Get the free Tax Scholarship Application - stcl

Show details

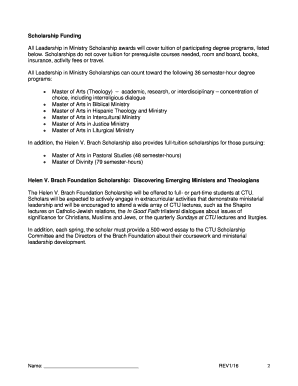

This document outlines the criteria, application process, and requirements for the Tax Executives Institute Tax Scholarship for 2L and 3L law students interested in taxation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax scholarship application

Edit your tax scholarship application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax scholarship application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax scholarship application online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax scholarship application. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax scholarship application

How to fill out Tax Scholarship Application

01

Gather all necessary personal financial documents.

02

Download the Tax Scholarship Application form from the official website.

03

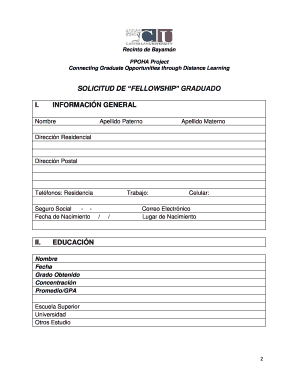

Fill in your personal details including name, address, and contact information.

04

Provide information about your family income and any other financial assistance received.

05

Detail your educational expenses related to your course of study.

06

Review your application for accuracy and completeness.

07

Submit the application form before the deadline set by the scholarship program.

Who needs Tax Scholarship Application?

01

Students pursuing higher education who require financial assistance.

02

Individuals seeking to offset their educational costs against tax liabilities.

03

Low-income families looking for support to fund their children's education.

Fill

form

: Try Risk Free

People Also Ask about

Are foreign scholarships taxable in the UK?

Payments from scholarships are generally exempt from income tax in the UK, provided: The scholarship holder is studying full-time; and. They are studying at a university, college, school, or other educational establishment.

What is the tax rate for international students in the US?

Stipend and fellowship payments to those on F or J visas are subject to 14% federal tax withholding. For anybody on a different type of visa, the standard rate is 30% federal tax withholding. Prize and award payments are subject to 30% federal tax withholding.

What is the pay rate in the USA for international students?

The minimum wage in the USA varies across the country, but always covers international students. In some states, it is equal to the federal minimum wage, which applies nationwide. In others, the figure is higher. The federal minimum wage is USD 7.25 per hour.

Can international students get a tax return for tuition in the USA?

Are international students due a tax refund? If the amount of tax deducted from your payments during the tax year is more than the tax shown on your 1040NR, then you will be due a refund, otherwise you will be required to pay your US tax liabilities.

What is the tax rate for foreigners in the USA?

Under US domestic tax laws, a foreign person generally is subject to 30% US tax on the gross amount of certain US-source income.

What is the best scholarship website for international students?

IEFA is the premier resource for international scholarship and grant information for students. You'll find the most comprehensive listing of scholarships for international students.

Do students have to pay tax in the USA?

Most people with earned income in the United States pay taxes on each paycheck they receive, F-1 students included. Do students have to file a tax return? Yes, if they earn money in several ways (outlined below). Taxable income can include everything from salaries to specific gifts and awards.

Are international students tax residents of the USA?

Generally, foreign students in F-1, J-1, or M-1 nonimmigrant status who have been in the United States more than 5 calendar years become resident aliens for U.S. tax purpose if they meet the “Substantial Presence Test” and are liable for Social Security and Medicare taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Scholarship Application?

The Tax Scholarship Application is a form that individuals use to apply for scholarships or financial aid that may be subject to tax regulations. It assesses eligibility for financial support based on various criteria.

Who is required to file Tax Scholarship Application?

Individuals who seek financial aid or scholarships that may incur tax liabilities are required to file the Tax Scholarship Application. This typically includes students, families, and individuals applying for educational funding.

How to fill out Tax Scholarship Application?

To fill out the Tax Scholarship Application, applicants need to gather necessary personal and financial information, complete the required sections of the form accurately, and submit it by the specified deadline, often providing supporting documentation as needed.

What is the purpose of Tax Scholarship Application?

The purpose of the Tax Scholarship Application is to determine eligibility for scholarships and financial aid while ensuring compliance with tax laws. It helps institutions verify the financial aid needs of applicants.

What information must be reported on Tax Scholarship Application?

On the Tax Scholarship Application, individuals must report personal information, financial details, income sources, tax identification numbers, and any other information relevant to assessing their eligibility for scholarships.

Fill out your tax scholarship application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Scholarship Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.