Get the Application for a Tax-Free Savings Account Identification Number - cra-arc gc

Show details

This document is used to apply for a Tax-Free Savings Account (TFSA) identification number as required by the Income Tax Act.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for a tax

Edit your application for a tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for a tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for a tax online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for a tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for a tax

How to fill out Application for a Tax-Free Savings Account Identification Number

01

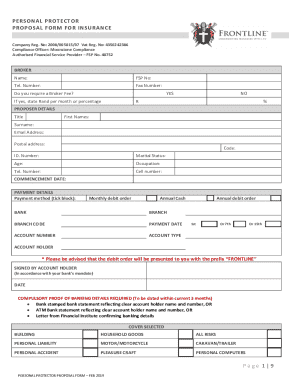

Gather necessary personal information such as your full name, date of birth, and Social Insurance Number (SIN).

02

Complete the application form for the Tax-Free Savings Account (TFSA) Identification Number, ensuring all fields are filled out accurately.

03

Provide information on your current residential address and contact details.

04

Indicate your eligibility for a TFSA by confirming your age (you must be at least 18 years old) and residency status in Canada.

05

Sign and date the application form to confirm that the information provided is correct.

06

Submit the completed application form to the appropriate tax authority, either online or by mail.

Who needs Application for a Tax-Free Savings Account Identification Number?

01

Individuals who are Canadian residents and at least 18 years old.

02

Individuals looking to open a Tax-Free Savings Account (TFSA).

03

Anyone wishing to benefit from tax-free investment growth on their savings.

Fill

form

: Try Risk Free

People Also Ask about

Is it better to keep money in savings or TFSA?

Bottom Line. Both of these accounts are extremely useful for different goals. Savings accounts are perfect for short-term savings and emergency funds, while TFSAs are an ideal place to save long-term and grow your investments tax-free. No maintenance or monthly fees.

How do I avoid tax on my TFSA?

Contributions to a TFSA are not deductible for income tax purposes. Any amount contributed as well as any income earned in the account (for example, investment income and capital gains) is generally tax-free, even when it is withdrawn.

What are the negatives of a TFSA?

Another big drawback is that TFSAs aren't protected from creditors. If you're involved in a law suit or bankruptcy your TFSA can be confiscated by your creditors. If you use a TFSA for your retirement savings they could unfortunately take it all. RRSPs on the other-hand are protected from creditors.

How to create a TFSA account?

To open a TFSA , you must do both of the following: Contact your financial institution, credit union, or insurance company (issuer). Provide the issuer with your SIN and date of birth so the issuer can register your qualifying arrangement as a TFSA . Your issuer could ask for supporting documents.

Do I need to report my TFSA to CRA?

As long as you are not considered a day trader you do not report TFSA gains or losses. If you trade daily or have hundreds of trades per year within a TFSA you likely are a day trader and need to report your gains or losses.

Can I open a TFSA account online?

Once you have your TD EasyWeb access set up, you can open a TD Canada Trust TFSA through TD EasyWeb. You can apply online if you already have a TD Canada Trust chequing or savings account. Once your account is open, you can make regular contributions online.

What is the downside of a TFSA account?

Another big drawback is that TFSAs aren't protected from creditors. If you're involved in a law suit or bankruptcy your TFSA can be confiscated by your creditors. If you use a TFSA for your retirement savings they could unfortunately take it all. RRSPs on the other-hand are protected from creditors.

What's the catch with a tax-free savings account?

You choose what to put in it: cash, ETFs, guaranteed investment certificates, stocks, and bonds. Since you already paid tax on the deposit, you won't pay again upon withdrawal. However, there is a government-mandated deposit limit, and if you over-contribute, the government will charge a significant penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for a Tax-Free Savings Account Identification Number?

The Application for a Tax-Free Savings Account Identification Number is a form submitted to the tax authorities to obtain a unique identification number for a Tax-Free Savings Account (TFSA). This number is required to manage contributions and withdrawals related to the TFSA.

Who is required to file Application for a Tax-Free Savings Account Identification Number?

Individuals who wish to open and contribute to a Tax-Free Savings Account are required to file this application to obtain their identification number.

How to fill out Application for a Tax-Free Savings Account Identification Number?

To fill out the application, provide personal information such as your name, address, date of birth, and Social Security number. Ensure all fields are completed accurately before submitting the application to the relevant tax authority.

What is the purpose of Application for a Tax-Free Savings Account Identification Number?

The purpose of the application is to officially register the individual's Tax-Free Savings Account and ensure that contributions and earnings within the account can be tracked for tax purposes.

What information must be reported on Application for a Tax-Free Savings Account Identification Number?

The information that must be reported includes the applicant's personal identification details, such as full name, address, date of birth, and taxpayer identification number, along with any required documentation verifying identity.

Fill out your application for a tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For A Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.