Get the free Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartmen...

Show details

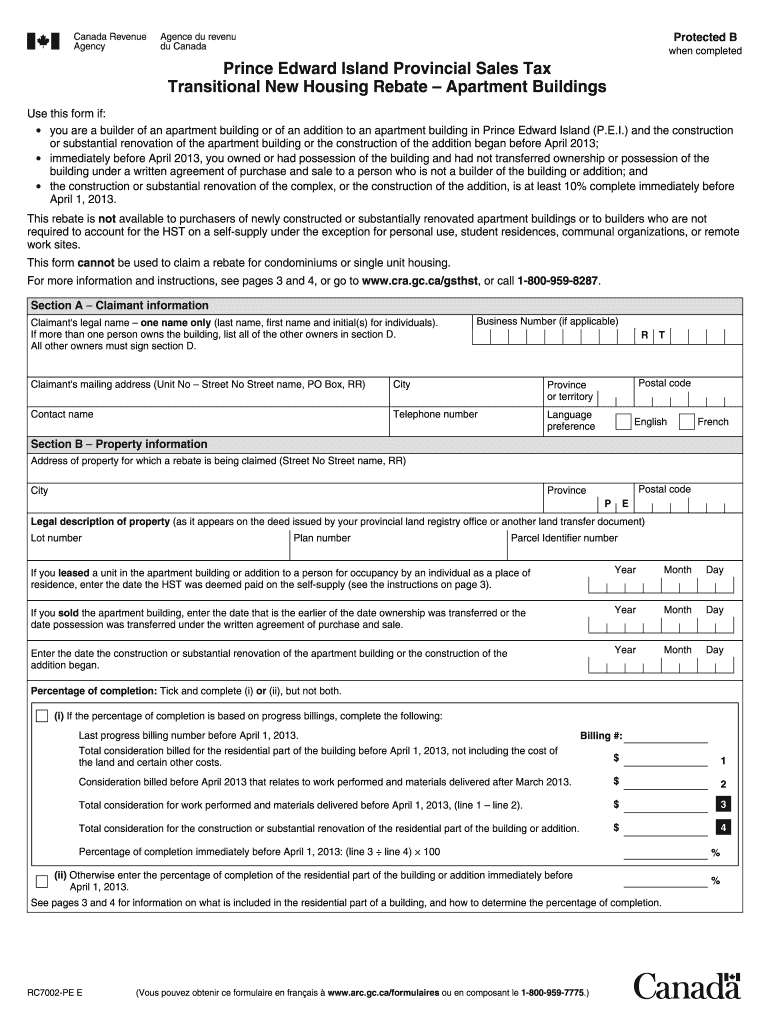

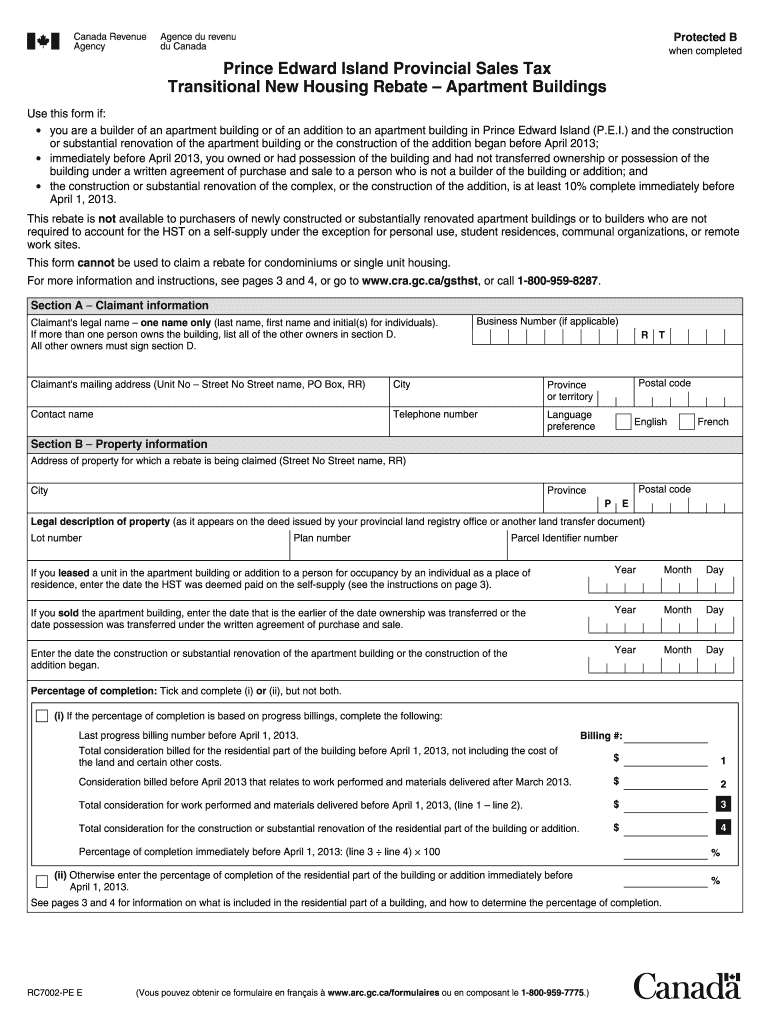

This form is used by builders of apartment buildings in Prince Edward Island to claim a rebate for the provincial sales tax (PST) applicable to construction costs incurred before April 2013.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign prince edward island provincial

Edit your prince edward island provincial form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your prince edward island provincial form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing prince edward island provincial online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit prince edward island provincial. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out prince edward island provincial

How to fill out Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings

01

Obtain the Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate application form from the official website or local tax office.

02

Ensure you meet the eligibility criteria, including being a builder or owner of a newly constructed apartment building.

03

Fill out the applicant information section with your details as either the builder or owner.

04

Provide complete information about the apartment building, including address, number of units, and construction details.

05

Include the total eligible expenses related to the construction of the apartment building.

06

Attach required supporting documentation, such as receipts, contracts, and proof of payment.

07

Calculate the rebate amount based on the guidelines provided in the rebate form.

08

Review the completed application for accuracy and completeness.

09

Submit the application form and all attachments to the appropriate tax authority in Prince Edward Island.

Who needs Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

01

Builders of newly constructed apartment buildings who are looking for tax relief on their construction costs.

02

Property owners investing in new apartment buildings who want to maximize their financial returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the provincial sales tax in Prince Edward Island?

The HST is made up of two components: an 10% provincial sales tax and a 5% federal sales tax.

What is exempt from PEI sales tax?

Do I have to pay HST on all purchases? Most purchases in PEI are subject to HST, but there are exemptions, such as basic groceries, prescription medications, and certain medical supplies.

What is the new home construction rebate in Canada?

Rebates for new housing. The GST/HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual's, or their relation's, primary place of residence, when all of the other conditions are met.

What is the tax rebate for home renovations in Canada?

You can claim up to $50,000 in qualifying expenditures for each qualifying renovation that is completed. The tax credit is 15% of your costs, up to a maximum of $7,500, for each claim you are eligible to make.

What is the PEI sales tax credit?

The Prince Edward Island sales tax credit is a tax-free amount paid to help offset the increase in the sales tax for households with low and modest incomes. This amount is combined with the quarterly payments of the federal GST/HST credit.

What is the BC new construction rebate?

The CleanBC Better Homes New Construction Program provides rebates of up to $15,000 for the construction of new, high-performance electric homes. It is open to builders constructing new Part 9 single-family detached homes, laneway homes, duplexes, triplexes, or townhomes.

What is the new home buyer program in Canada?

Under the RRSP Home Buyers' Plan (HBP), first-time home buyers can withdraw up to $60,000 from their RRSP to put toward a home purchase. There's no special contribution limit for the HBP itself; your annual RRSP contribution room is still determined by your income and CRA limits.

What is the maximum income to qualify for GST?

A single person would receive the credit for July 2024 to June 2025 if their 2023 adjusted family net income was $54,704 or less. A married/common-law couple with 2 children would receive the credit if their adjusted family net income was $65,084 or less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

The Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate for Apartment Buildings is a financial incentive provided by the government to help offset the costs of building new apartment units. This rebate aims to stimulate the construction of rental housing and support the province's housing market.

Who is required to file Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

Typically, builders and developers who have incurred provincial sales tax costs associated with constructing new apartment buildings in Prince Edward Island are required to file for this rebate.

How to fill out Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

To fill out the rebate form, applicants must provide details such as their business information, specifics about the apartment building construction, the total sales tax paid, and any supporting documentation required by the provincial tax authority.

What is the purpose of Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

The purpose of the rebate is to encourage the development of new rental housing units, make housing more affordable, and stimulate economic growth in the province by alleviating the financial burden on builders and developers.

What information must be reported on Prince Edward Island Provincial Sales Tax Transitional New Housing Rebate – Apartment Buildings?

Applicants must report information including the address of the property, the total amount of provincial sales tax paid, a description of the project, and any relevant supporting documents such as invoices and construction contracts.

Fill out your prince edward island provincial online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Prince Edward Island Provincial is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.