Federal Perkins Loan Request for Cancellation free printable template

Show details

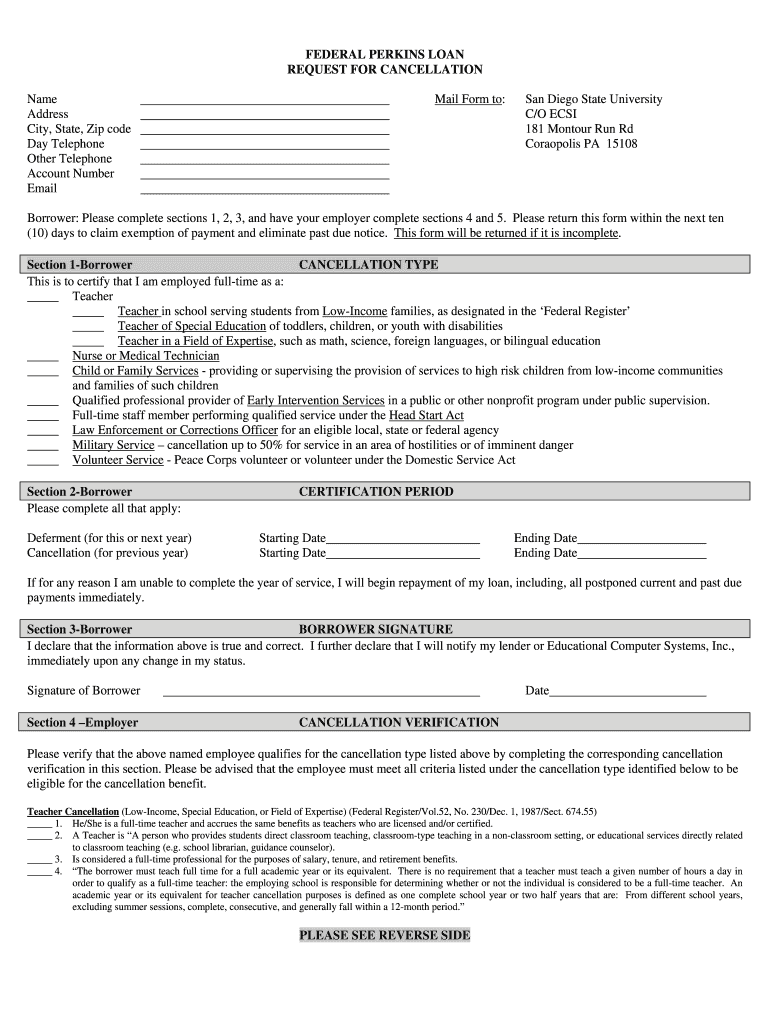

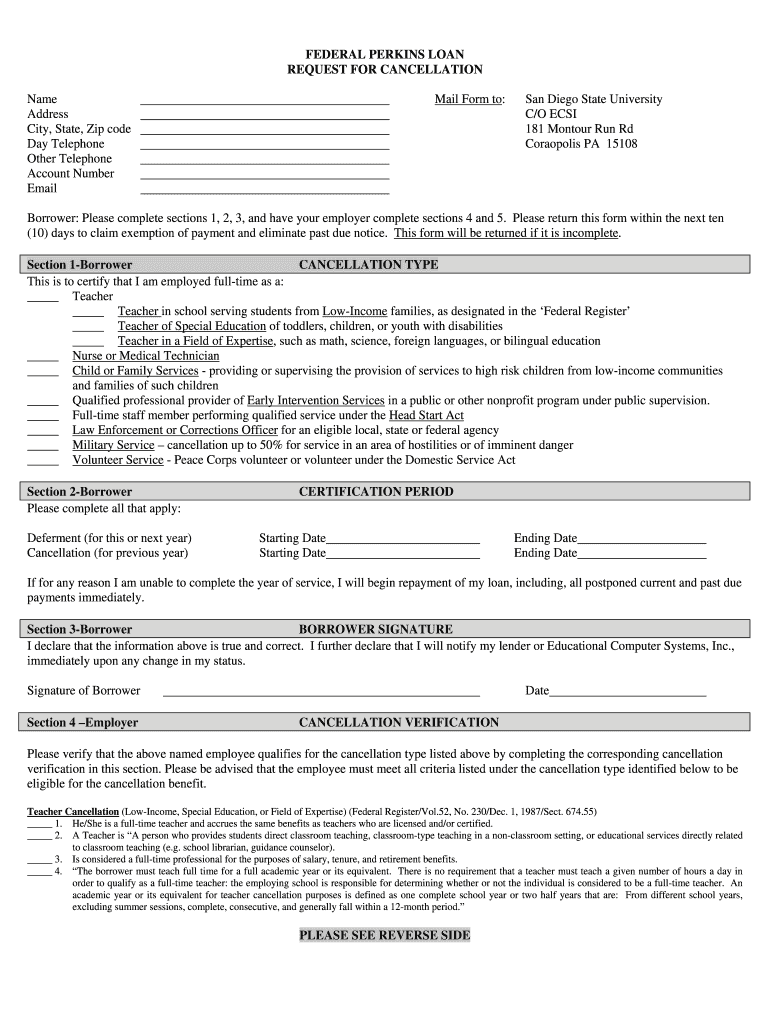

FEDERAL PERKINS LOAN REQUEST FOR CANCELLATION Name Address City, State, Zip code Day Telephone Other Telephone Account Number Email Mail Form to: San Diego State University C/OE CSI 181 Contour Run

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign perkins form sdsu

Edit your Federal Perkins Loan Request for Cancellation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Federal Perkins Loan Request for Cancellation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Federal Perkins Loan Request for Cancellation online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Federal Perkins Loan Request for Cancellation. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Federal Perkins Loan Request for Cancellation

How to fill out Federal Perkins Loan Request for Cancellation

01

Obtain the Federal Perkins Loan Request for Cancellation form from your school's financial aid office or the official website.

02

Fill in your personal information, including your name, address, and student ID.

03

Indicate the reason for requesting cancellation (e.g., employment in qualifying public service jobs, full-time teaching, etc.).

04

Provide documentation to support your eligibility for cancellation, such as proof of employment or service qualification.

05

Review the form for accuracy and completeness to ensure all required information is included.

06

Sign and date the form.

07

Submit the completed form to your school's financial aid office or the appropriate department handling Perkins loans.

08

Follow up with the office to confirm receipt and inquire about the cancellation process timeline.

Who needs Federal Perkins Loan Request for Cancellation?

01

Individuals who have Federal Perkins Loans and are seeking cancellation due to qualifying employment or service.

02

Teachers or education professionals working in low-income schools.

03

Employees of public service organizations.

04

Individuals who meet other cancellation criteria as outlined in the Federal Perkins Loan program guidelines.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my Federal Perkins Loan out of default?

A borrower may rehabilitate a defaulted Perkins Loan by making nine consecutive, on-time, monthly payments. A rehabilitated Perkins Loan is returned to regular repayment status. (See Default Status and Perkins Eligibility later in this chapter.)

How long can you defer Perkins loan?

You may qualify for Forbearance on your Perkins Loan. During forbearance, loan payments are postponed or reduced with interest continuing to accrue on the principal loan balance. You will be responsible for the interest payments. Forbearance can be granted in intervals of up to 12 months for a total of 3 years.

What is Perkins loan Cancellation?

Perkins Cancellation. A borrower may have all or part of his or her loan cancelled for teaching, certain volunteer service serving in the military or as a law enforcement or corrections officer, or full-time employment in certain other public services.

How do you get a Perkins Loan out of default?

A borrower may rehabilitate a defaulted Perkins Loan by making nine consecutive, on-time, monthly payments. A rehabilitated Perkins Loan is returned to regular repayment status.

What happens if you don't pay Perkins Loan?

Defaulting on your Perkins Loan can have very unpleasant financial consequences: You can be required to repay the entire loan immediately and can be sued by either the school or the Federal Government to collect it. You can be charged all interest plus late payment fees, court fees and collection costs.

Are Perkins Loans eligible for cancellation?

Note: As of Oct. 7, 1998, all Perkins Loan borrowers are eligible for all cancellation benefits regardless of when the loan was made or the terms of the borrower's promissory note.

How can you cancel Perkins Loans?

Application for cancellation or discharge of a Perkins Loan must be made to the school that made the loan or to the school's Perkins Loan servicer. The school or its servicer can provide forms and instructions specific to your type of cancellation or discharge.

Why was the Perkins loan Cancelled?

You're eligible for immediate and total discharge of 100% of your Perkins loan amount in the cases of: Bankruptcy, if the bankruptcy court rules repayment would cause undue hardship. Death. School closure, if your school closed before you could complete your degree.

Why did my Perkins loan get Cancelled?

A borrower may have all or part of his or her loan cancelled for teaching, certain volunteer service serving in the military or as a law enforcement or corrections officer, or full-time employment in certain other public services.

What is Perkins loan cancelation?

Perkins Cancellation. A borrower may have all or part of his or her loan cancelled for teaching, certain volunteer service serving in the military or as a law enforcement or corrections officer, or full-time employment in certain other public services.

What happens if you default on a Perkins loan?

If you default on a Perkins loan, it is usually the school that will come after you to collect. In some cases, the school will assign a Perkins loan to the Department of Education. In 2015, Congress chose not to keep the program.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit Federal Perkins Loan Request for Cancellation on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Federal Perkins Loan Request for Cancellation right away.

Can I edit Federal Perkins Loan Request for Cancellation on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign Federal Perkins Loan Request for Cancellation right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I complete Federal Perkins Loan Request for Cancellation on an Android device?

On an Android device, use the pdfFiller mobile app to finish your Federal Perkins Loan Request for Cancellation. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Federal Perkins Loan Request for Cancellation?

The Federal Perkins Loan Request for Cancellation is a formal application submitted by borrowers seeking to have all or part of their Perkins Loan debt forgiven due to qualifying service in certain public service jobs, including teaching, nursing, or other specified professions.

Who is required to file Federal Perkins Loan Request for Cancellation?

Individuals who have Federal Perkins Loans and who believe they qualify for loan cancellation due to eligible employment or service are required to file the Federal Perkins Loan Request for Cancellation.

How to fill out Federal Perkins Loan Request for Cancellation?

To fill out the Federal Perkins Loan Request for Cancellation, borrowers must complete the designated form provided by their loan servicer or school, providing necessary details about their employment, eligibility, and any supporting documentation of service.

What is the purpose of Federal Perkins Loan Request for Cancellation?

The purpose of the Federal Perkins Loan Request for Cancellation is to initiate the process through which eligible borrowers can have their loans canceled in recognition of their service in specific fields that benefit the public.

What information must be reported on Federal Perkins Loan Request for Cancellation?

The information that must be reported on the Federal Perkins Loan Request for Cancellation includes the borrower's personal information, details about their employment or qualifying service, dates of service, as well as documentation that supports their request for cancellation.

Fill out your Federal Perkins Loan Request for Cancellation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Perkins Loan Request For Cancellation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.