Get the free Expense Worksheet - Existing Position Grant - wyomingworkforce

Show details

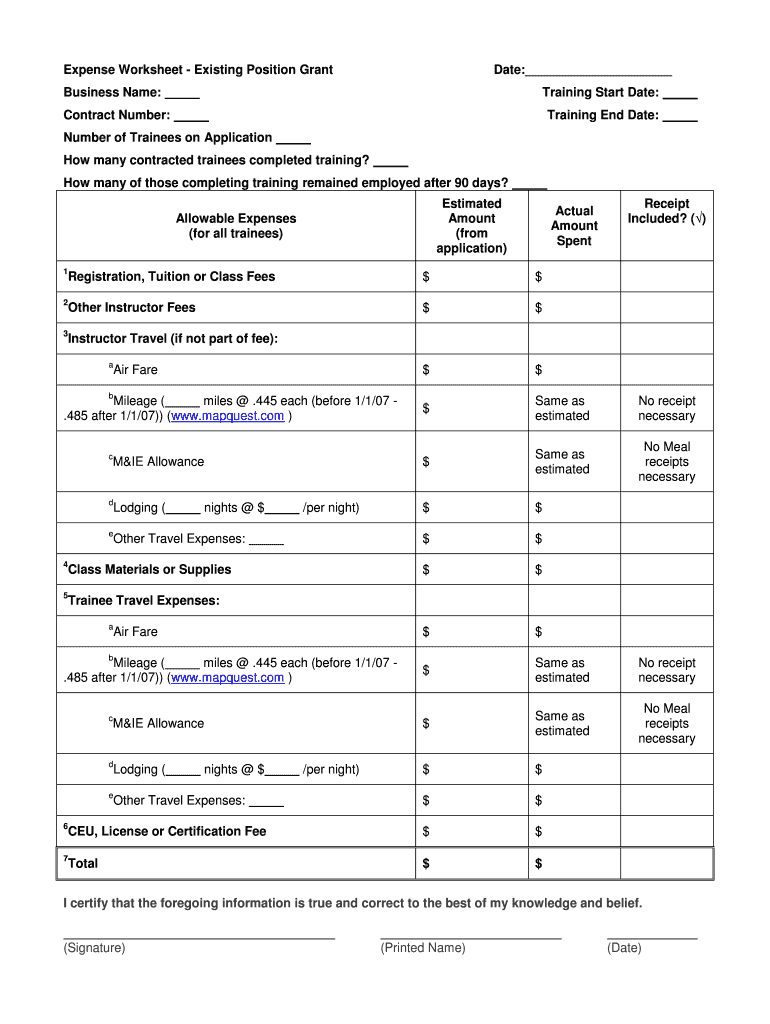

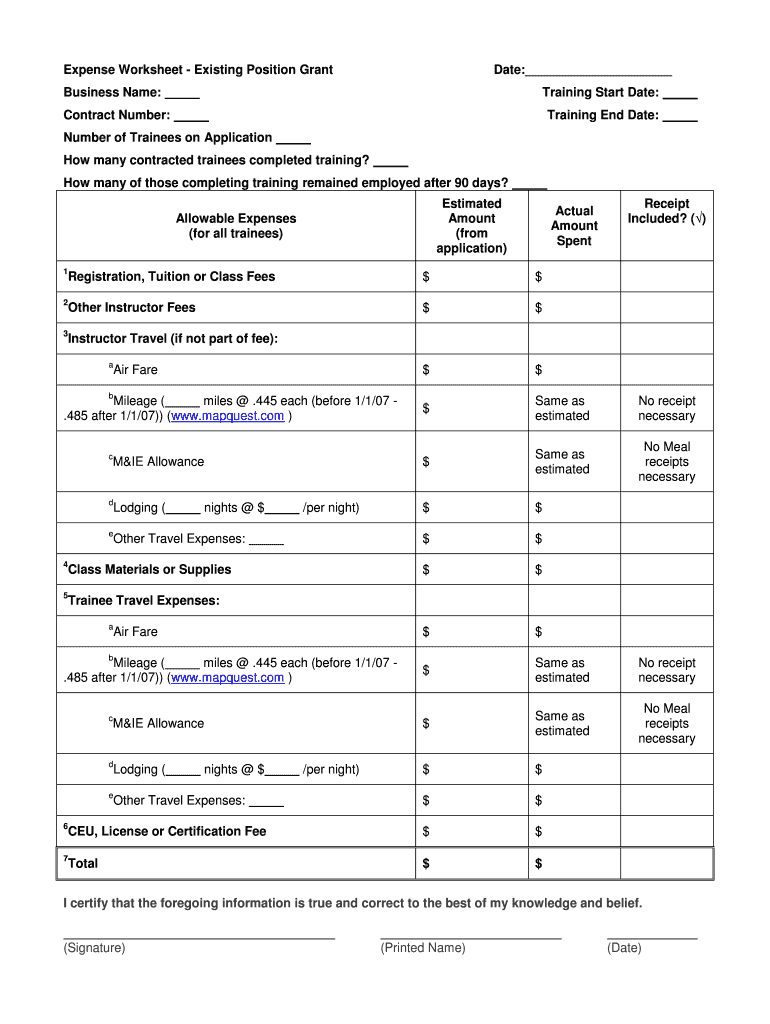

A worksheet designed to track and record expenses related to training and hiring under an existing position grant, including allowables expenses, actual amounts spent, and certifications of accuracy.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expense worksheet - existing

Edit your expense worksheet - existing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expense worksheet - existing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit expense worksheet - existing online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit expense worksheet - existing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expense worksheet - existing

How to fill out Expense Worksheet - Existing Position Grant

01

Gather all relevant receipts and invoices related to the expenses you want to claim.

02

Open the Expense Worksheet - Existing Position Grant document.

03

Fill out your name and contact information at the top of the worksheet.

04

Enter the date of each expense in the designated column.

05

Provide a description of each expense in the corresponding column.

06

Input the amount spent for each expense in the amount column.

07

If applicable, indicate whether the expenditure is part of a larger budget category.

08

Ensure that all entries are clear and accurate.

09

Attach all supporting documents, such as receipts, to the worksheet.

10

Review the worksheet for any errors and submit it as per your organization's instructions.

Who needs Expense Worksheet - Existing Position Grant?

01

Individuals or organizations that have received a grant to maintain an existing position and need to report their expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the 50 30 20 rule in Excel?

Using a 50/30/20 budget template for Excel offers a structured way to manage money every month. The template starts with a field where users input their monthly income, which is automatically divided into 50 percent for needs, 30 percent for wants and 20 percent for savings.

How do you calculate 50 30 20 rule in Excel?

Setting Up Your 50/30/20 Rule Spreadsheet Open up Excel or Google Sheets. Create three main columns: Needs, Wants, and Savings/Debt. Under each column, list out specific expenses. Add a row for your monthly after-tax income. Set up formulas to calculate 50%, 30%, and 20% of your income.

How to create a nonprofit budget in Excel?

How can you create a nonprofit budget using Excel? Choose a template. Enter your income sources. Enter your expense items. Compare your income and expenses. Adjust your budget as needed. Be the first to add your personal experience. Review and finalize your budget. Here's what else to consider.

What is the 80 20 rule in Excel?

The Pareto Principle (also commonly known as the 80/20 rule or 'the law of the vital few') states that 80 per cent of results come from 20 per cent of causes. For example, a common business example is that 80 per cent of sales come from 20 per cent of clients.

What is the 50/30/20 rule with examples?

The 50-30-20 rule works like this: 50% of your income goes to things you must have/need to spend on (rent, electricity, food, taxes), 30% goes to things you want to buy (that new iPhone, eating out, relaxing and watching a movie), and 20% goes to savings (bank savings, insurance, college funds, you name it).

How to make a personal expense sheet?

Run the Excel program on the computer and open a new file or spreadsheet. Put in the necessary details on the spreadsheet in order for it to calculate the figures involved in the file. Basic budget spreadsheets are often labeled with Income and Expenditure, which will be totaled by the file itself.

How to make an expenses spreadsheet?

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

How do you calculate the 50/30/20 rule?

50% of your net income should go towards living expenses and essentials (Needs), 20% of your net income should go towards debt reduction and savings (Debt Reduction and Savings), and 30% of your net income should go towards discretionary spending (Wants).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Expense Worksheet - Existing Position Grant?

The Expense Worksheet - Existing Position Grant is a financial document used to report expenditures associated with existing grant-funded positions within an organization.

Who is required to file Expense Worksheet - Existing Position Grant?

Organizations that have received funding through grants for existing positions are required to file the Expense Worksheet to report their spending.

How to fill out Expense Worksheet - Existing Position Grant?

To fill out the Expense Worksheet, you need to provide details such as the grant number, the position funded by the grant, the total expenses incurred, and any supporting documentation as required.

What is the purpose of Expense Worksheet - Existing Position Grant?

The purpose of the Expense Worksheet is to ensure transparency and accountability in the use of grant funds, allowing organizations to track expenses and comply with grant requirements.

What information must be reported on Expense Worksheet - Existing Position Grant?

The information that must be reported includes the grant number, position title, employee details, expenditure categories, total costs, and any additional notes or comments related to the expenses.

Fill out your expense worksheet - existing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expense Worksheet - Existing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.