Get the free Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active - h...

Show details

This document outlines the benefits, eligibility, and premium rates associated with the Voluntary Life Insurance and Accidental Death and Dismemberment (AD&D) coverage provided by the Regional University

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary life insurance with

Edit your voluntary life insurance with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary life insurance with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary life insurance with online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit voluntary life insurance with. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary life insurance with

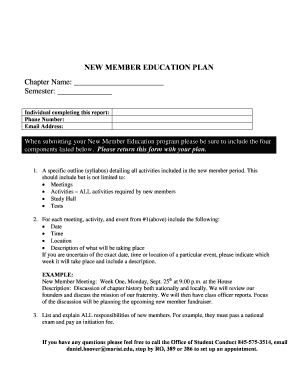

How to fill out Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active

01

Obtain the Voluntary Life Insurance application form from your employer or insurance provider.

02

Read the instructions and eligibility requirements carefully.

03

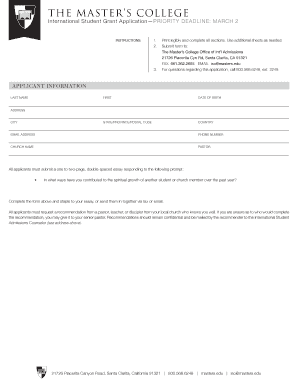

Fill out your personal information, including your name, address, and date of birth.

04

Specify the coverage amount you desire for both Life Insurance and Accidental Death and Dismemberment (AD&D).

05

Provide any required medical history and health information as requested.

06

Designate beneficiaries for the life insurance policy.

07

Review the completed application for accuracy and completeness.

08

Submit the application by the specified deadline, either online or via mail.

Who needs Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

01

Individuals who desire additional life insurance coverage beyond employer-provided options.

02

People who want financial security for their beneficiaries in the event of their untimely death.

03

Those who are concerned about the potential financial impact of accidental death or dismemberment.

04

Employees with dependents who may rely on their income for support.

05

Individuals looking to supplement their existing life insurance policy.

Fill

form

: Try Risk Free

People Also Ask about

What is an accidental death and dismemberment AD&D policy will pay the?

Accidental Death & Dismemberment (AD&D) insurance is a plan that pays a benefit if you lose your life, limbs, eyes, speech, or hearing due to an accident. Full-time regular staff are eligible for AD&D coverage.

What is the AD&D insurance coverage?

The AD&D insurance meaning refers to the coverage provided when a policyholder accidentally passes away or is dismembered. Dismemberment occurs when someone loses an entire body part (limb) or the use of a specific body part. This includes vision, hearing and speech.

What is covered by ad&d insurance?

Injuries covered by AD&D include loss of limbs or loss of their use. Blindless, deafness, and paralysis are also covered. The benefit payout may be adjusted depending on the severity of the injury. For example, loss of one leg may result in a 50% payout as opposed to the loss of both at a 100% payout.

Is it worth it to get AD&D insurance?

It really depends on your individual needs and lifestyle. If your life insurance policy offers adequate coverage for you in the case of death or accidental dismemberment, AD&D may be an unnecessary additional cost. If you're in a high-risk profession, however, it may be worth consideration.

What is excluded from ad&d?

AD&D policies provide financial protection against accidental death or injury, but can have a variety of exclusions. These can include intentional self-inflicted injuries, deaths resulting from natural causes, and injuries from illegal activities.

Is ad&d insurance worth it?

Most of them do help provide a greater level of coverage for non-death events. If you are the primary or sole earner, I'd seriously consider the AD&D. Lots of people found out that long-COVID and other issues can make working full time in service / information fields very difficult.

Do I need both life insurance and ad&d?

You may want both life insurance and AD&D insurance depending on your personal needs. For individuals in high-risk jobs or for parents of young children who cannot afford a gap in income due to an accident, AD&D insurance may be particularly important.

What is voluntary accidental death & dismemberment ad&d?

Voluntary group accidental death and dismemberment (AD&D) insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a family member dies or is dismembered as a result of a covered accident.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active is a type of life insurance policy that allows employees to purchase additional life insurance coverage beyond what is provided by their employer, with added benefits for accidental death and dismemberment.

Who is required to file Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

Employees who wish to enroll in or modify their Voluntary Life Insurance with AD&D coverage are typically required to file the necessary enrollment forms or applications with their employer or insurance provider.

How to fill out Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

To fill out the Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active form, individuals should provide personal information such as their name, contact details, and beneficiary information, along with any required health information or medical history as specified in the application.

What is the purpose of Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

The purpose of Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active is to provide financial protection to the insured's beneficiaries in the event of their death or serious injury resulting from an accident, thus allowing for peace of mind and security for families.

What information must be reported on Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active?

Information that must be reported on the Voluntary Life Insurance with Accidental Death and Dismemberment (AD&D) - Active form includes personal identification details, desired coverage amounts, beneficiary designations, and any pertinent health declarations or medical history as required by the insurer.

Fill out your voluntary life insurance with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Life Insurance With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.