Get the free Foundations of Finance - pages stern nyu

Show details

This document contains a problem set for a finance course, focusing on margin trading, limit order books, real rates of return, capital market lines, portfolio selection, and risk assessment related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foundations of finance

Edit your foundations of finance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foundations of finance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foundations of finance online

Follow the guidelines below to benefit from the PDF editor's expertise:

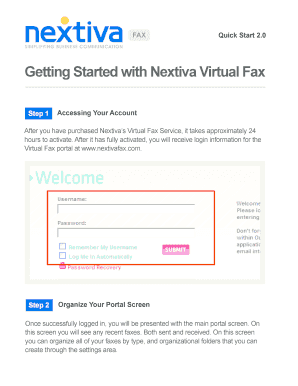

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit foundations of finance. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foundations of finance

How to fill out Foundations of Finance

01

Gather all necessary financial documents and data.

02

Review the course syllabus and understand the key concepts covered.

03

Start by filling out your personal information accurately.

04

Complete the introductory sections to establish foundational knowledge.

05

Answer each question based on your understanding and research.

06

Review your answers for clarity and completeness.

07

Submit the filled-out document by the given deadline.

Who needs Foundations of Finance?

01

Students pursuing finance or business degrees.

02

Professionals seeking to enhance their financial literacy.

03

Individuals preparing for a career in finance or investment.

04

Anyone looking to better manage personal or organizational finances.

Fill

form

: Try Risk Free

People Also Ask about

What are the five foundations of finance literacy?

Financial Literacy Month: Five Finance Basics Everyone Should Budgeting: The Foundation Of Financial Health. Saving & Investing: Grow Your Wealth Over Time. Credit & Debt Management: Keep Your Score Strong. Smart Spending: Make Every Dollar Count. Extra Ways To Save Money In 2025. Final Thoughts.

What are the 5 principles of finance?

A: The five major principles of finance are time value of money, risk and return, diversification, capital budgeting, and cost of capital. Understanding these principles is crucial for anyone working in finance or aspiring to do so.

What does foundation finance do?

Our Mission: We provide fast, common sense loan decisions and simple, flexible consumer finance programs that help our dealers build their bottom line. All our interactions are built on a foundation of respect, honesty and fairness.

What are the fundamentals of finance?

These include the time value of money, bond and equity valuations, risk and returns, and various sources of capital. This book aims to enhance the learning experience by offering a thorough understanding of these fundamental financial principles.

What are the foundations of standard finance?

Standard finance has four foundation blocks: (1) investors are rational; (2) markets are efficient; (3) investors should design their portfolios ing to the rules of mean-variance portfolio theory and, in reality, do so; and (4) expected returns are a function of risk and risk alone.

What are the 5 principles of finance?

A: The five major principles of finance are time value of money, risk and return, diversification, capital budgeting, and cost of capital. Understanding these principles is crucial for anyone working in finance or aspiring to do so.

What are the topics of foundation of finance?

This course is designed to familiarise students with the components of the financial system as well as to introduce them to the three basic ideas underpinning finance, namely the time value of money, diversification and arbitrage.

What are foundations of finance?

This course provides a rigorous, but straightforward, introduction to the key concepts of financial understanding. Using real-world case studies and practitioner interviews, as well as timely knowledge checks, you will integrate your new knowledge and problem solving skills with practical application.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foundations of Finance?

Foundations of Finance is a fundamental course or framework that introduces key concepts and principles in financial management and investment analysis.

Who is required to file Foundations of Finance?

Individuals or entities engaged in finance-related activities, such as businesses, financial analysts, and investors, may be required to file documents related to Foundations of Finance.

How to fill out Foundations of Finance?

To fill out Foundations of Finance, one should gather relevant financial information, follow the provided guidelines, and accurately complete the required sections, ensuring compliance with financial reporting standards.

What is the purpose of Foundations of Finance?

The purpose of Foundations of Finance is to provide a structured approach to understanding financial principles, enabling better decision-making and effective financial management.

What information must be reported on Foundations of Finance?

Information that must be reported includes financial data, investment information, risk assessments, and any relevant transactions or changes in financial status.

Fill out your foundations of finance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foundations Of Finance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.