CA FTB 540 2009 free printable template

Show details

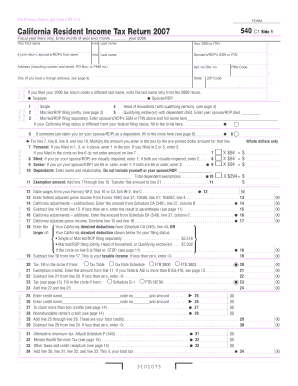

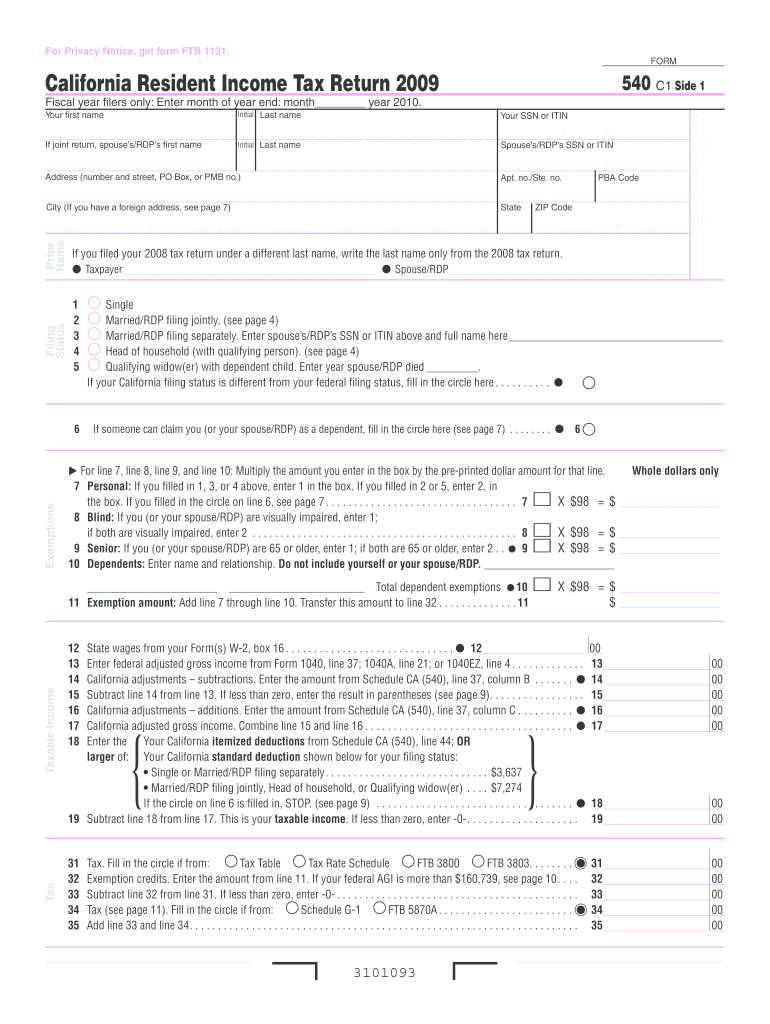

94 Side 2 Form 540 C1 2009 Contributions Code California Seniors Special Fund see page 22. 400 Alzheimer s Disease/Related Disorders Fund.. For Privacy Notice get form FTB 1131. FORM California Resident Income Tax Return 2009 540 C1 Side 1 Fiscal year filers only Enter month of year end month year 2010. Attach Schedule P 540. 61 Mental Health Services Tax see page 12. 62 Other taxes and credit recapture see page 13. 63 Add line 48 line 61 line 62 and line 63. This is your total tax. Other Taxes...California income tax withheld see page 13. 2009 CA estimated tax and other payments see page 13. Real estate and other withholding see page 13. Your first name Initial Last name Your SSN or ITIN If joint return spouse s/RDP s first name Spouse s/RDP s SSN or ITIN - Apt. no. /Ste. no. City If you have a foreign address see page 7 State Filing Status Prior Name Address number and street PO Box or PMB no. AC PBA Code ZIP Code A R RP If you filed your 2008 tax return under a different last name...write the last name only from the 2008 tax return* Taxpayer Spouse/RDP 1. Single 2. Married/RDP filing jointly. see page 4 4. Head of household with qualifying person. see page 4 5. Qualifying widow er with dependent child. Enter year spouse/RDP died. If your California filing status is different from your federal filing status fill in the circle here. Exemptions P If someone can claim you or your spouse/RDP as a dependent fill in the circle here see page 7. For line 7 line 8 line 9 and line...10 Multiply the amount you enter in the box by the pre-printed dollar amount for that line. Whole dollars only 7 Personal If you filled in 1 3 or 4 above enter 1 in the box. If you filled in 2 or 5 enter 2 in the box. If you filled in the circle on line 6 see page 7. 7 X 98 8 Blind If you or your spouse/RDP are visually impaired enter 1 if both are visually impaired enter 2. 8 X 98 9 Senior If you or your spouse/RDP are 65 or older enter 1 if both are 65 or older enter 2. 9 X 98 10...Dependents Enter name and relationship* Do not include yourself or your spouse/RDP. Tax Taxable Income Total dependent exemptions 10. X 98 11 Exemption amount Add line 7 through line 10. Transfer this amount to line 32. 11 12 State wages from your Form s W-2 box 16. 12 13 Enter federal adjusted gross income from Form 1040 line 37 1040A line 21 or 1040EZ line 4. 13 14 California adjustments subtractions. Enter the amount from Schedule CA 540 line 37 column B. 14 15 Subtract line 14 from line...13. If less than zero enter the result in parentheses see page 9. 15 18 Enter the Your California itemized deductions from Schedule CA 540 line 44 OR larger of Your California standard deduction shown below for your filing status Single or Married/RDP filing separately. 3 637 If the circle on line 6 is filled in STOP. see page 9. 18 Tax. Fill in the circle if from Tax Table Tax Rate Schedule FTB 3800 FTB 3803. 31 Exemption credits. Enter the amount from line 11. If your federal AGI is more...than 160 739 see page 10.

pdfFiller is not affiliated with any government organization

Instructions and Help about CA FTB 540

How to edit CA FTB 540

How to fill out CA FTB 540

Instructions and Help about CA FTB 540

How to edit CA FTB 540

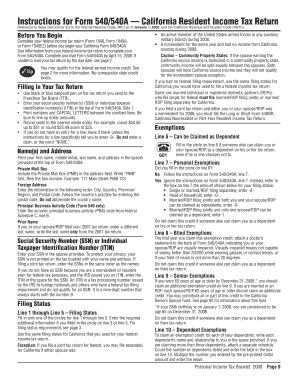

To edit CA FTB 540, utilize tools that allow for direct modifications to the PDF format. Tools such as pdfFiller can assist with making necessary changes, allowing users to annotate or input information accurately on the form.

How to fill out CA FTB 540

Filling out CA FTB 540 involves gathering relevant financial documents, such as W-2s and 1099s. Ensure you have your Social Security number, California residency status, and any applicable tax credits before starting. Follow these steps to complete the form:

01

Download CA FTB 540 from the California Franchise Tax Board website or access a fillable version online.

02

Enter personal information including your name, address, and Social Security number.

03

Report income sources in the designated sections and calculate your total income.

04

Claim deductions and credits as applicable to arrive at your taxable income.

05

Review your entries for accuracy before submitting the form.

About CA FTB previous version

What is CA FTB 540?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CA FTB previous version

What is CA FTB 540?

CA FTB 540 is the California Resident Income Tax Return form used by individuals to report their income, claim deductions, and compute their tax liabilities. This specific form is utilized by California residents who are required to file a state income tax return, providing necessary information to determine state tax obligations.

What is the purpose of this form?

The purpose of CA FTB 540 is to facilitate the income tax reporting process for California residents. It allows taxpayers to declare their earnings, claim deductions, and calculate the taxes owed or refunds due. Completing this form accurately ensures compliance with California tax laws and avoidance of penalties.

Who needs the form?

Individuals who are residents of California and have income to report must complete CA FTB 540. This applies to various income sources including wages, rental income, and business profits. If your gross income exceeds the minimum filing requirement set by the California FTB, you are legally obliged to file this return.

When am I exempt from filling out this form?

You may be exempt from filling out CA FTB 540 if your income falls below the state's minimum threshold. Additionally, if you are a non-resident or you only have income that is not taxable in California, you do not need to use this form. Special circumstances such as certain retirement income may also provide exemptions.

Components of the form

CA FTB 540 includes several sections including personal information, income reporting, adjustments, tax computation, and signatures. The form requires you to input your adjusted gross income, along with any deductions for which you qualify. Attach necessary schedules and documents that support your income and deductions.

What are the penalties for not issuing the form?

Failure to file CA FTB 540 by the due date can result in penalties, including fines and interest on unpaid taxes. The California FTB imposes a late filing penalty, which can be a percentage of the unpaid tax amount. Consistent failure to comply may also lead to more severe repercussions, including lien and garnishment of wages.

What information do you need when you file the form?

To file CA FTB 540, gather essential documents including W-2 forms from employers, 1099s for other income, records of deductions and credits, and any necessary tax documents. Key personal information such as your Social Security number, California residency status, and filing status must also be ready for accurate completion of the form.

Is the form accompanied by other forms?

Yes, CA FTB 540 may require accompanying forms, particularly if you have additional schedules for deductions or income sources. Common additional forms include Schedule CA (540) for adjustments and Schedule D for capital gains. Ensure that all necessary forms are included when submitting your return.

Where do I send the form?

Send the completed CA FTB 540 to the mailing address specified in the instructions on the form. The address can vary depending on whether you are enclosing a payment or filing without a payment. Always confirm the correct address on the California Franchise Tax Board's official website to avoid processing delays.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Helps me annotate my documents for my clients , making them easier to read.

AT LEAST I'M THINKING I'M GETTING BETTER

See what our users say