Get the free APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING - transportation stanford

Show details

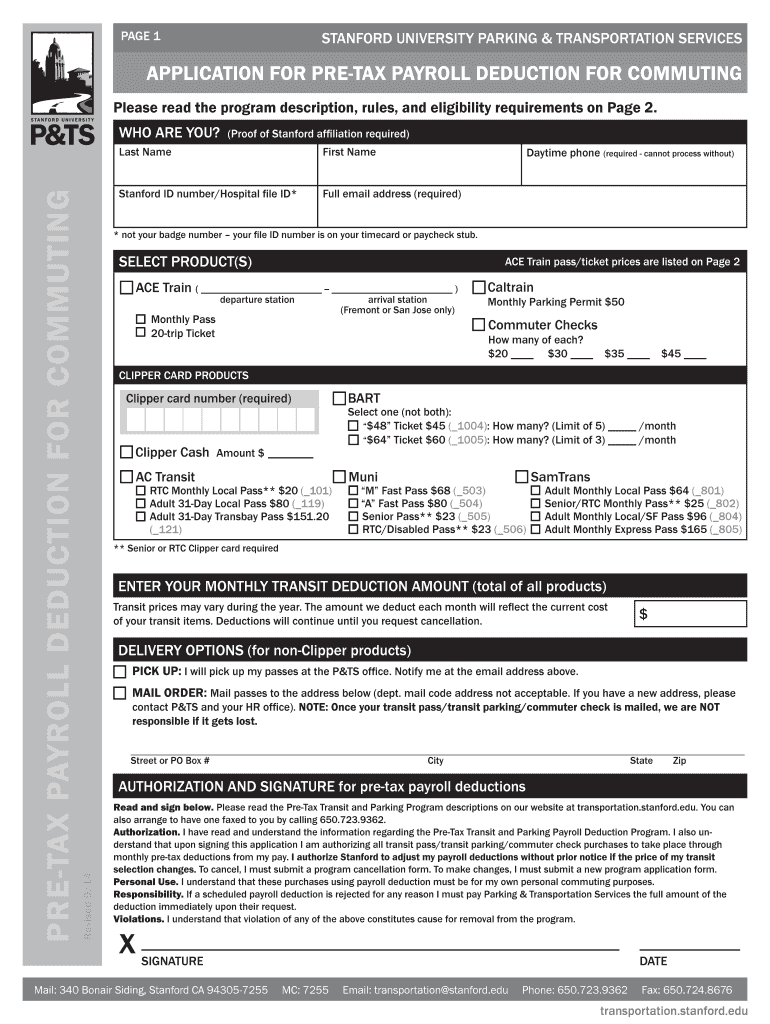

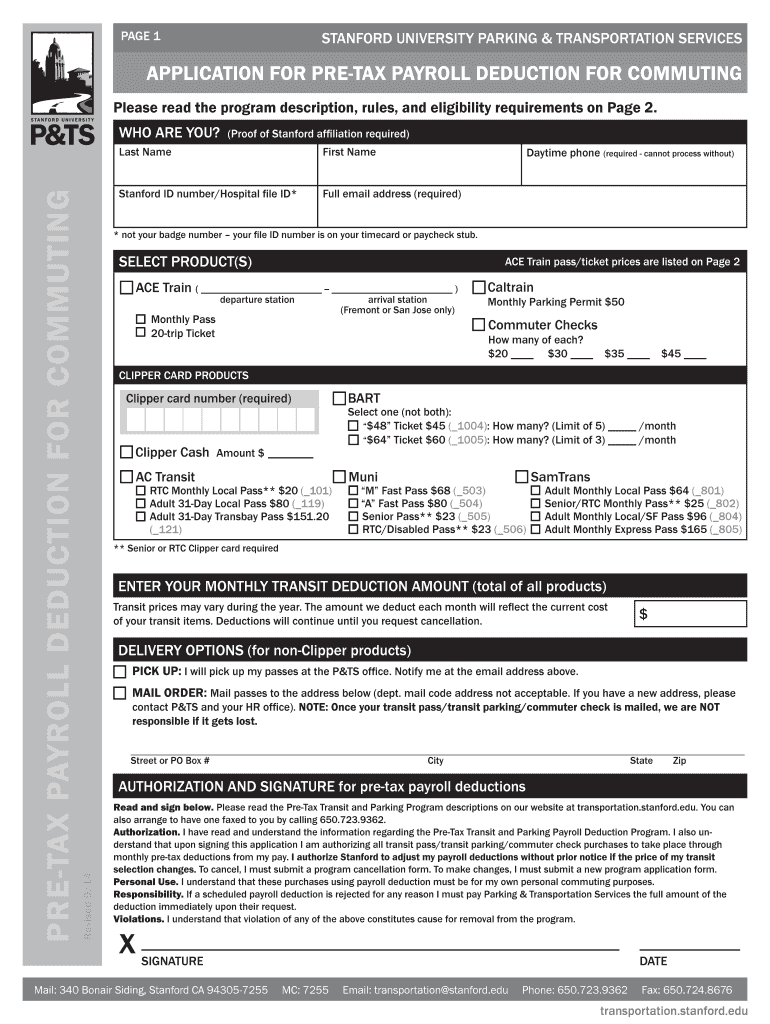

This document is an application for Stanford University employees to enroll in a pre-tax payroll deduction program for commuting expenses related to transit passes and commuter checks.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for pre-tax payroll

Edit your application for pre-tax payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for pre-tax payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for pre-tax payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for pre-tax payroll. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for pre-tax payroll

How to fill out APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING

01

Obtain the APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING form from your employer or HR department.

02

Fill in your personal details, including your name, employee ID, and contact information, in the required fields.

03

Specify the type of commuting expenses you wish to deduct, such as public transportation or parking fees.

04

Indicate the requested deduction amount for each pay period.

05

Sign and date the application form to certify the information provided is accurate.

06

Submit the completed application to your payroll department or designated HR person for processing.

Who needs APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

01

Employees who regularly commute to work and wish to reduce their taxable income through pre-tax deductions.

02

Individuals using public transportation or incurring qualified parking expenses as part of their daily commute.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum tax free contribution for 2025?

The maximum TFSA contribution limit for 2025 is $7,000. Any unused amount rolls over while TFSA withdrawals count towards next year's limit. You could withdraw from your TFSA anytime tax-free, and re-contribute the amount the following year.

What are Edenred commuter benefits?

Commuter benefits help employees pay for their daily commute with pre-tax earnings, while helping employers save on payroll taxes. Currently, nine U.S. metros mandate transit benefits, but employers across the country choose Edenred's commuter benefits to: Enhance employer branding for retention and recruitment.

What are the pre-tax benefits for commuters in NY?

Monthly Pre-Tax Limit Under federal tax law and effective January 1, 2025, employees can use up to $325 a month of their pre-tax income to pay for qualified transportation.

What is the maximum FSA limit for 2025?

An employee who chooses to participate in an FSA can contribute up to $3,300 through payroll deductions during the 2025 plan year. Amounts contributed are not subject to federal income tax, Social Security tax or Medicare tax. If the plan allows, the employer may also contribute to an employee's FSA.

What is the maximum pre tax contribution for 2025?

To give you a clear snapshot, here are the contribution limits for 2025: Employees under 50: $23,500 personal limit; $70,000 combined employee and employer limit. Employees 50 and older: $31,000 total with catch-up; $77,500 combined employee and employer limit.

What is the maximum pre tax commuter benefit?

The amount that employees can contribute to their transit account is determined by the federal government and can change from year to year. As of 2025, employees can allocate up to $325 per month ($3,900 / year) of their pre-tax earnings towards commuter benefits.

What is the maximum pre-tax commuter benefit for 2025?

2025 Tax Free Commuter Benefits Limits The monthly pre-tax limits are reviewed each year by the IRS. The commuter benefits tax free limits for 2025 are $325/month for transit and $325/month for parking.

What is the maximum transit benefit?

The IRS boosted the fringe benefit limit for transit and parking to $325 per month in 2025, up from $315, to account for inflation and increased commuting costs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING is a form used by employees to request a deduction from their paycheck for commuting expenses before taxes are applied, allowing them to save on taxable income.

Who is required to file APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

Employees who wish to participate in a pre-tax commuting benefit program and want to have their commuting expenses deducted from their pre-tax income are required to file this application.

How to fill out APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

To fill out the APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING, employees should provide their personal information, commuting details, the amount they wish to allocate for pre-tax deductions, and sign the form.

What is the purpose of APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

The purpose of this application is to allow employees to set aside a portion of their salary for commuting expenses on a pre-tax basis, which can reduce their overall tax liability and increase their disposable income.

What information must be reported on APPLICATION FOR PRE-TAX PAYROLL DEDUCTION FOR COMMUTING?

The application must report the employee's name, job title, employee ID, the type of commuting expense (e.g., public transit, parking), and the amount to be deducted from their paycheck on a pre-tax basis.

Fill out your application for pre-tax payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Pre-Tax Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.