Get the free 2013-201 Dependent Verification Form - georgian

Show details

This form is used to verify information provided in the FAFSA application for students applying for financial aid, particularly focused on tax documentation and family information for the aid process.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013-201 dependent verification form

Edit your 2013-201 dependent verification form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013-201 dependent verification form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013-201 dependent verification form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2013-201 dependent verification form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013-201 dependent verification form

How to fill out 2013-201 Dependent Verification Form

01

Obtain the 2013-201 Dependent Verification Form from your employer or the appropriate website.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact information.

04

List all dependents you are verifying, including their names, dates of birth, and relationship to you.

05

Provide any necessary supporting documents required to verify each dependent's eligibility.

06

Review the completed form for accuracy and ensure all required fields are filled out.

07

Sign and date the form in the appropriate section.

08

Submit the form and any supporting documents to the designated recipient, such as your HR department or benefits administrator.

Who needs 2013-201 Dependent Verification Form?

01

Employees who wish to enroll dependents in a benefits or insurance plan.

02

Individuals needing to verify eligibility of their dependents for health insurance coverage.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to attach W2 to my New York tax return?

DO NOT attach a W-2 to your NYS income tax return. Keep the state copy for your records. Complete Lines 1 through 18. Transfer the amounts from your federal income tax return to the Federal Amount column and income you earned in New York State (New York-source income) to the NYS amount column.

What is the dependent exemption in NY State?

For taxable years beginning after 1987, a resident individual is allowed a New York exemption of $1,000 for each dependent exemption properly allowable to such individual under section 151(c) of the Internal Revenue Code.

What is line 47 on a tax return?

Line 47 of Form 1040 (line 30 of Form 1040A and line 7 of Form 1040EZ) provides a Rate Reduction Credit for those taxpayers who did not get the maximum benefit from last summer's Advance Payments, and whose 2001 income or tax amounts qualify them for an additional amount.

How to report excess Roth IRA contribution on tax return?

If your total IRA contributions (both traditional and Roth combined) are greater than your allowed amount for the year, and you haven't withdrawn the excess contributions, you'll owe a 6% penalty tax on the excess contribution and you must complete Form 5329 Additional Taxes on Qualified Plans (Including IRAs) and

Is the 1040 the same as it-201?

The State Tax Form 201, also known as IT-201, is the standard income tax return form for New York State residents. This form is used to report income, calculate tax liability, and claim credits or deductions. Think of it as the New York equivalent of the federal Form 1040.

Who fills out it-201?

The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201 and both spouses' income will be taxed as full-year residents of New York State.

What line is taxable?

1:27 2:50 And then subtracting your deductions. The final number you get is your taxable income. Which you'llMoreAnd then subtracting your deductions. The final number you get is your taxable income. Which you'll find on line 15 of the form. 1040.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

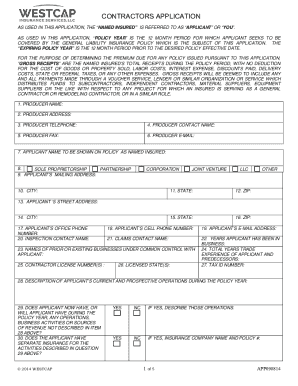

What is 2013-201 Dependent Verification Form?

The 2013-201 Dependent Verification Form is a document used by employers or benefit providers to verify the eligibility of dependents covered under an employee's health insurance plan.

Who is required to file 2013-201 Dependent Verification Form?

Employees who wish to enroll or maintain dependent coverage on their health insurance plans are required to file the 2013-201 Dependent Verification Form for each dependent.

How to fill out 2013-201 Dependent Verification Form?

To fill out the form, employees must provide accurate information about themselves and their dependents, including their names, dates of birth, social security numbers, and any relevant supporting documentation.

What is the purpose of 2013-201 Dependent Verification Form?

The purpose of the form is to ensure that only eligible dependents are covered under employee health insurance plans, helping to prevent fraud and manage insurance costs.

What information must be reported on 2013-201 Dependent Verification Form?

The form requires the reporting of the employee's information, dependent's name, relationship to the employee, date of birth, social security number, and any supporting documentation as needed to verify eligibility.

Fill out your 2013-201 dependent verification form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013-201 Dependent Verification Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.