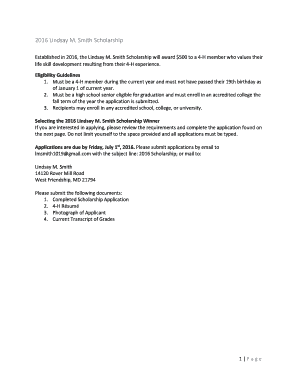

New HUD-1a approved by the Secretary of Housing and Urban Development for use when there is no Seller. For use for refinancing. This form is in fillable PDF format. This form is designed to be printed on legal size. 8 1/2 by 14.

Get the free HUD-1A

Show details

This document serves as an optional form for settlement statements related to transactions without sellers. It details the costs and charges associated with a loan transaction, including disbursements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hud-1a

Edit your hud-1a form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hud-1a form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hud-1a online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit hud-1a. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hud-1a

How to fill out HUD-1A

01

Obtain a copy of the HUD-1A form.

02

Fill in the name and address of the borrower(s) at the top.

03

Fill in the name and address of the seller(s).

04

Enter the closing date and property address.

05

List all costs associated with the settlement in the appropriate sections.

06

Fill in the loan amount in the designated area.

07

Include credits to buyer/seller as applicable.

08

Verify all entries for accuracy and completeness.

09

Review the form with all parties involved before signing.

10

Keep a copy for personal records.

Who needs HUD-1A?

01

Homebuyers or borrowers involved in a real estate transaction.

02

Sellers who are transferring property.

03

Real estate agents and brokers facilitating the transaction.

04

Mortgage lenders providing financing.

05

Attorneys or settlement agents overseeing the closing.

Fill

form

: Try Risk Free

People Also Ask about

What is the HUD-1 now called?

The HUD-1 and final TIL will be replaced by the Closing Disclosure (CD) which must be verified as delivered to the consumer (borrower) three days before loan documents can be signed. Seller will receive a separate Seller CD. The term for Buyer/Borrower is now “Consumer”. ( Seller remains “Seller”)

Are HUD-1 forms still used?

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

What is a HUD-1 now called?

Closing Disclosure (CD - formerly HUD-1) The Closing Disclosure (CD - formerly the HUD-1 Uniform Settlement Statement) is a three-page, government-mandated form that details the costs associated with a real estate transaction. The borrower should receive a copy of the CD at least one day prior to the closing.

What is HUD title 1?

Summary: This program insures mortgage loans made by private lending institutions to finance the purchase or refinancing of a new or used manufactured home. Purpose: HUD has been providing loan insurance on manufactured homes under Title I since 1969.

Who fills out the hud 1 form?

The settlement agent shall complete the HUD-1 to itemize all charges imposed upon the Borrower and the Seller by the loan originator and all sales commissions, whether to be paid at settlement or outside of settlement, and any other charges which either the Borrower or the Seller will pay at settlement.

What is the difference between HUD-1 and HUD 1A?

The HUD-1 (or a similar variant called the HUD-1A) is used primarily for reverse mortgages and mortgage refinance transactions. The reference to 'HUD' in the form's name refers to the Department of Housing and Urban Development.

What is a HUD 1a settlement statement?

The HUD-1 Settlement Statement is a document that lists all charges and credits to the buyer and to the seller in a real estate settlement, or all the charges in a mortgage refinance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HUD-1A?

HUD-1A is a standard form used in real estate transactions to provide a detailed breakdown of the closing costs when a sale of property occurs. It is specifically utilized for transactions that do not involve a traditional mortgage.

Who is required to file HUD-1A?

The seller and the buyer in a real estate transaction are typically required to complete and file the HUD-1A to outline the terms of sale and associated costs.

How to fill out HUD-1A?

To fill out HUD-1A, one must gather all relevant financial information regarding the transaction, including sale price, loan amounts, closing costs, pre-paid items, and any other charges. The form should then be completed section by section to ensure all details are accurately reported.

What is the purpose of HUD-1A?

The purpose of HUD-1A is to provide transparency in real estate transactions by detailing the financial aspects of the deal, ensuring that both the buyer and seller understand the costs involved.

What information must be reported on HUD-1A?

Information that must be reported on HUD-1A includes the sale price, loan amounts, details of financing, itemized closing costs, pre-paid items, any settlement fees, taxes, and other charges related to the property transaction.

Fill out your hud-1a online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hud-1a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.