IRS W-3C 2011 free printable template

Instructions and Help about IRS W-3C

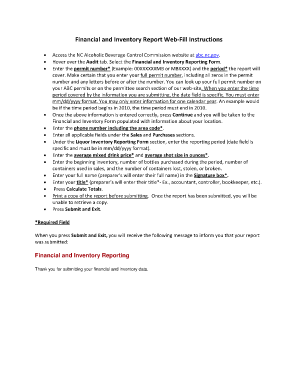

How to edit IRS W-3C

How to fill out IRS W-3C

About IRS W-3C 2011 previous version

What is IRS W-3C?

What is the purpose of this form?

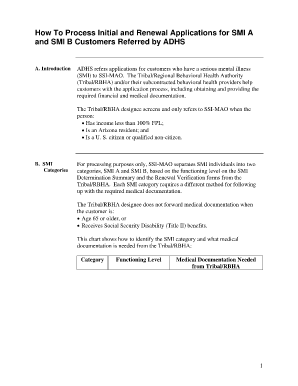

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-3C

What should I do if I realize I've made a mistake after filing the 2011 form w 3?

If you've realized a mistake on your submitted 2011 form w 3, you may need to file a corrected return. Submit Form W-3C for corrections, ensuring to also correct any related Forms W-2 if applicable. Retain documents that reflect the corrections for your records in case of future audits.

How can I verify if my 2011 form w 3 was processed by the IRS?

To verify the status of your submitted 2011 form w 3, you can contact the IRS directly or use their online tools to check for processing updates. It's important to have your details handy, such as your Employer Identification Number (EIN) and filing date to expedite the inquiry.

Are there any common errors to look out for when filing the 2011 form w 3?

Yes, common errors include incorrect EIN, mismatches between the W-2 forms and the W-3, and incomplete fields. Double-check the accuracy of all information and ensure totals match before submission to avoid any potential rejections or processing delays.

What should I know about the privacy and data security of my 2011 form w 3?

When handling your 2011 form w 3, it's crucial to adhere to privacy measures by securely storing it and only sharing with authorized personnel. Be cautious of phishing scams that may target your personal information, and use secure e-filing services if submitting electronically.

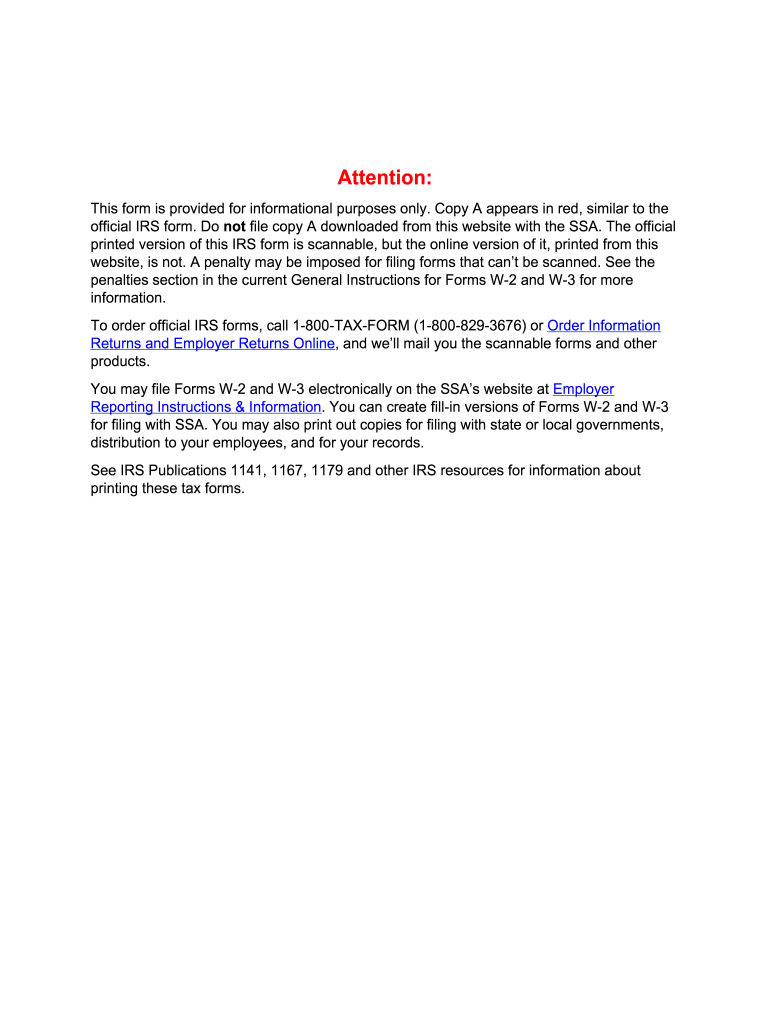

Can I e-file the 2011 form w 3, and what are the technical requirements?

Yes, you can e-file the 2011 form w 3, provided you use compatible software that meets IRS standards. Ensure your system and internet browser are up to date to avoid issues during submission, and check for any specific e-filing instructions that apply to your situation.

See what our users say