Get the free Gifts of Securities - advance uri

Show details

This document provides information on how to make a gift of appreciated securities to the University of Rhode Island Foundation, including instructions for transferring securities and contact information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gifts of securities

Edit your gifts of securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gifts of securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gifts of securities online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gifts of securities. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

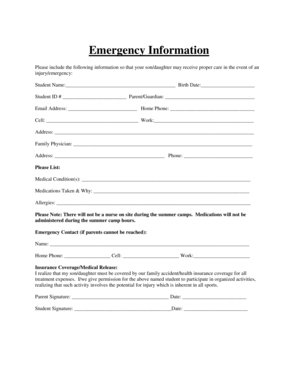

How to fill out gifts of securities

How to fill out Gifts of Securities

01

Obtain the necessary forms from your brokerage account.

02

Fill out the donor's information including name, address, and account number.

03

Provide the recipient's information including name and address.

04

Specify the number of shares and the type of securities being gifted.

05

Sign the form as the donor.

06

Send the completed form to the brokerage firm or designated department.

07

Ensure that all securities are transferred properly and that records are kept for tax purposes.

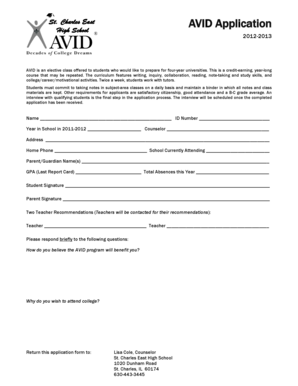

Who needs Gifts of Securities?

01

Individuals wishing to give charitable donations.

02

Donors looking to reduce their taxable income.

03

People planning their estate to avoid capital gains taxes.

04

Organizations seeking to receive securities as contributions.

Fill

form

: Try Risk Free

People Also Ask about

What is a gift of securities for CNIB?

Leave a gift of securities You can create a powerful legacy of support by donating stocks, mutual funds, or traded securities directly to CNIB. When you give a gift of securities, you won't pay capital gains tax and you will receive a charitable tax receipt for the full amount of your gift.

Is a gift of stock considered a sale?

The recipient of a gift does not pay tax on any gift valued at $11,000 or less, no matter if it is a boat, car, cash, or stock. This means you don't owe taxes at the time of the gift of the stock. When the recipient sells the stock, however, it is a taxable event.

What is considered a sale of securities?

Sale of Securities means any sale conducted by an entity of its securities. Seen in 1 SEC filing. Sale of Securities means when a Trust has to sell its held securities, it undertakes the sales through a Selling Agent, who will solicit bids from at least three nationally reputed broker-dealers.

What are the rules for gifting securities?

Special Benefits of Giving Securities To enjoy the most favorable benefits from gifts of securities, you must have owned them for more than one year. Such gifts are deductible up to 30 percent of adjusted gross income (AGI) in the year of the gift.

What is a gift of securities?

A gift of securities refers to the donation of stocks, bonds, or other investment assets to a charitable organization. Instead of making a cash donation, individuals or entities can transfer ownership of these securities directly to the charity.

Is a gift of assessable securities a sale?

Exam takers, for example, are required to know that a gift of assessable stock is considered both a sale, as well as an offer; the person that received the gift of stock and also has received an offer to essentially buy more stock at a set price, once the company that issued it asks for more money.

What is a gift of securities?

A gift of securities refers to the donation of stocks, bonds, or other investment assets to a charitable organization. Instead of making a cash donation, individuals or entities can transfer ownership of these securities directly to the charity.

Is a gift of securities considered a sale?

Outright gifts of securities can be made quickly, and these gifts let you have a bigger impact thanks to the tax advantages. A charitable gift of appreciated securities held long term is not considered a sale and does not generate any capital gains tax, no matter the amount of the gain.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Gifts of Securities?

Gifts of Securities refers to the process of transferring ownership of stocks, bonds, or other financial instruments as a gift to another individual or organization.

Who is required to file Gifts of Securities?

Individuals or entities that make gifts of securities valued above a certain threshold are required to file Gifts of Securities, as mandated by tax authorities to ensure proper reporting of gift transactions.

How to fill out Gifts of Securities?

To fill out Gifts of Securities, you need to provide detailed information including the donor's information, recipient's information, a description of the securities being gifted, their value, and any applicable dates.

What is the purpose of Gifts of Securities?

The purpose of Gifts of Securities is to allow individuals to transfer wealth, support charitable causes, or make contributions to relatives or friends, while also potentially benefiting from tax deductions associated with the gifts.

What information must be reported on Gifts of Securities?

The information that must be reported includes the names and addresses of the donor and recipient, a description of the securities, their fair market value at the time of the gift, and the date the gift was made.

Fill out your gifts of securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gifts Of Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.