Get the free Strategic Tracking Employee Pay System (STEPS) - smu

Show details

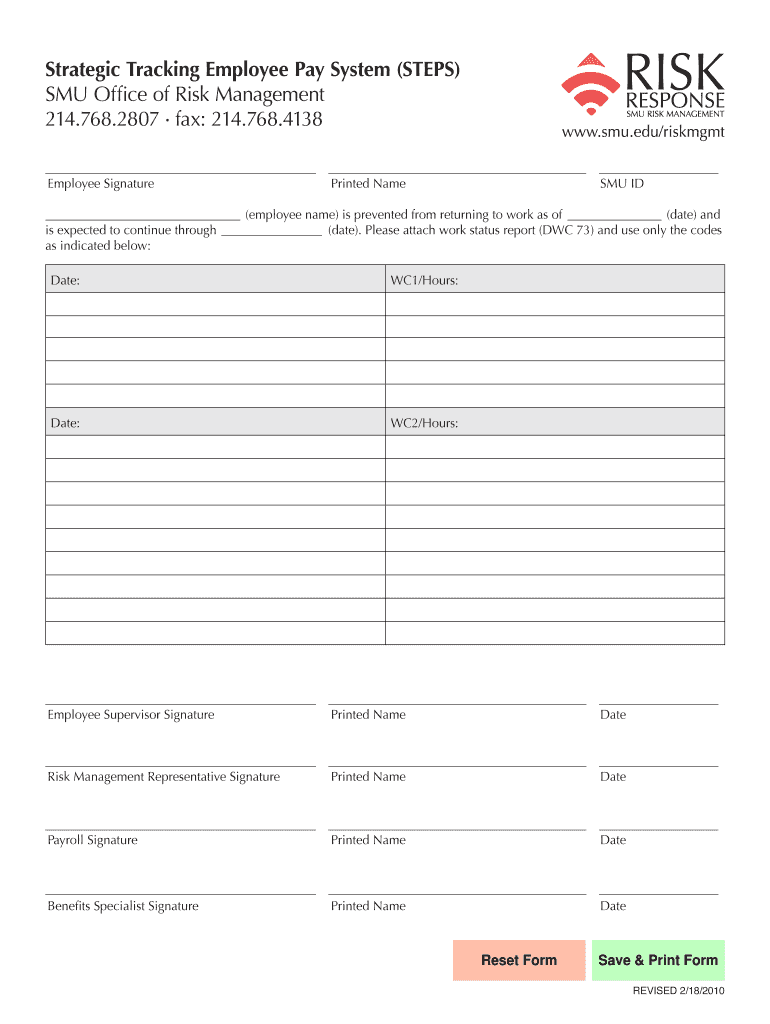

This document is a form for tracking employee pay in relation to work status due to injuries or other leave. It includes sections for employee information, supervisor, risk management, payroll, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign strategic tracking employee pay

Edit your strategic tracking employee pay form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your strategic tracking employee pay form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit strategic tracking employee pay online

Follow the steps below to use a professional PDF editor:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit strategic tracking employee pay. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out strategic tracking employee pay

How to fill out Strategic Tracking Employee Pay System (STEPS)

01

Access the Strategic Tracking Employee Pay System (STEPS) portal.

02

Log in with your assigned credentials.

03

Navigate to the 'Employee Information' section.

04

Enter the employee's details such as name, ID, and position.

05

Input the pay period dates relevant to the employee's salary.

06

Specify the payment amount and any deductions that apply.

07

Review the entered information for accuracy.

08

Submit the form and save a copy of the confirmation.

09

Monitor the status of the submission on the dashboard.

Who needs Strategic Tracking Employee Pay System (STEPS)?

01

HR personnel responsible for payroll management.

02

Managers overseeing employee compensation.

03

Finance teams handling budget and payroll processes.

04

Employees seeking access to their pay records and history.

Fill

form

: Try Risk Free

People Also Ask about

What are the three stages of payroll?

The payroll process can be divided into three different stages, which are the pre-payroll, the post-payroll and the actual payroll processing stage. Each of these stages can be broken down into several substeps and activities.

What are the 5 basic steps of using the payroll system?

By following these five simple steps - collecting accurate employee information, calculating gross pay, deducting taxes, processing payments accurately, and maintaining meticulous records - small businesses can ensure a seamless payroll service that benefits both the company and its employees.

What are the steps to process payroll?

How to process payroll Gather time card information. Compute gross pay. Calculate payroll taxes. Determine employee deductions. Calculate net pay. Approve payroll. Pay employees. Distribute pay stubs.

What is an example of a payroll goal?

You can set goals to reduce the expenses of your payroll department without losing efficiency and accuracy. For example, you might set a goal to reduce your payroll expenses by 15% over the next quarter.

What is the strategic compensation process?

A strategic compensation plan encompasses key components such as thorough job analysis and market research to determine fair wages, the establishment of a clear pay structure, performance-based incentives, a comprehensive benefits package, transparent communication, legal compliance, employee feedback mechanisms, and

What is KPI for payroll manager?

Another term that is often used interchangeably with payroll metrics is payroll KPIs. Working with key performance indicators involves setting a goal beforehand, and then tracking the progress made towards that goal at different stages.

What are the 5 basic steps of using the payroll system?

By following these five simple steps - collecting accurate employee information, calculating gross pay, deducting taxes, processing payments accurately, and maintaining meticulous records - small businesses can ensure a seamless payroll service that benefits both the company and its employees.

What is a payroll strategy?

A payroll strategy is a comprehensive plan outlining how a company manages its payroll operations to ensure accuracy, efficiency, and compliance with legal standards. It's a crucial element of business strategy, impacting employee satisfaction and financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Strategic Tracking Employee Pay System (STEPS)?

The Strategic Tracking Employee Pay System (STEPS) is a system used to monitor and report employee compensation data to ensure compliance with relevant regulations and promote transparency in pay practices.

Who is required to file Strategic Tracking Employee Pay System (STEPS)?

Employers with a certain number of employees or those that meet specific criteria set by regulatory authorities are required to file the STEPS.

How to fill out Strategic Tracking Employee Pay System (STEPS)?

To fill out STEPS, employers must gather employee compensation data, ensure accuracy, and submit the information through the designated reporting format as outlined by the governing body.

What is the purpose of Strategic Tracking Employee Pay System (STEPS)?

The purpose of STEPS is to provide insights into pay practices, ensure equity in compensation, and support compliance with labor laws and regulations.

What information must be reported on Strategic Tracking Employee Pay System (STEPS)?

Employers must report employee demographics, job titles, pay rates, hours worked, and any relevant benefits as required by the STEPS guidelines.

Fill out your strategic tracking employee pay online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Strategic Tracking Employee Pay is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.