Get the free ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST - procurement gatech

Show details

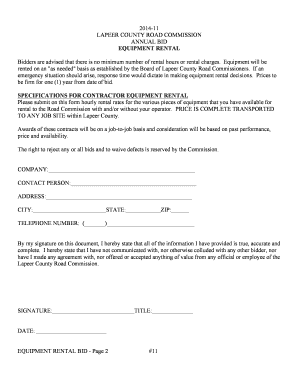

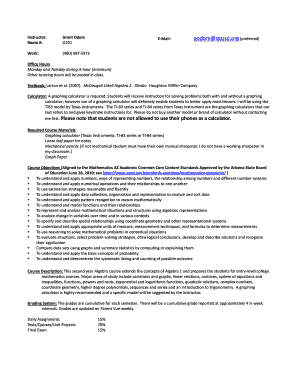

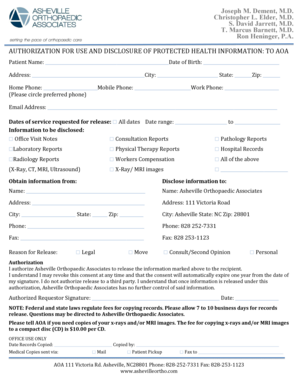

This form is used to request recurring payments for stipends, participant payments, monthly leases, and non-GT student fellowships that are not supported by a vendor invoice.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable recurring payment

Edit your accounts payable recurring payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable recurring payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts payable recurring payment online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit accounts payable recurring payment. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable recurring payment

How to fill out ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST

01

Begin by entering the date on the top right corner of the form.

02

Fill in the vendor's name and address in the designated fields.

03

Specify the payment amount in the appropriate section.

04

Choose the frequency of the recurring payment (e.g., monthly, quarterly).

05

Indicate the start and end dates for the recurring payments.

06

Provide any relevant invoice numbers or references.

07

Sign the form and add the date.

08

Submit the completed form to the accounts payable department for processing.

Who needs ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

01

Employees or departments that regularly need to make scheduled payments to vendors.

02

Finance team members responsible for managing recurring expenses.

03

Budget managers who oversee expenditures that occur on a regular basis.

Fill

form

: Try Risk Free

People Also Ask about

What are the two types of payment terms?

Some standard or common terms include: Payment in advance: This can be a partial deposit or complete payment before a project is begun or a product is delivered. Cash on Delivery (COD): The seller pays for the goods or services at the time they are delivered.

Is accounts payable the same as accounts Rec?

Difference between accounts payable and accounts receivable Whereas accounts payable represents money that your business owes to suppliers, accounts receivable represents money owed to your business by customers.

Do you send invoices to AP or AR?

In contrast to accounts payable, accounts receivable is the accounting category that addresses the funds that are owed to your business, typically by your customers. Basically, if you receive an invoice, it's A/P. If you send an invoice, it's A/R. These unpaid debts show up on your balance sheet as a current asset.

What is the AP payment method?

Key takeaways. Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

What is the difference between AP and AR process?

In other words, AR refers to the outstanding invoices your business has or the money your customers owe you, while AP refers to the outstanding bills your business has or the money you owe to others.

What are the two types of accounts payable?

What are the types of accounts payable? Payables are often categorised as trade payables (payables for the purchase of physical goods that are recorded in inventory) and expense payables (payables for the purchase of goods or services that are expensed).

What is another name for accounts payable in accounting?

Accounts payable is also commonly known as trade payables or bills to pay.

Is accounts Rec the same as payable?

Accounts receivable: Money owed to your business by customers for goods or services they purchased on credit. You can think of it as money coming in. Accounts payable: Money your business owes to suppliers or vendors for goods or services purchased on credit. This is money going out.

What are the two types of payments in AP?

Main types of AP payments Expense payables: payments owed for operational expenses (such as utilities, rent, and professional fees) that are recorded upon receipt of the invoice. Accrued expenses: expenses that have been incurred (and entered into the books) but not yet invoiced.

What is the difference between AP and P2P?

To elaborate, P2P is a broader business process that encompasses the entire cycle from the procurement of goods or services to final payment. AP is a specific subset of the P2P process focusing on the management of the money a company owes to its suppliers or vendors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST is a formal request used by organizations to authorize regular payments to suppliers or service providers for recurring expenses, ensuring timely payments for continual services or products.

Who is required to file ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

Typically, departments or units within an organization that incur regular expenses, such as administrative departments or project teams using ongoing services, are required to file the ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST.

How to fill out ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

To fill out the ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST, one must provide details such as vendor information, payment frequency, amount due, your department's details, and the justification for the recurring payment.

What is the purpose of ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

The purpose of the ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST is to streamline the payment process for regular, predictable expenses, ensuring efficient cash flow management and adherence to contract payment terms.

What information must be reported on ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST?

The ACCOUNTS PAYABLE RECURRING PAYMENT REQUEST must report information including the vendor name, payment schedule, payment amount, account code, and any necessary approvals or documentation to validate the request.

Fill out your accounts payable recurring payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable Recurring Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.