UK IS Notes 2014 free printable template

Show details

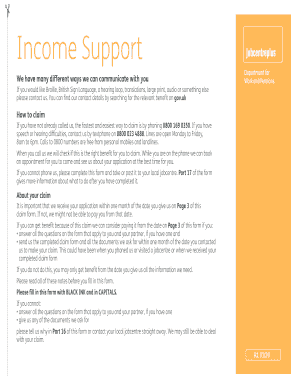

13-Oct-11 Income Support This booklet contains information about how to work out if you can get Income Support how to claim Income Support Print all (74 pages) Print form only (61 pages) To find out

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK IS Notes

Edit your UK IS Notes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK IS Notes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK IS Notes online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK IS Notes. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK IS Notes Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK IS Notes

How to fill out UK IS Notes

01

Gather all necessary personal and financial information.

02

Download the UK IS Notes form from the official website or obtain a physical copy.

03

Fill in your personal details, including name, address, and contact information.

04

Provide details about your income sources and any other financial information required.

05

Complete the sections regarding your expenses and savings.

06

Review all information for accuracy and completeness.

07

Sign and date the form as required.

08

Submit the completed UK IS Notes form as instructed, either online or by mail.

Who needs UK IS Notes?

01

Individuals applying for financial assistance or benefits in the UK.

02

People who need to declare their financial situation to relevant authorities.

03

Anyone seeking to provide information for tax assessment or financial evaluations.

Fill

form

: Try Risk Free

People Also Ask about

How much does Universal Credit give you?

Standard allowance How much you'll getMonthly standard allowanceIf you're single and under 25£292.11If you're single and 25 or over£368.74If you live with your partner and you're both under 25£458.51 (for you both)If you live with your partner and either of you are 25 or over£578.82 (for you both)

Is universal credit means tested?

Universal Credit is a means-tested benefit that's paid monthly. It's designed to help you if you're on a low income or out of work.

What benefits do I get if I claim Universal Credit?

Help with housing costs and bills a cheaper 'social tariff' for broadband or mobile phone services. a Cold Weather Payment. Disabled Facilities Grants. Discretionary Housing Payments if your Universal Credit payment is not enough to pay your rent.

How much is income support UK?

Income Support includes: a basic payment (personal allowance) extra payments (premiums)Personal allowance. Your situationWeekly paymentLone parent - age 18 or over£84.80Couples - both under 18£67.20Couples - both under 18 getting 'higher rate'£101.50Couples - one under 18, the other 18 to 24£67.206 more rows

How many hours can you work without it affecting your benefits UK?

There's no limit to how many hours you can work. Your Universal Credit does not stop if you work more than 16 hours a week. Use a benefits calculator to see how increasing your hours or starting a new job could affect what you get. Most employers will report your earnings for you.

How does universal credit work?

Universal Credit is made up of a basic allowance plus different elements for things like housing costs, bringing up children, caring or sickness and disability. The amount you get in Universal Credit can go down or up, depending on what income you get from: working. a pension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my UK IS Notes in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your UK IS Notes right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out UK IS Notes using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign UK IS Notes and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit UK IS Notes on an Android device?

With the pdfFiller Android app, you can edit, sign, and share UK IS Notes on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is UK IS Notes?

UK IS Notes refers to the United Kingdom's Income Statement Notes, which are accompanying documents providing detailed insights into the income statement of a company, explaining the numbers and accounting policies.

Who is required to file UK IS Notes?

Companies registered in the UK that prepare annual financial statements in accordance with UK accounting standards are required to file UK IS Notes.

How to fill out UK IS Notes?

To fill out UK IS Notes, businesses should provide detailed explanations regarding their revenue, expenses, and accounting policies used. This includes notes on significant accounting estimates, new accounting standards adopted, and any material transactions.

What is the purpose of UK IS Notes?

The purpose of UK IS Notes is to provide additional clarity and context to the numbers presented in the income statement, helping users of the financial statements to better understand the financial performance and accounting practices of the company.

What information must be reported on UK IS Notes?

UK IS Notes must report information such as revenue recognition policies, breakdown of revenue sources, details of expenses, significant accounting estimates, risks and uncertainties, related party transactions, and any other relevant disclosures.

Fill out your UK IS Notes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK IS Notes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.