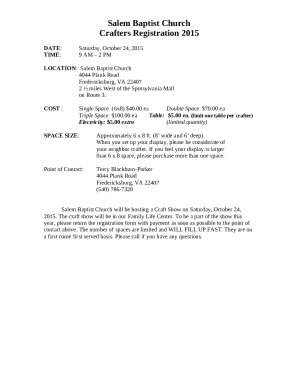

Get the free FICA Refund Request – Nonresident Alien - www2 binghamton

Show details

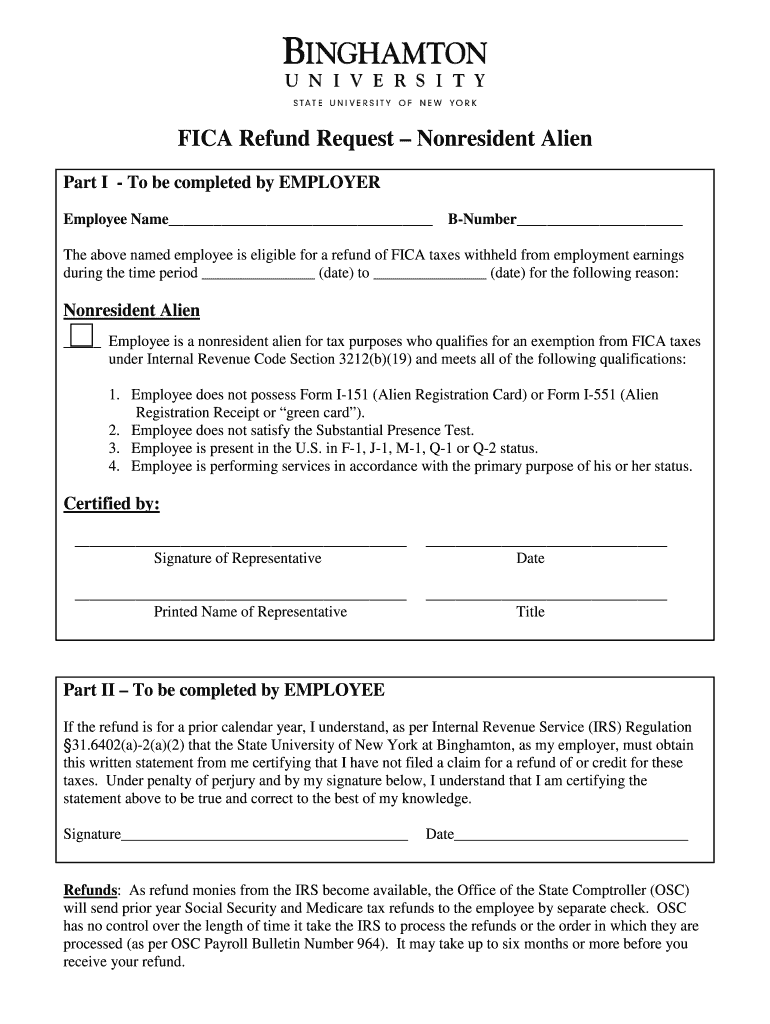

This document is a request form for nonresident aliens to claim a refund of FICA taxes withheld from their employment earnings. It includes sections for both the employer and the employee to complete,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fica refund request nonresident

Edit your fica refund request nonresident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fica refund request nonresident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fica refund request nonresident online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit fica refund request nonresident. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fica refund request nonresident

How to fill out FICA Refund Request – Nonresident Alien

01

Gather required documents such as Form 843, your Form W-2, and any relevant supporting documents.

02

Complete Form 843 by providing your personal information, tax identification number, and detailing the refund request for FICA taxes.

03

Attach the completed Form 843 to your W-2 and any additional documentation that supports your claim.

04

Mail the Form 843 along with your W-2 to the appropriate IRS address based on your location.

05

Keep copies of all submitted documents for your records and follow up with the IRS if necessary.

Who needs FICA Refund Request – Nonresident Alien?

01

Nonresident aliens who have mistakenly had FICA taxes withheld from their paychecks while working in the United States.

Fill

form

: Try Risk Free

People Also Ask about

How do I know if I am a nonresident alien or resident alien?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

What is the tax form for resident alien?

Form 1040 is the federal individual income tax return applicable to U.S. citizens and resident aliens.

Do nonresident aliens have to report foreign income?

While nonresident aliens must report worldwide income on their tax return, non-U.S. income might be exempted under a foreign-earned income exclusion, a foreign income tax credit, or a tax treaty. Nonresident aliens, on the other hand, don't pay taxes on foreign income.

Who is exempted from paying FICA tax in the US?

FICA (Social Security and Medicare) taxes do not apply to service performed by students employed by a school, college or university where the student is pursuing a course of study. Whether the organization is a school, college or university depends on the organization's primary function.

Do US expats pay FICA?

FICA tax is imposed on compensation for services performed in the US, regardless of the citizenship or residence of the employee or employer.

What is 8316?

Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received.

Does resident alien need to pay FICA?

Foreign students in F-1, J-1, M-1, or Q-1nonimmigrant status who have been in the United States more than 5 calendar years are RESIDENT ALIENS and are liable for social security/Medicare taxes.

What is the difference between a US citizen and a resident alien?

Resident aliens are non-U.S. citizens who are taxable as if they were citizens. You will be treated as a resident alien if you are foreign-born and either have a green card or meet the test for substantial presence in the U.S.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FICA Refund Request – Nonresident Alien?

The FICA Refund Request for Nonresident Aliens is a request submitted to recover Social Security and Medicare taxes that were incorrectly withheld from a nonresident alien's wages.

Who is required to file FICA Refund Request – Nonresident Alien?

Nonresident aliens who had FICA taxes withheld from their wages, despite being exempt based on their nonresident status, are required to file the FICA Refund Request.

How to fill out FICA Refund Request – Nonresident Alien?

To fill out the FICA Refund Request, you need to complete Form 843, include the required supporting documentation such as a copy of your tax return and proof of FICA withholding, and submit it to the IRS.

What is the purpose of FICA Refund Request – Nonresident Alien?

The purpose of the FICA Refund Request for Nonresident Aliens is to obtain a refund of Social Security and Medicare taxes that should not have been withheld due to their nonresident alien status.

What information must be reported on FICA Refund Request – Nonresident Alien?

The information reported on the FICA Refund Request includes the nonresident alien's name, address, Social Security number, tax identification details, amount of tax withheld, and reasons for the refund claim.

Fill out your fica refund request nonresident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fica Refund Request Nonresident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.