Get the free NYU Stern Faculty Retirement Program - web-docs stern nyu

Show details

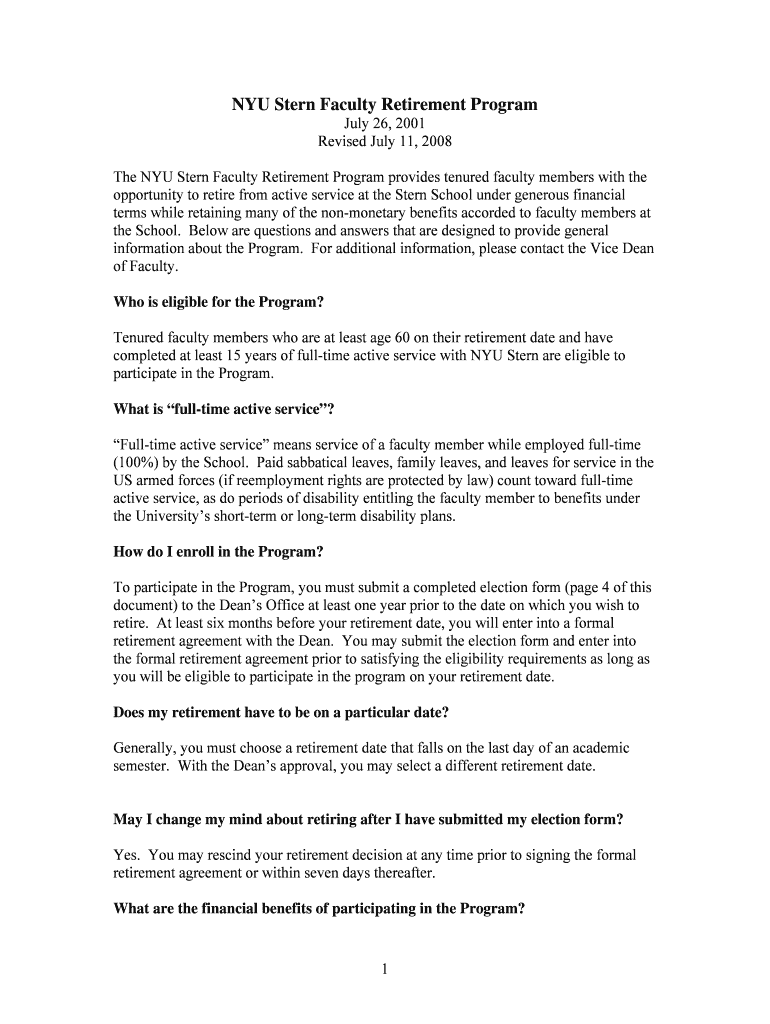

The document outlines the NYU Stern Faculty Retirement Program, detailing eligibility requirements, enrollment process, financial benefits, phased retirement options, and additional resources for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nyu stern faculty retirement

Edit your nyu stern faculty retirement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyu stern faculty retirement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nyu stern faculty retirement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit nyu stern faculty retirement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

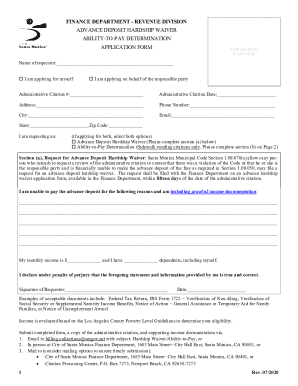

How to fill out nyu stern faculty retirement

How to fill out NYU Stern Faculty Retirement Program

01

Obtain the NYU Stern Faculty Retirement Program application form from the HR department or the NYU Stern website.

02

Carefully read the program guidelines and eligibility criteria outlined in the application materials.

03

Fill out personal information, including your name, employee ID, department, and contact details in the designated sections of the form.

04

Provide your current retirement plan details, including the type of plan you are enrolled in and the contribution amounts.

05

Indicate the desired retirement date and ensure it aligns with the program's stipulations.

06

Review the terms of the retirement program, including benefits, monetary contributions, and impact on existing retirement plans.

07

Gather any required documentation, such as proof of years of service or other related records, as specified in the application instructions.

08

Sign and date the application form affirmatively, confirming your eligibility and agreement to the terms.

09

Submit the completed application form and supporting documents to the HR department by the specified deadline.

10

Follow up with HR to confirm receipt of your application and inquire about the next steps in the process.

Who needs NYU Stern Faculty Retirement Program?

01

Faculty members at NYU Stern who are nearing retirement age and wish to take advantage of the retirement benefits offered by the program.

02

Long-term employees who have contributed to the university's retirement plan and are considering retirement options.

03

Faculty who are looking for financial security and structured support during their transition to retirement.

Fill

form

: Try Risk Free

People Also Ask about

What is the retirement age for NYU?

your age plus years of continuous, full-time service equals 70 or more, and you're at least age 55 with at least ten years of continuous full-time service; or if you have 10 or more years of continuous, full-time service and you are found eligible for Long-Term Disability.

At what age do professors retire in the USA?

Generally speaking, most full-time professors retire around their mid-to-late 60s, which is pretty in line with the average retirement age in the U.S. However, it's important to note that unlike some other professions, there isn't a mandatory retirement age for college professors.

How much does NYU contribute to retirement?

After a year of service, NYU provides a non-elective contribution of 5% of your base salary and, if you make employee contributions, NYU will make a matching contribution of up to 5% of your base salary up to the IRS annual compensation limit.

Do NYU employees get a pension?

Once you retire, you can receive income from the Supplemental Tax Deferred Annuity (STDA) Plan and Staff Pension Plan (SPP) at any time. For the STDA plan, you can elect immediate payment in a single sum, make partial withdrawals, or choose an annuity.

What is tenured professor at NYU?

The Tenured Faculty consists of the Professors and Associate Professors who have full-time appointments at the University and who have been awarded permanent or continuous tenure at the University in ance with University procedures for the awarding of such tenure, including receipt of a letter from an authorized

What is the new retirement age in New York?

Tier 1 members are eligible to retire at age 55. For members of Tiers 2, 3, 5 and 6 (note Tier 4 is not applicable for PFRS), the minimum retirement age for full benefits is 62 if they have completed at least five years of service.

What is the retirement age for NYU professors?

Who is eligible for retirement with benefits? Faculty are eligible for retiree medical and life insurance benefits from NYU if they meet the rule of 70.

What is the retirement age for teachers in New York?

For the full retirement benefit, you must be 62 years old at retirement or, if you have 30 years of credited service, you may retire as early as age 55. With less than 30 years of service, you may retire as early as age 55, but you will receive a reduced benefit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NYU Stern Faculty Retirement Program?

The NYU Stern Faculty Retirement Program is a retirement initiative designed to support faculty members of NYU Stern in planning for their retirement, providing structured options and benefits for a smooth transition.

Who is required to file NYU Stern Faculty Retirement Program?

Eligible NYU Stern faculty members nearing retirement age are required to file for the NYU Stern Faculty Retirement Program to access retirement benefits and ensure proper planning.

How to fill out NYU Stern Faculty Retirement Program?

To fill out the NYU Stern Faculty Retirement Program documentation, faculty members should follow the specific guidelines provided by the program, including required forms available through the NYU HR portal and necessary supporting documents.

What is the purpose of NYU Stern Faculty Retirement Program?

The purpose of the NYU Stern Faculty Retirement Program is to facilitate the retirement process for faculty members, ensuring they receive the benefits and support necessary for a successful transition from active employment.

What information must be reported on NYU Stern Faculty Retirement Program?

The information that must be reported on the NYU Stern Faculty Retirement Program includes personal identification details, employment history, retirement dates, and any relevant benefits elections or financial choices.

Fill out your nyu stern faculty retirement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nyu Stern Faculty Retirement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.