Get the free LOCAL SERVICES TAX – EXEMPTION CERTIFICATE - administration sru

Show details

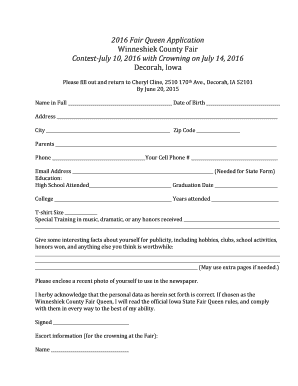

This document is used to apply for an exemption from the Local Services Tax (LST) for the 2010 tax year, requiring completion and submission to employers and the relevant political subdivision.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local services tax exemption

Edit your local services tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local services tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing local services tax exemption online

To use the professional PDF editor, follow these steps below:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit local services tax exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local services tax exemption

How to fill out LOCAL SERVICES TAX – EXEMPTION CERTIFICATE

01

Obtain the LOCAL SERVICES TAX – EXEMPTION CERTIFICATE form from your local tax authority's website or office.

02

Fill out the top section with your personal information, including your name, address, and Social Security number.

03

Indicate the type of exemption you qualify for by checking the appropriate box on the form.

04

Provide any required documentation that supports your claim for exemption, such as proof of income or residency status.

05

Review the completed form for accuracy and ensure that all necessary information is included.

06

Sign and date the form, certifying that the information provided is correct and that you qualify for the exemption.

07

Submit the completed certificate to your local tax authority, either in person or via mail, as per their instructions.

Who needs LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

01

Individuals who earn below the local income threshold and are not subject to the LOCAL SERVICES TAX.

02

Students attending school who are eligible for exemption based on school enrollment criteria.

03

Certain non-profit organizations that engage in specific exempt activities and meet the required criteria.

04

Individuals with disabilities, retirees, or those receiving certain public assistance who qualify for an exemption.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay local service tax?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

Who is supposed to pay local service tax?

This is a tax levied on salaries, wages and incomes of all persons in gainful employment and its purpose is to raise additional revenue service delivery in the Capital City.

How do I fill out a tax exemption certificate?

The exemption certificate is properly completed and legible: Name and address of the purchaser. Description of the item to be purchased. The reason the purchase is exempt. Signature of purchaser and date; and. Name and address of the seller.

Do I have to pay local service tax?

The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

What does a tax exemption certificate mean?

A sales tax exemption certificate is an official document that allows a business to make purchases without paying the standard sales tax. This certificate is proof that the purchases are not subject to sales tax due to specific exemptions that apply to the business.

What is local services tax exemption certificate?

To receive an exemption, a person must annually file an exemption certificate with his or her employer and with the taxing body stating that he or she reasonably expects to receive less than $12,000 (or the exemption in place) in earned income or net profits in that year.

What is a local services tax exemption certificate?

To receive an exemption, a person must annually file an exemption certificate with his or her employer and with the taxing body stating that he or she reasonably expects to receive less than $12,000 (or the exemption in place) in earned income or net profits in that year.

What is a service tax exemption certificate?

A sales tax exemption certificate is a document that allows a business, organization, or individual to purchase normally taxable goods or services tax free. Purchasers apply for exemption certificates and provide them to sellers at checkout.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

The LOCAL SERVICES TAX – EXEMPTION CERTIFICATE is a document that allows individuals or entities to declare their exemption from the local services tax based on specific criteria set by local governing bodies.

Who is required to file LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

Individuals or businesses that qualify for exemption from local services tax due to certain conditions, such as income level, disability, or retirement status, are required to file a LOCAL SERVICES TAX – EXEMPTION CERTIFICATE.

How to fill out LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

To fill out the LOCAL SERVICES TAX – EXEMPTION CERTIFICATE, one needs to provide personal identification details, specify the grounds for exemption, and sign the document to affirm accuracy and eligibility for the exemption.

What is the purpose of LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

The purpose of the LOCAL SERVICES TAX – EXEMPTION CERTIFICATE is to formally document an individual's or entity's eligibility for exemption from local services tax, thereby ensuring compliance with local tax regulations.

What information must be reported on LOCAL SERVICES TAX – EXEMPTION CERTIFICATE?

The information that must be reported on the LOCAL SERVICES TAX – EXEMPTION CERTIFICATE includes the individual's or entity’s name, address, reason for exemption, and any relevant identification numbers or additional supporting information required by the local jurisdiction.

Fill out your local services tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Services Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.