assets that the borrower pledges to secure a loan.

What is a partial release of collateral letter?

A partial release letter is typically given by a lender to a borrower after the borrower fulfils certain conditions under a secured loan agreement. This Standard Document has integrated drafting notes with important explanations and negotiating tips.

What is a letter to the bank for release of collateral security?

This is a standard form of release of collateral letter. A release letter is typically given by a lender to a borrower after repayment of the borrower's outstanding loans to the lender under a secured loan agreement.

What is partial collateral?

Side collateral is a pledge to partially collateralize a loan in case of a borrower default. It can consist of a physical asset, financial asset, or personal guarantee. Side collaterals typically involve signing a security agreement that gives the lender legal authority to sell or dispose of the collateral.

What is the meaning of partial release?

A partial release enables lenders to waive their claim on a certain amount of collateral in a mortgage agreement. It is usually enacted through a specific provision in your real estate purchase agreement or mortgage contract.

What does partially released mean?

With a partial release, the lender releases a portion of the lien on the collateral securing the loan after the borrower has paid off a portion of the mortgage. The lender maintains a lien on the remaining property until the mortgage has been completely paid off.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Partial Release of Collateral?

Partial Release of Collateral refers to the process of removing a portion of the collateral that has been pledged against a loan or obligation while retaining the remaining collateral.

Who is required to file Partial Release of Collateral?

Typically, the borrower or the party that holds the collateral is required to file for a Partial Release of Collateral to officially document the release of part of the collateral.

How to fill out Partial Release of Collateral?

To fill out a Partial Release of Collateral, one must provide identifying information about the original loan, details of the collateral being released, and signatures from relevant parties agreeing to the release.

What is the purpose of Partial Release of Collateral?

The purpose of Partial Release of Collateral is to allow borrowers to access or utilize part of their pledged assets without fully paying off their debt, while still providing security to the lender for the remaining collateral.

What information must be reported on Partial Release of Collateral?

Information that must be reported includes the loan number, details of the collateral being released, the remaining collateral, and any obligations or terms associated with the release.

Fill out your partial release of collateral online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partial Release Of Collateral is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.